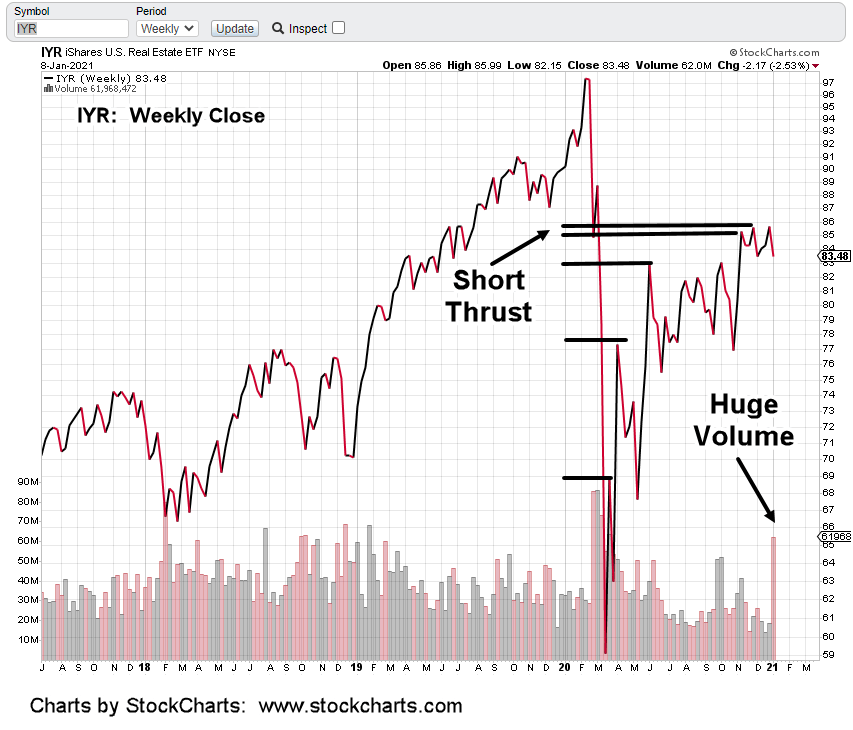

The clip below is the last 20-minutes of IYR going into the close. It’s less than a minute long, so the trade action has been sped up.

There are several important parts.

First, there’s a Fibonacci retrace tool being used that has top origins off the view of the chart.

The dashed line at the top of screen is the 38.2% retrace of the entire move over the past two months.

It’s clear IYR has tested and pulled back from this area.

Next we see to the far left price action topping around 83.75. Following that line to the right, in the middle of today’s session is a small triangular wedge that’s six-candles wide (approx: 90-minutes).

As the recording starts, price action has come back to that (83.75) area. It can either bounce off to the upside or break down.

A breakdown indicates support is weak; we may have seen the end of the counter-trend move discussed in the mid-day update.

As noted, price action broke through minor support and closed below. We’ll see what happens next.

For the day, IYR tested and pulled back from the 38.2% retrace area; suggesting it’s ready to continue subdividing lower.

TC2000 Charts courtesy of Worden Brothers, Inc. www.worden.com