By The Book

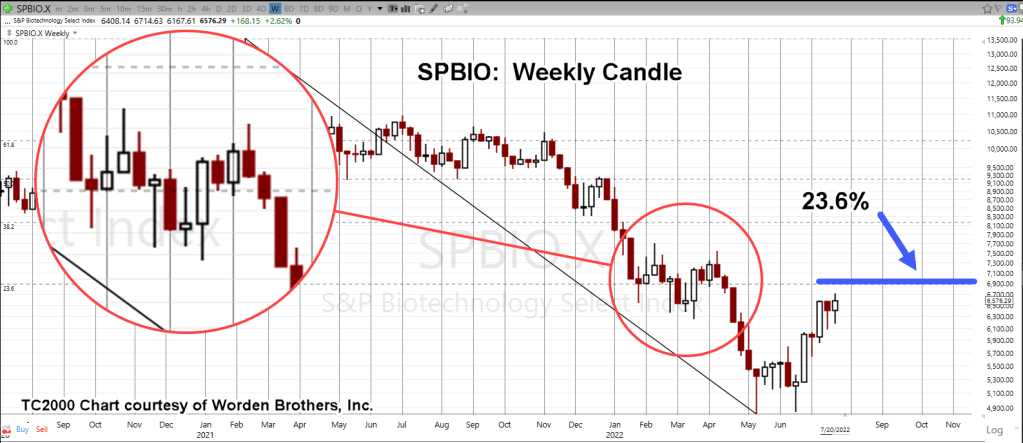

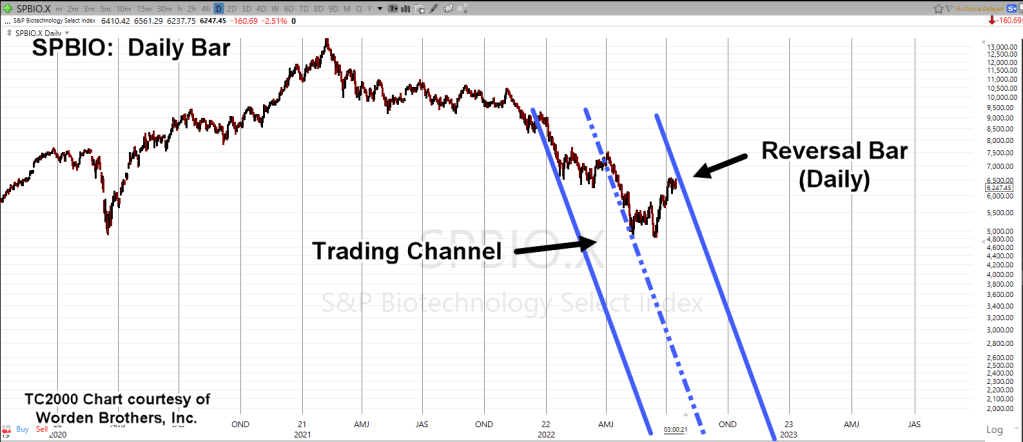

With about 40-minutes left in the session, biotech SPBIO, appears to be completing a test of its downside reversal.

Prior updates have shown the potential for a massive trading range; right along with a very weak reversal at Fibonacci 23.6%.

We’ve happened to locate a short video from the Wyckoff Stock Market Institute, detailing the nuances of Wyckoff spring action.

That video is linked here.

