The Bull & Bear Side

The last biotech trade (going short) was back in August, as LABD-24-17.

The trade posted a -3.6%, loss and from then, the decision was made to stand aside.

The sector was not validating its up-thrust (bearish) set-up discussed many times prior; price action itself, showed something else at work.

Fast forward to now.

At this point, we’re at (upside) resistance and threatening to break out; biotech has made the news, link here.

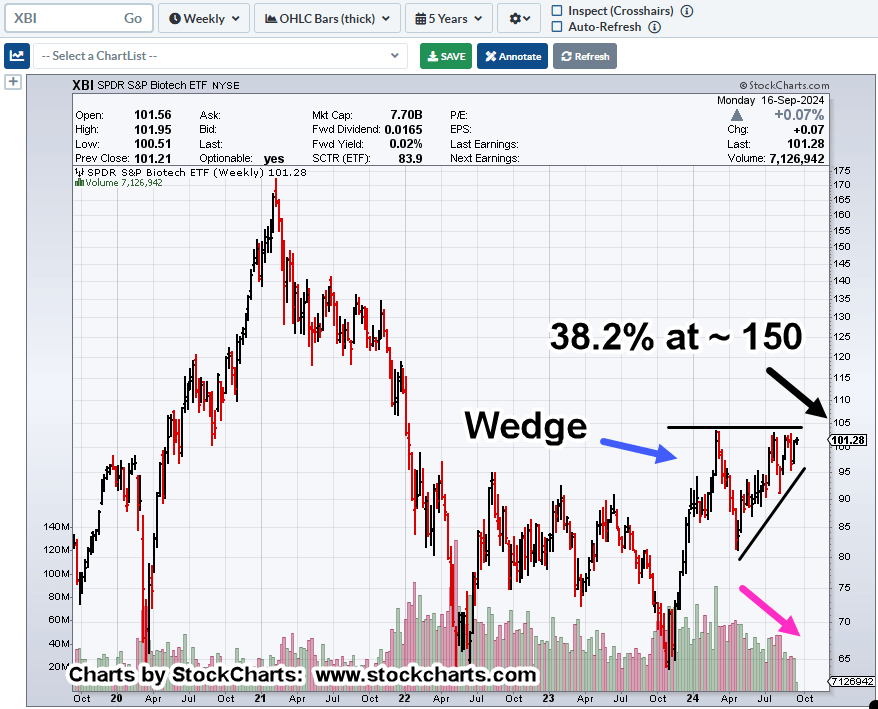

Biotech XBI, Weekly

“What do you see?”

Shown below is a wedge formation, the likely premise for all the hoopla in the linked article above.

Also shown, we’re just ticks away from a Fibonacci 38.2%, retrace of the entire move; February 2021 highs to lows, May of 2022.

Possibly as important, the volume (magenta arrow); where is it?

Where’s the volume (demand) for this underperforming sector, rising into some kind of (potential) breakout?

If there is a breakout, which could be as soon as tomorrow’s Fed announcement, price action will be monitored closely.

Bond Digression

The Fed does what the bond market tells it to do (not advice, not a recommendation).

From the last report, the potential downside reversal, was negated and bonds (TLT) are at their own breakout (up-thrust) level.

That being the case, probabilities favor a rate cut; finally, after 1.5 years of mainstream jawboning on the topic.

Back to biotech.

If we do get an upside breakout and it fails … we’ll cover the downside potential at that point.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279