Because You Can ‘Eat’ Gold, Right?

A military invasion of Ukraine, nuclear power plant (supposedly) bombed, set on fire, power outages and potential food rationing, yet gold’s still below all-time highs?

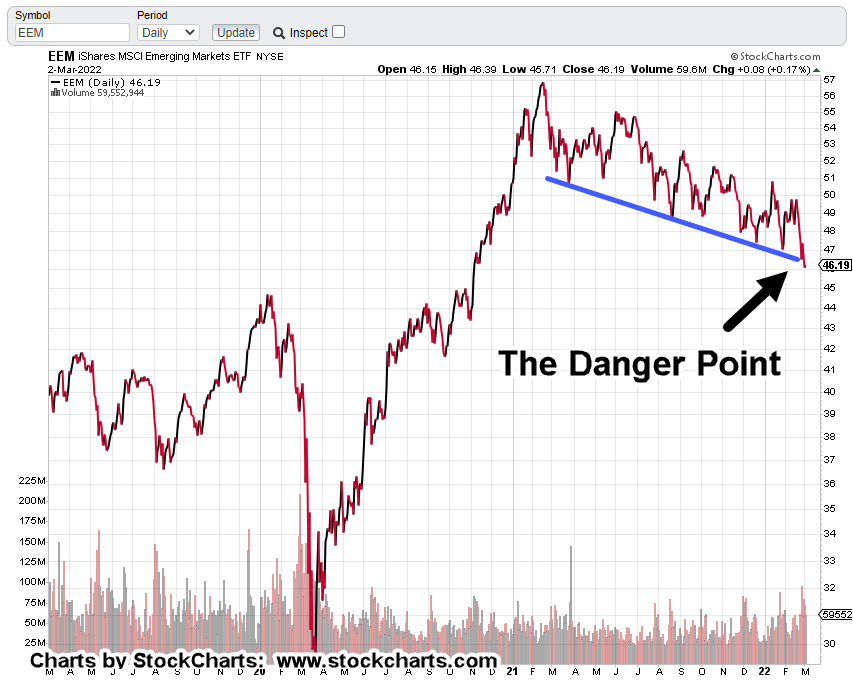

Not only that as we’ll see below, the actual price has traced out what’s so far, a counter-trend (a-b-c) move; that is, the main trend is down … not up.

I like gold as much as the next guy but we’re seeing again and again, that’s not the crux of the immediate (world-wide) plan on a go forward basis.

Dollar & Gold: Game Of ‘Chicken’

Like a game of chicken, both the dollar and gold rallying strongly together; waiting to see who’s going to reverse first.

What do you think?

With as much control as certain entities have over both the dollar and gold … who’s likely to turn lower first?

If it’s gold, then at this juncture (below), it’s in a good position for reversal.

Weekly Gold (GLD) Close

The yellow vertical lines above, are of equal length.

GLD could push slightly higher and still maintain the ‘corrective’ a-b-c, structure.

As labeled, price action fits the ‘rule of alternation‘. The structure of the ‘a’ wave is brief and sharp. The structure of the ‘c’ wave is overlapping and longer duration.

The Danger Point:

Gold (GLD) is there now.

Continued upward pressure would change the ‘reversal’ assessment, to potential breakout … much higher prices ahead.

However, as J.B., points out in this latest video (time stamp 9:25) saying, he’s never seen so much traffic on the roads … as if gasoline’s at 99-cents.

One answer could be, this is the herd:

Completely unprepared and running around to find another herd as equally unprepared.

Panic buying of precious metals because everybody else is doing it, could be the reason behind gold’s current juncture.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279