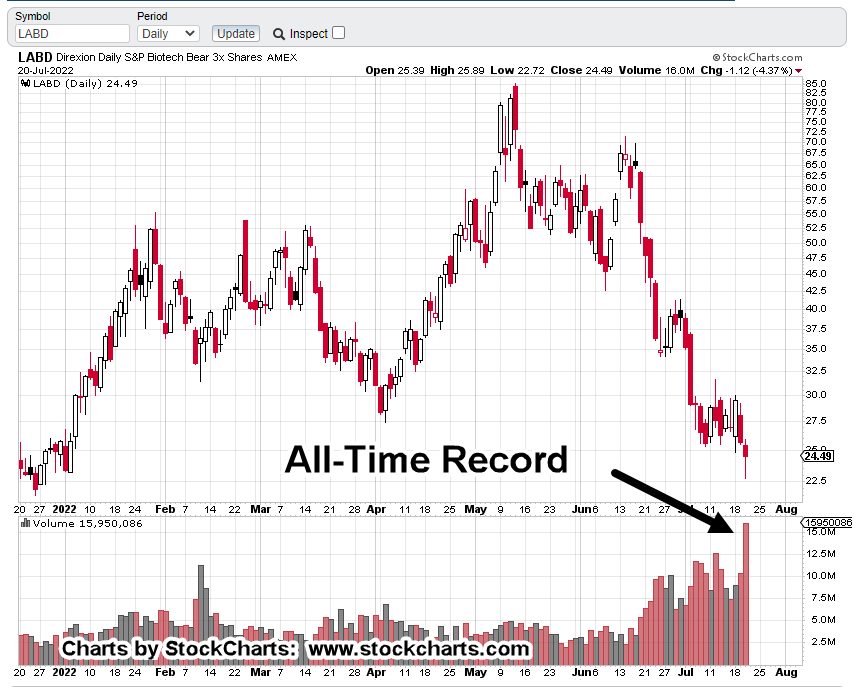

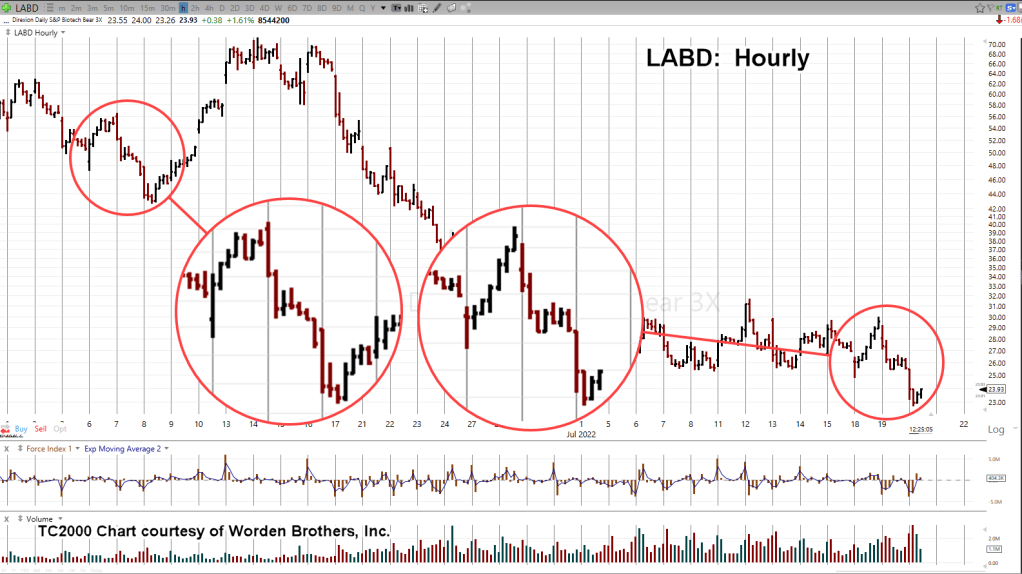

Watch the video and then look at the chart of leveraged inverse fund LABD, below.

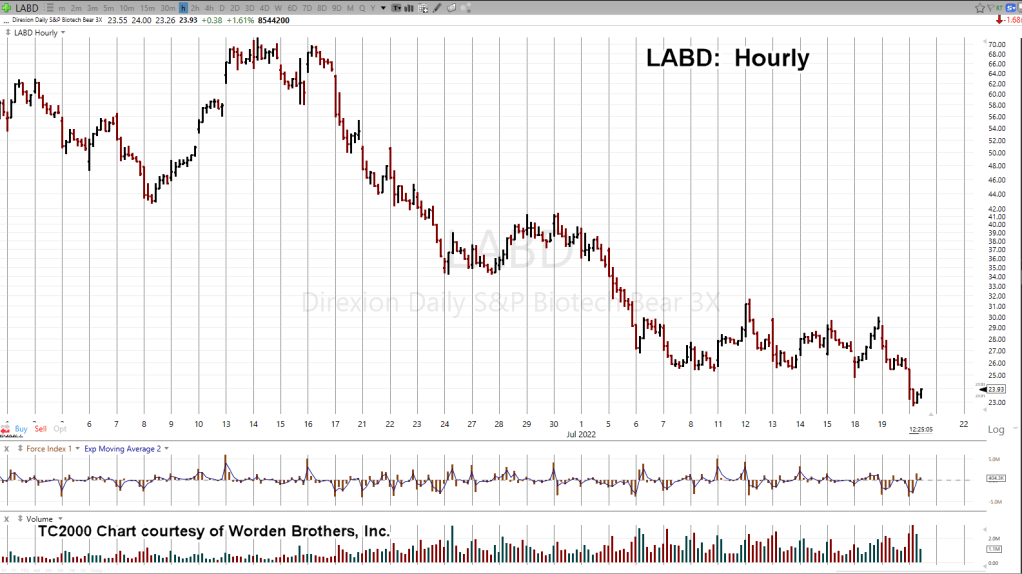

SPBIO, 3X Leveraged Inverse LABD, Hourly Chart

If the test has competed, we can expect a swift LABD rally (spring) to the upside (down for SPBIO).

Summary

The potential for a significant down-move in SPBIO, has already been covered.

Reference updates linked here, here, and here.

If this is a move of major significance, we’re still in the very early stages.

Positions have already been established; LABD-22-05, TDA-LABD-22-02 (not advice, not a recommendation).

SPBIO itself, will define the next course of action.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279