The final arbiter is price action itself. We can analyze all we want but if the position does not cooperate, it’s time to leave.

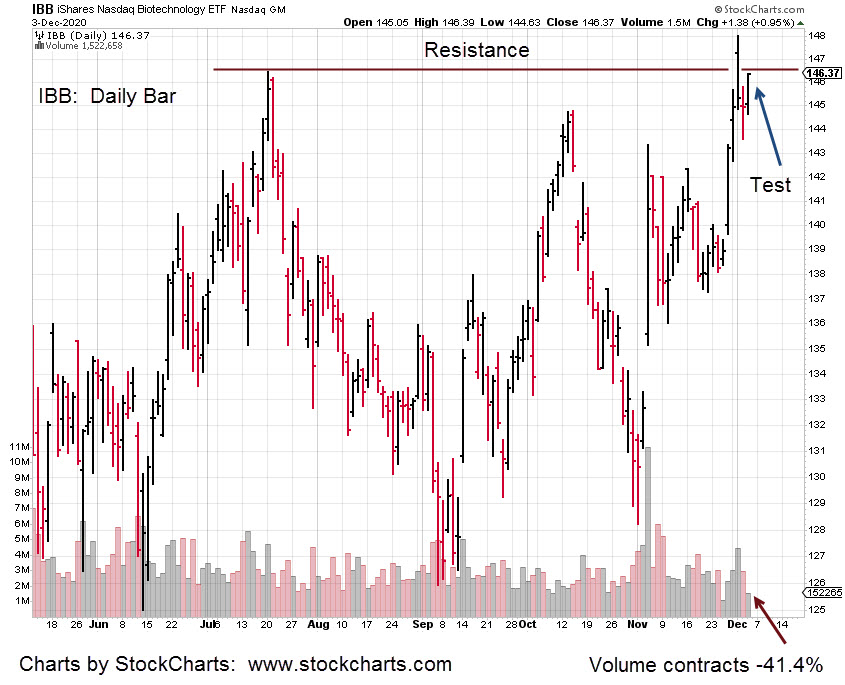

Similar to closing nat-gas positions on November 3rd, as detailed here, it’s time to move on from Biotech; let it play out without us.

Biotech’s not working on the short side. So, we’ll come back when it is.

It’s important to note, after leaving UNG, it’s -21.2%, lower than November 3rd.

