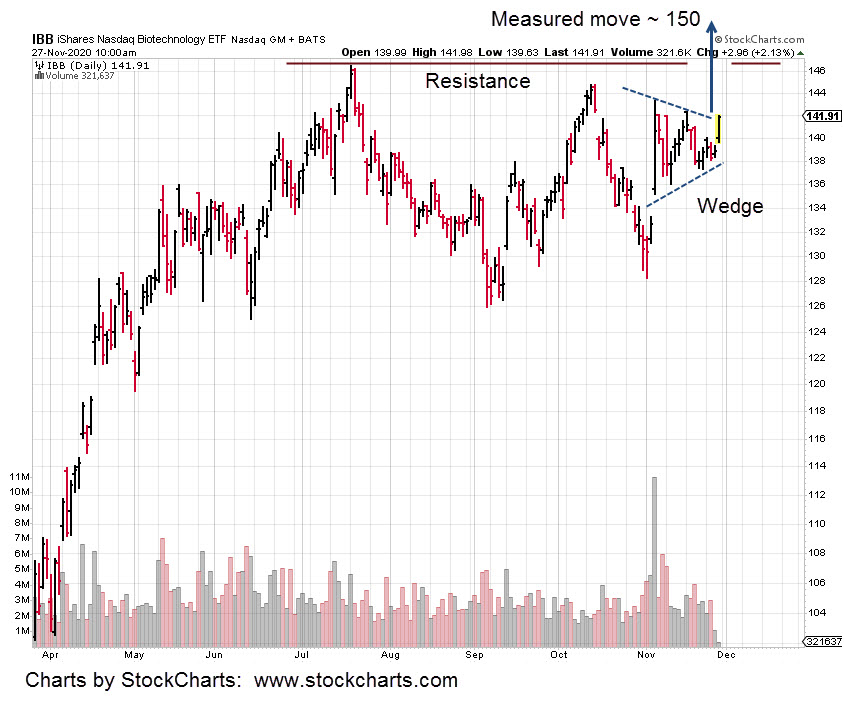

Wedge patterns are the end of the line. They typically come after a sustained move whether it’s up or down.

IBB has been oscillating and coiling for weeks.

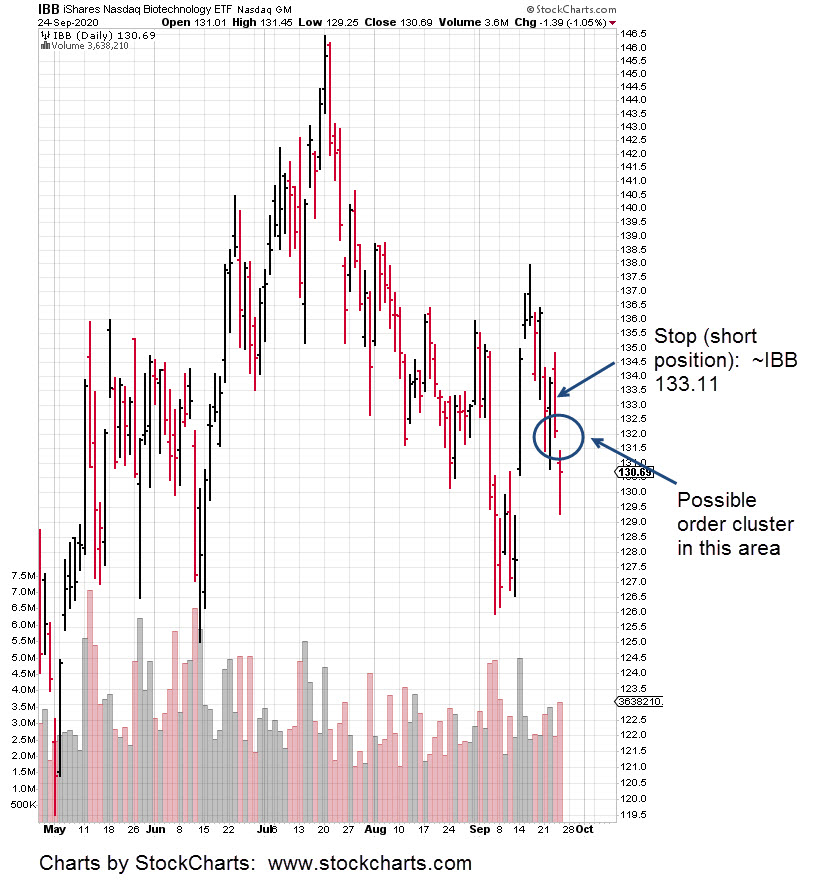

The last trade in this sector was a short position (via BIS), opened October 14th, then closed the next day for a gain slightly higher than 4%.

Back then, the thinking was IBB is to make new highs just before the election (in turn posting a bearish MACD on the weekly) and then reverse.

It didn’t happen.

This is the way of the markets. Setups begin to form, come to fruition or fade away.

Contrary to what the advertisements say (to lure the uninitiated), you don’t “work five minutes a day” and achieve phenomenal success.

It’s just another lie … at this point we should all be used to that.

If IBB continues higher in a measured move to the 150-area, it will push past resistance and post all time highs in the process.

It could set up for a bearish MACD divergence as well.

If and when this happens, depending on price action, we might see another low-risk area for a short position.

Stay Tuned.

Charts by StockCharts