Exhaustion Gap?

With rival CarMax, down nearly -63%, from its all-time highs, increasing loan-loss reserves, and boots-on-the-ground reporting like this, it’s interesting that somehow, Carvana seems to have transcended the fundamentals. 🙂

Or is it really as Jesse Livermore used to say, ‘all about the numbers’.

No, not the earnings, P/E, or any other ‘financial’ metric, but numbers like Fibonacci, as we’ll see below.

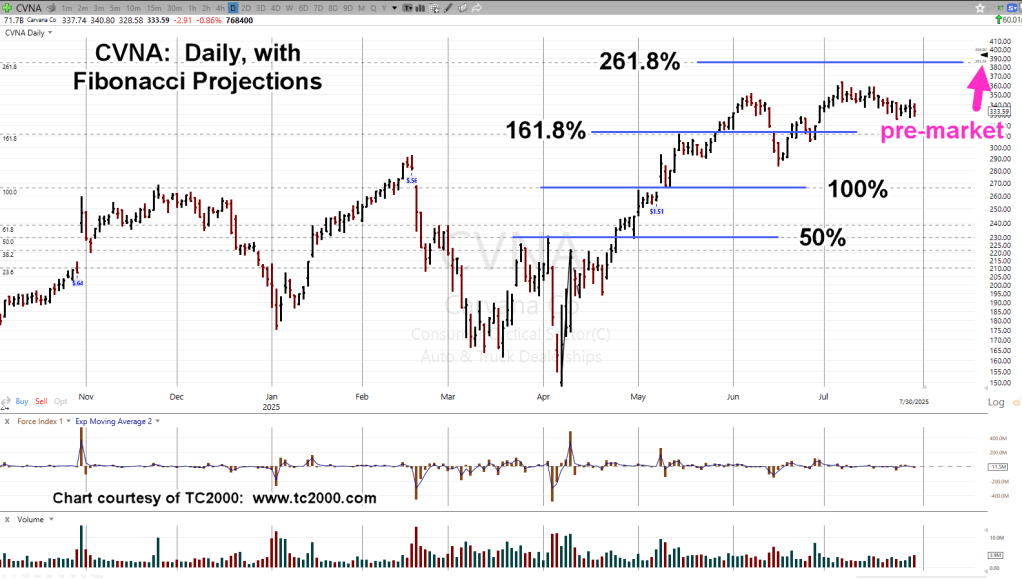

Carvana, CVNA, Daily

We’re still in pre-market trading with about thirty minutes to go before the open.

If CVNA, opens at its current level, it’s right at the 261.8%, Fibonacci projection and all-time highs.

Short interest on CVNA is currently listed at 9.36%, here.

If the open is at the level shown, it’s likely to clear out some (or most) that are short (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279