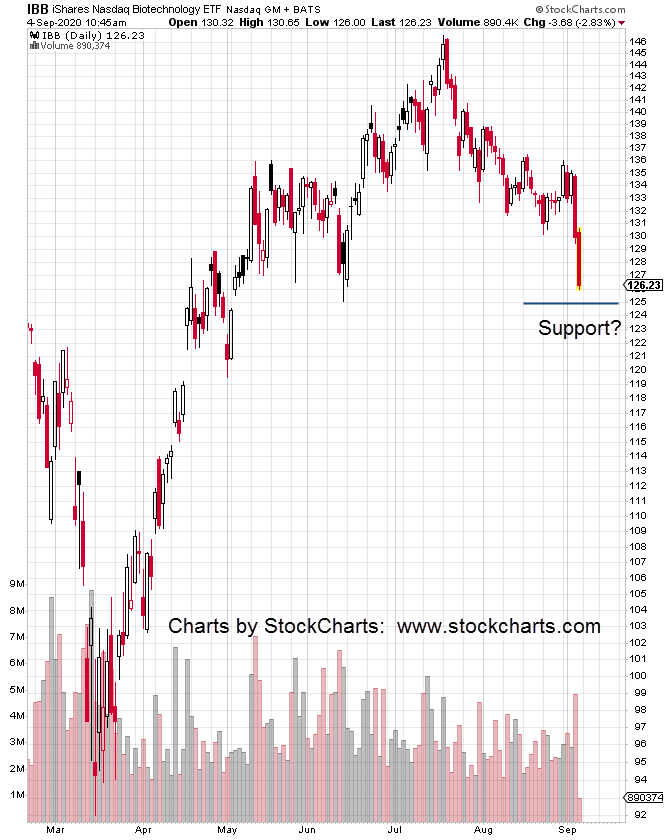

Of the nine market indices listed below, only one has a bearish weekly MACD cross-over: Biotech

IYM: Basic Materials

IBB: Biotech

DIA: Dow 30

IYT: Dow transports

QQQ: NASDAQ 100

IYR: Real Estate

IWM: Russell 2000

SOXX: Semiconductors

SPY: S&P 500

Yesterday, the indices were are at all time highs except for real estate (IYR), biotech (IBB), and Russell 2000 (IWM).

Looking at IYR and IWM, we can see, although they are below the high, there’s still a persistent up-trend.

Even with today’s on-going reversal (three-hours before close), only biotech has posted a bearish, weekly MACD cross-over.

Of course, it won’t be known until after the fact why biotech is unique. A hint at what might be the reason, is here (if it’s still available).

A gallery of the weekly index charts, listed above (as of 9/2/20) can be found here.

The focus of this firm, since June 3rd, exactly three months ago, has been biotech and its impending reversal.

A significant short position has been established over those three months via BIS, the 2X, inverse fund. Current Stop: 32.18

So, just what is ‘significant’? How big is that?

To be transparent, without giving specifics, avoiding the usual internet keyboard warrior, and/or hater, the position is as follows:

We’re short what amounts to a full year’s wage for the typical American worker. Fair enough?

When the position is closed out, results will be posted on the company site, located here.

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

Trading books and specifically

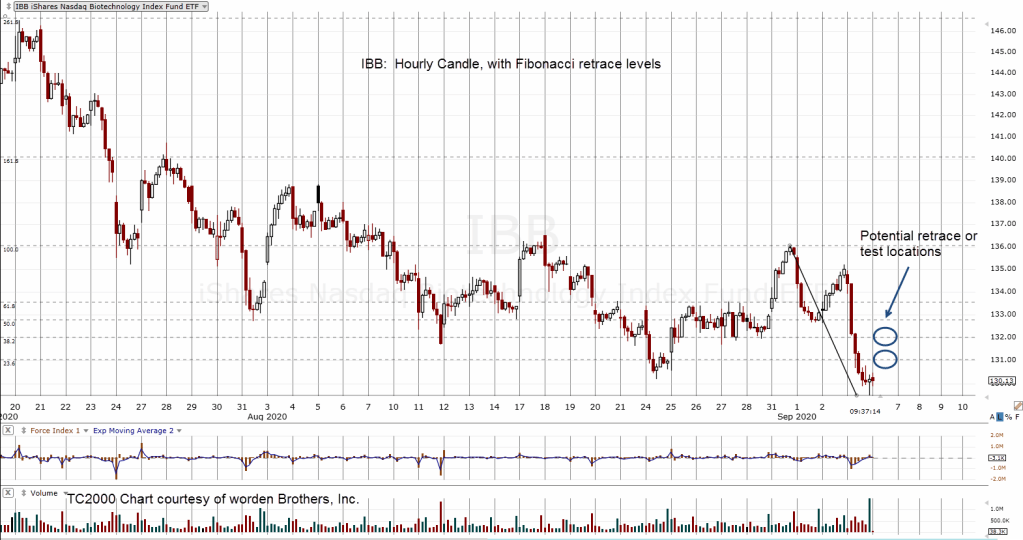

Trading books and specifically  Speculative volume for potential downside in biotech is increasing. Last Friday’s volume in BIS was the highest in nearly four years.

Speculative volume for potential downside in biotech is increasing. Last Friday’s volume in BIS was the highest in nearly four years.