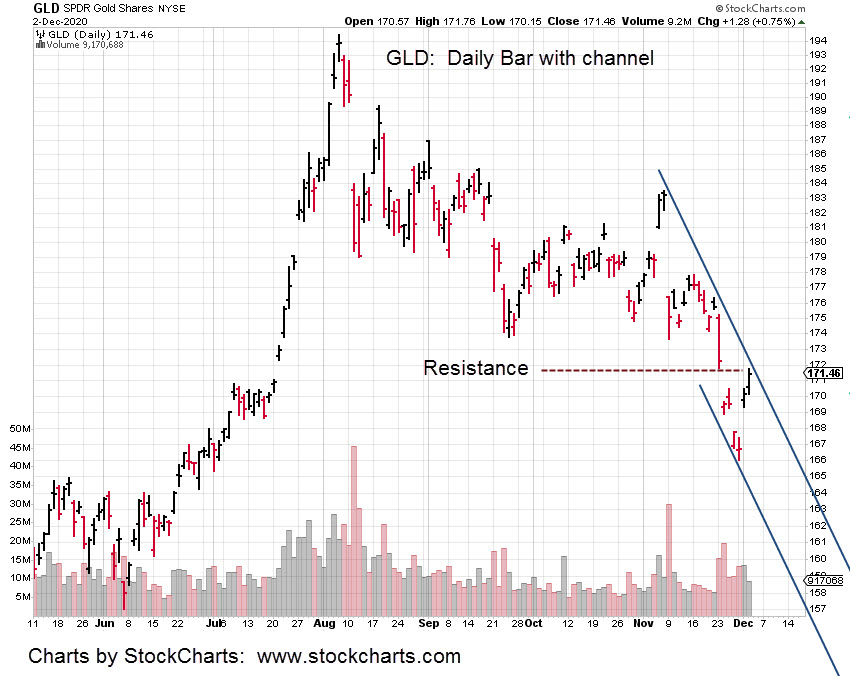

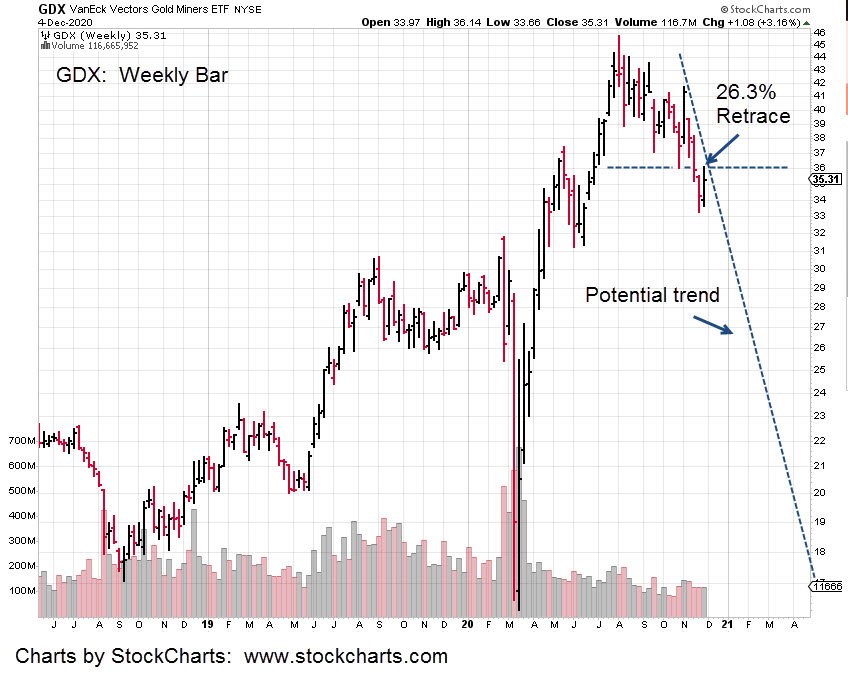

What’s working (for shorting), is gold and the miners (GDX) via DUST (not advice, not a recommendation). The GDX chart below shows the resistance level which is also the 23.6%, retrace.

A Fibonacci 23.6%, retrace is rare.

If that level is not challenged and GDX continues lower, the shallow retrace (to the upside) indicates significant weakness.

