Biotech is breaking down, now.

For this firm, going short has been an on-again, off-again, back on-again affair.

Those with engineering degrees (including this author) or some other science degree, would have decided long ago, since the original entry’s not perfect (being stopped out), the idea must be wrong.

Those with engineering degrees (including this author) or some other science degree, would have decided long ago, since the original entry’s not perfect (being stopped out), the idea must be wrong.

Others easily distracted (those with i-phones) would have given up as well … only to see their (short) premise come to fruition without them.

So, here we are. Biotech (IBB) is breaking down with inverse BIS moving higher while the overall market continues to rise. As of this post, the S&P 500, is up 25-points or about +0.75%.

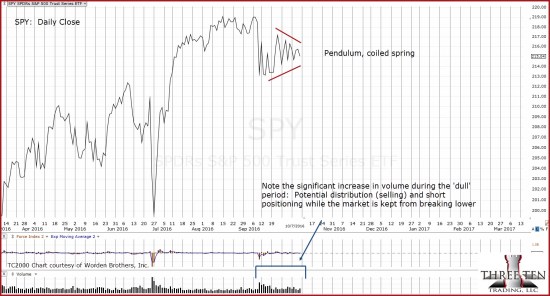

The chart and the expanded insert, show trading activity over the past two weeks.

Prior to the ‘exit’ point shown, we’re positioned long BIS (short biotech). Then, price action broke down through the prior day’s low. BIS was exited entirely.

Prior to the ‘exit’ point shown, we’re positioned long BIS (short biotech). Then, price action broke down through the prior day’s low. BIS was exited entirely.

Almost immediately after the break, the down-side price bar was challenged with up-side action.

After that, next day saw even more upside. When new daily highs were posted, BIS was re-entered.

Two days later, last Friday, the trade was increased by 7%. Just topping it all off for what amounts to a full position.

Since we’re using trading techniques from early masters, the last two months or so, mimic actions that may have been taken by Livermore or Wyckoff.

Not saying we’re in the same league as them. Just saying based on their writings, the approach mimics documented trading behavior in the markets of their time.

At this point and being fully positioned, we wait. Livermore put it as: “Get right, and sit tight”.

An obvious stop level is anything below today’s BIS low of: 33.01.

Charts by StockCharts

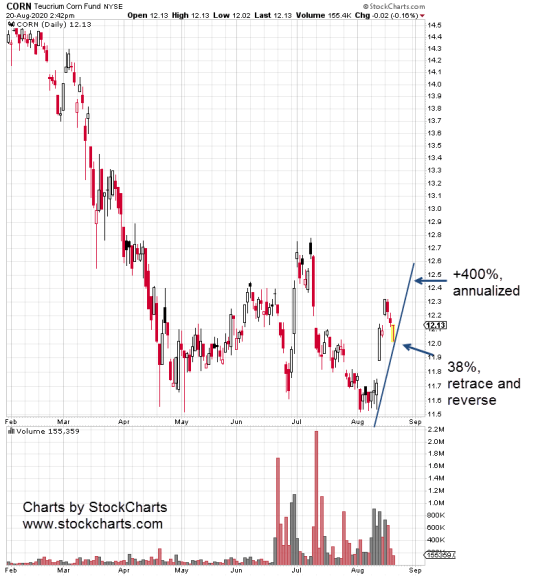

Meanwhile, back at the farm (literally), the food supply is undergoing controlled demolition.

Meanwhile, back at the farm (literally), the food supply is undergoing controlled demolition.

Maybe it’s stocks and bonds going lower together. No safe havens. Is it possible?

Maybe it’s stocks and bonds going lower together. No safe havens. Is it possible? Effectively trading TBT requires a sustained down move in the corresponding market (to mitigate the down-bias). The latest example shows bonds ready to break lower with rates ($TNX) moving higher.

Effectively trading TBT requires a sustained down move in the corresponding market (to mitigate the down-bias). The latest example shows bonds ready to break lower with rates ($TNX) moving higher. If the chart pattern (below) is in effect, if price action moves according to the breakout forecast, real estate … along with

If the chart pattern (below) is in effect, if price action moves according to the breakout forecast, real estate … along with

The problem is, it’s similar by an order of magnitude or more.

The problem is, it’s similar by an order of magnitude or more. It’s different now.

It’s different now. That’s the direction of the Dow Jones 30, the S&P 500 and the Russell 2000.

That’s the direction of the Dow Jones 30, the S&P 500 and the Russell 2000.