Looking For The ‘Reversal’ To Fail

The $2-Trillion Op-Ex today, provided upward bias for the overall markets.

Not expected, was biotech SPBIO, to be part of that move.

After today and possibly because of this announcement, we’re out of the sector until price action demands attention.

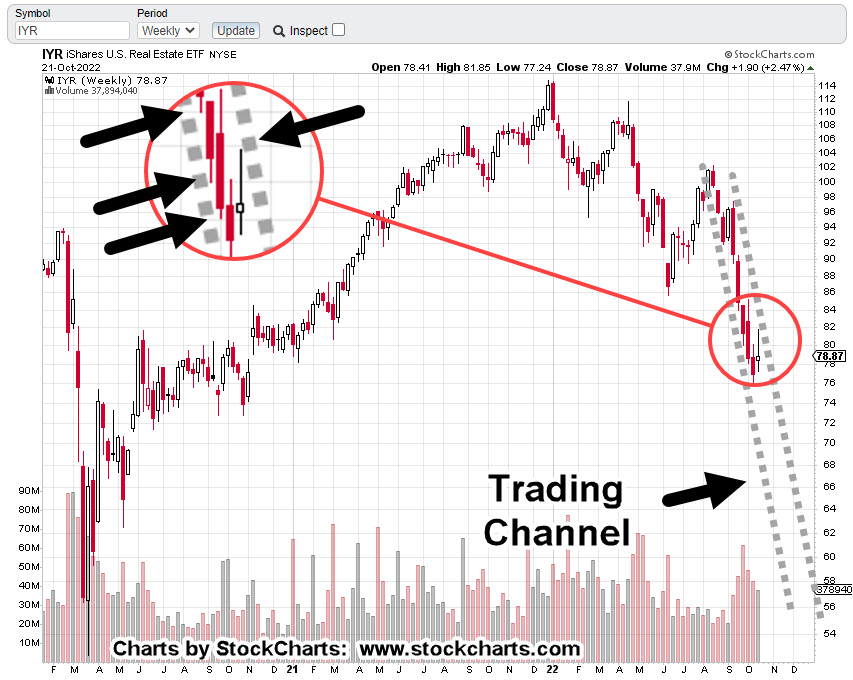

While the Dow, S&P, NASDAQ were up significantly for the day, obviously absent, was real estate (IYR).

Days like today help narrow the focus. Who is not participating in the up move?

While the other indices are up multiple percentage points, IYR, finished the day up only +0.69%.

Real Estate (IYR) Weekly

The prior linked YouTube post from Scott Walters is not the premise for going short (not advice, not a recommendation).

It is, however, a reminder that what’s going on, is at a level no one has seen before.

Unless IYR, somehow gets out of the channel, it’s declining at -84%, annualized.

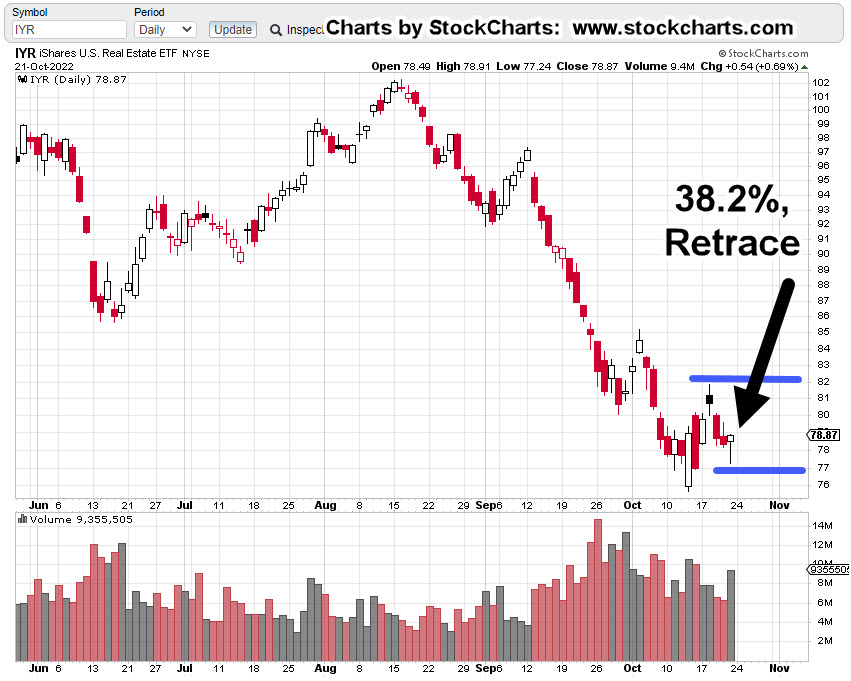

The set-up for this short trade (DRV-22-05) is based on a weak retrace (to 38.2%) on the daily with the anticipation, today’s reversal bar will ‘fail’ at the next session.

Real Estate, (IYR) Daily

The expectation for the next session is straightforward; lower open or gap-lower open and posting a new daily low.

The chart of IYR below, shows what we’re looking for (not advice, not a recommendation).

Obviously, a new daily high at the next session negates the set-up and warrants a trade exit.

A new daily low and we’ve got a ‘failure’ of the reversal bar; DRV-22-05, is liklely to be increased (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279