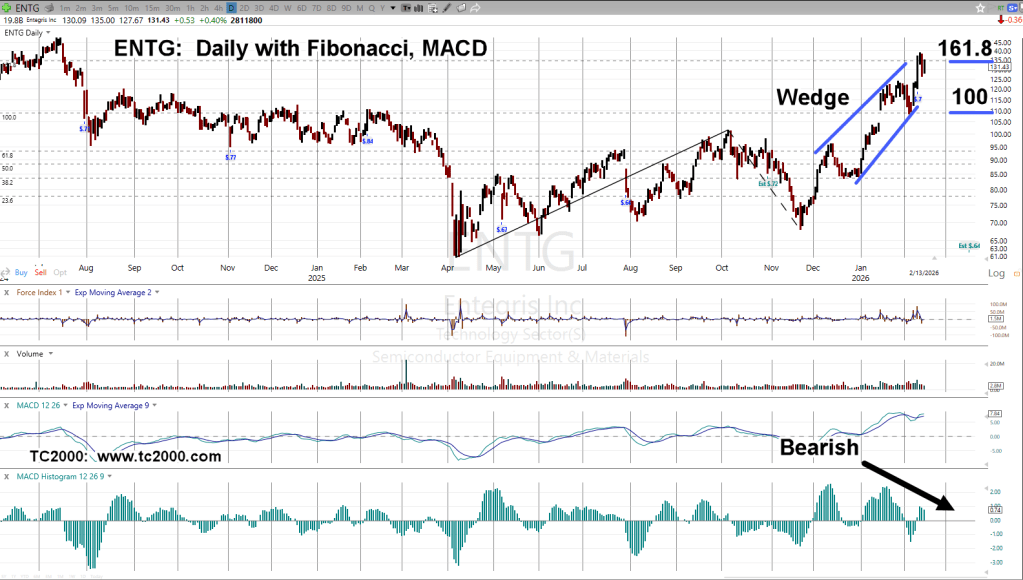

With Fibonacci Sequence

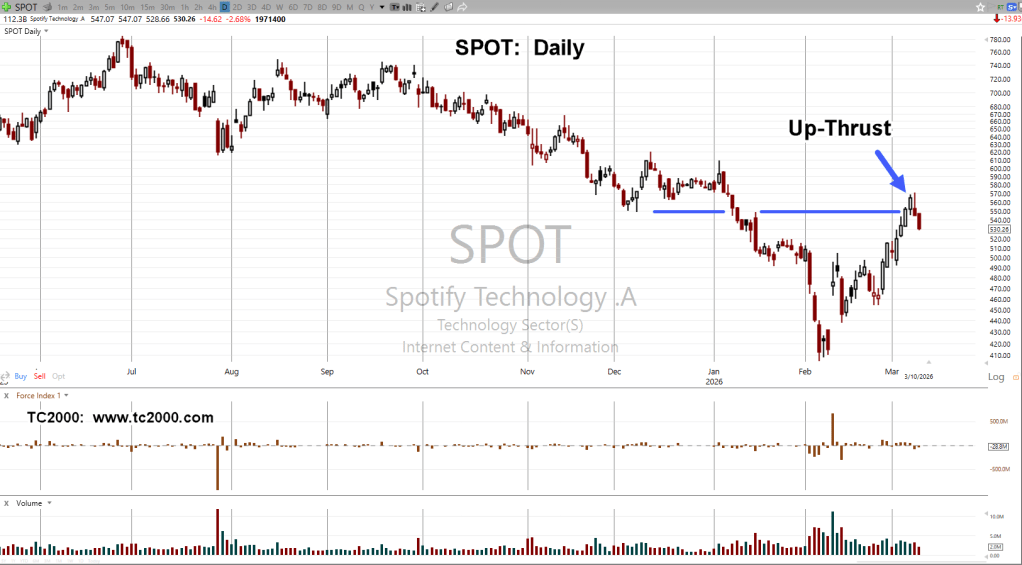

The last update on SPOT, identified the retrace targets for a potential reversal, link here.

Price action hit 38%, then printed an up thrust, then a reversal (not advice, not a recommendation).

In an almost surreal situation, SPOT has declined 48% on the first leg down, retraced in Fibonacci 21-Days (not shown), all the while, short interest remains muted at just over 3%, listed here.

Where are the bears?

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279