Wyckoff Schematic

An excellent schematic tutorial on Wyckoff, can be found here.

Going to the link, scrolling down to ‘Distribution’, we have a schematic that includes the notation “UTAD”.

UTAD, stands for, Upthrust After Distribution.

The accompanying text for the schematic indicates the distribution has already taken place; UTAD, is essentially a ‘last gasp’ to see if there’s any more demand.

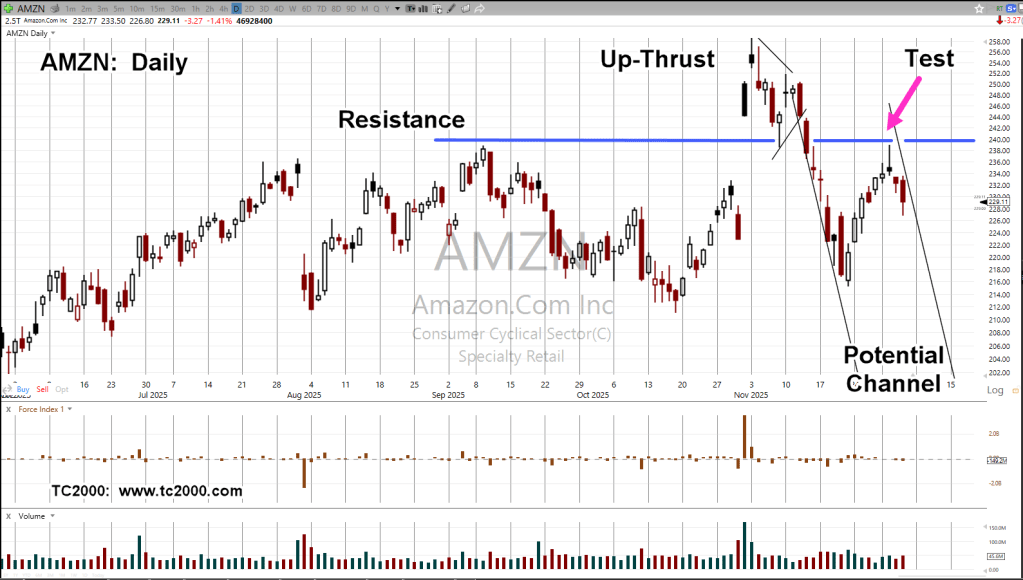

A fascinating question would be, ‘Was the heavy volume associated with this update an indication of distribution?’

Does that mean the subsequent blip higher in this update, was essentially UTAD?

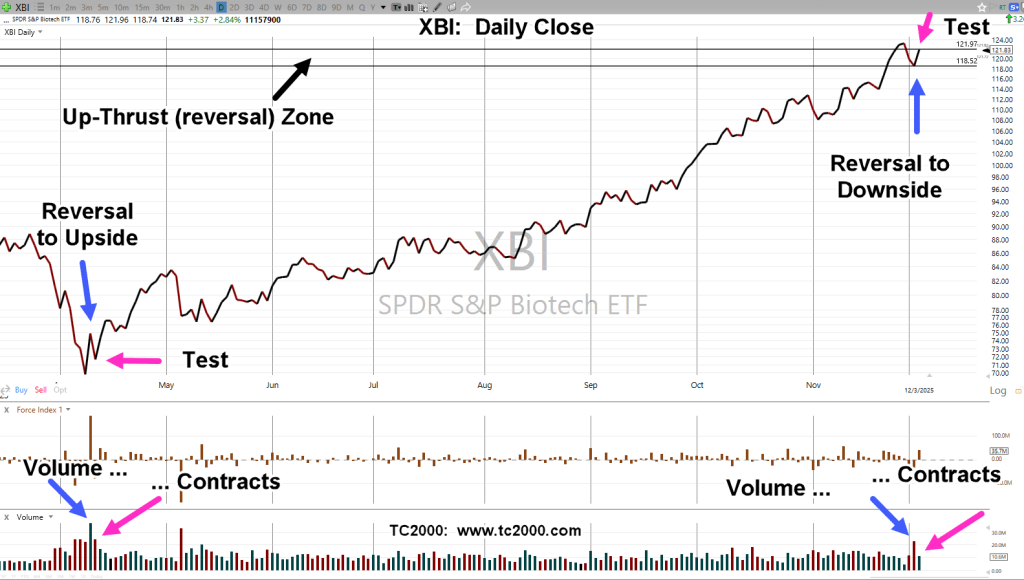

Biotech XBI, Hourly

The heavy volume (potential) distribution is noted.

If this is a correct view of XBI, then right now, it’s at The Danger Point®; where risk on a short is least (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279