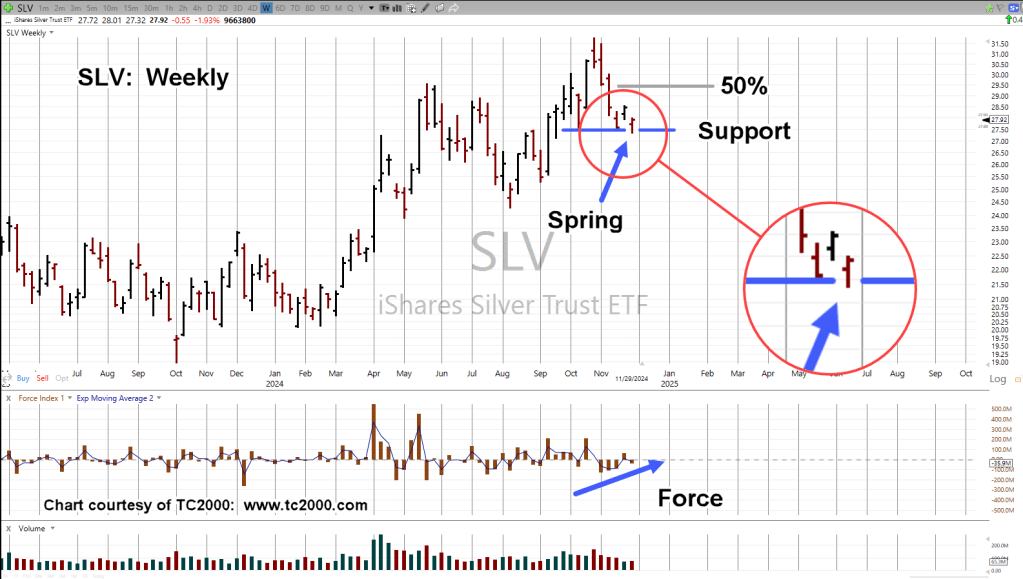

Parallel Channels

Moves that take years to develop, once started, can go on much longer than anyone would expect.

Depending on your viewpoint, biotech XBI, has been congesting sideways (in a range) from one-to-three years.

Either way, the current breakdown suggests the potential for a sustained down trend (not advice, not a recommendation).

Biotech XBI, Daily

Remember, Wyckoff said the market itself, will tell us what levels and trendlines are significant.

If the current (right-side) channel is valid, the market itself shows us a similar channel in the past.

Two things to note.

First: Record Volume

As far as known (source, TC2000), November 15th’s volume of 30.3 million, was the largest ever recorded for the XBI:

That’s ‘thirty-point-three’ (thirty-three), you can’t make this stuff up. 🙂

Second: Short Position

There were two attempts to short this market.

Trade: XBI-24-01

Actual, sell-short, closed with -0.40%, loss

Trade: LABD-24-21

Leveraged inverse fund LABD, currently open with +27.31%, profit (as of 9:02 a.m., EST).

Volatility & Leveraged Inverse

The objective is to trade short using LABD, for as long as practical (not advice, not a recommendation).

If the XBI begins to get volatile with wide swings and chop either up or down, slippage-decay on inverse funds becomes prohibitive.

LABD-24-21 may be exited at any time, without notice.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279