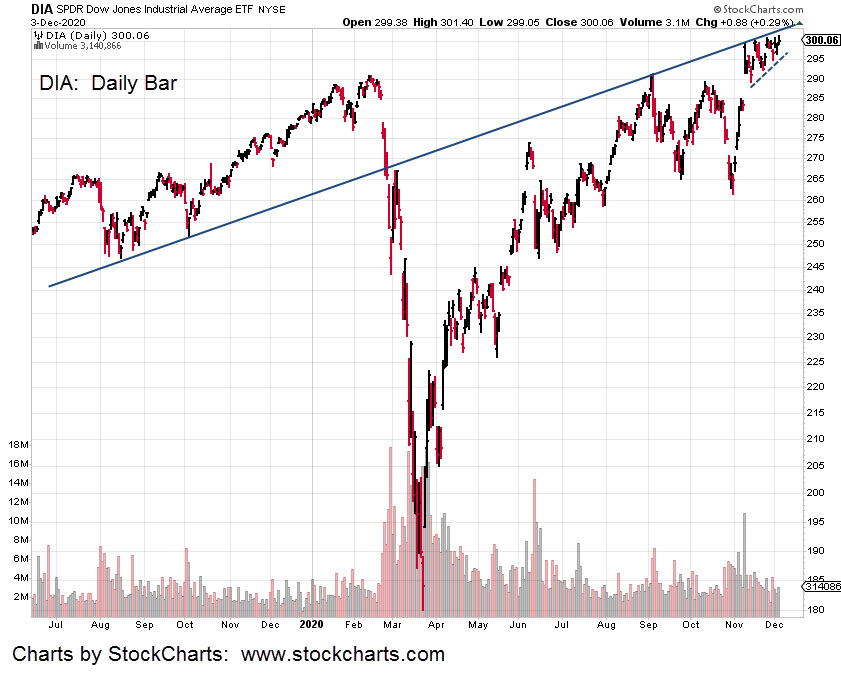

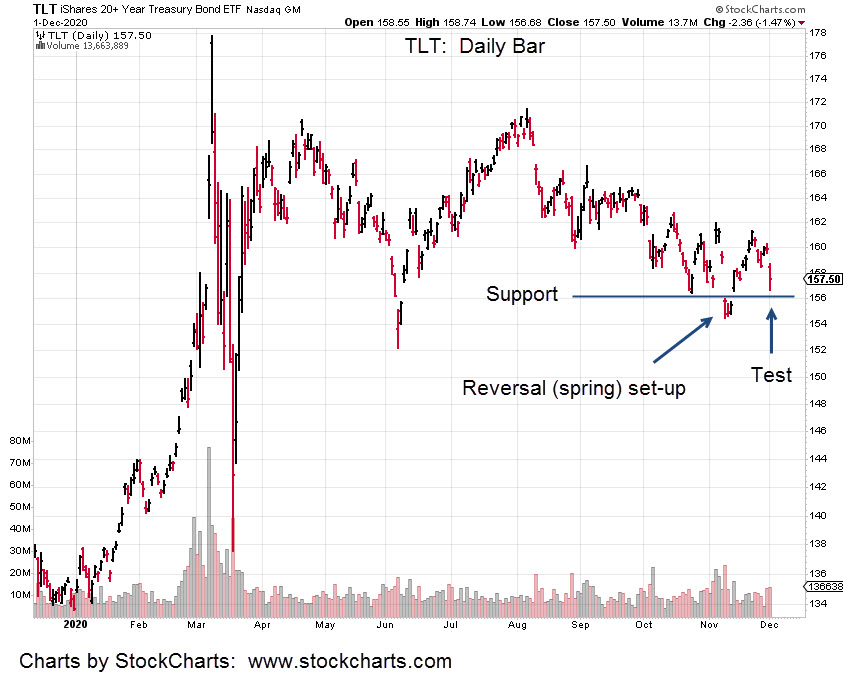

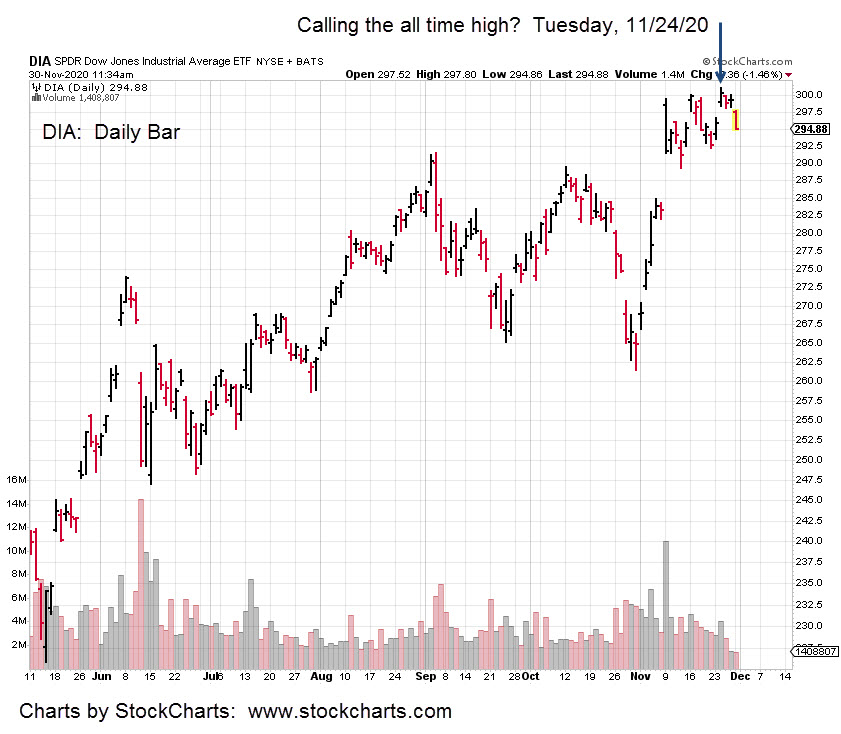

Recap: Markets (S&P, Dow, NASDAQ) at all time highs. The 30-yr Bond and Dollar, at short level extremes; the most in history.

Gold and GDX appear to be out in front, leading the way lower.

Managed Accounts

Number Detail Position Stop

6XXX-XXXX Short GDX DUST 21.81

5XXX-XXXX Short GDX DUST 21.81

Charts by StockCharts