A Long Way Down

On February 3rd, also represented as; 2/3/23, it all changed.

That was the day the ‘toxic train‘ derailed in East Palestine, Ohio.

It was also the day biotech sector SPBIO, reversed to the downside.

The biotech reversal was identified to the day with the following quote:

” … today’s action is consistent with resolution of the five-months of congestion …”

Biotech had been in a congestion zone, a bear flag, for an incredible five-months. There’s no other pattern like on the chart of SPBIO (ticker, $SPSIBI, on StockCharts).

The analysis stated that if or when this sector breaks to the downside, the extended period of congestion suggests a long, sustained, move lower (not advice, not a recommendation).

So, here we are.

Now, the downside reversal is obvious. Then again, it’s likely we’re still very early in the move as we’ll see below.

Projection Methods

We’re going to use two projection methods:

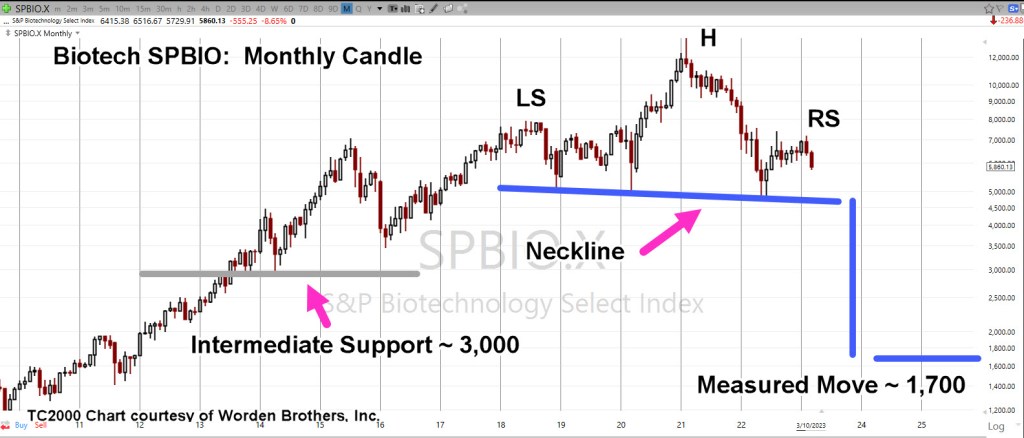

First: The standard classical chart which identifies a potential Head & Shoulders pattern.

Second: The century old technique of ‘counting’ via Point & Figure (P&F).

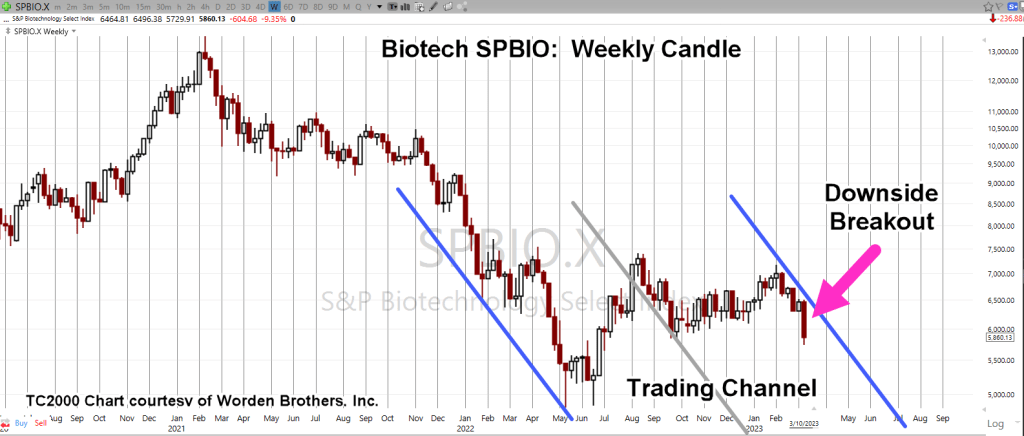

Biotech SPBIO, Weekly (Classical)

Two charts are in classical format. The first shows the trading channel that spans 39-weeks from week 5/13/22, to week 2/3/23.

Note: Let’s not miss the symbolism (also, here and here): May 13th, 2022, was Friday. Then we have 2/3/23.

“For we wrestle not … “

The second chart is a compressed view.

Note the “3,000-level”, discussed in the P&F section.

Biotech SPBIO, Monthly

If the H&S pattern is in-effect and the neckline is broken, we have a measured move projection to the vicinity of SPBIO ~ 1,700 (not advice, not a recommendation).

Now, on to the P&F.

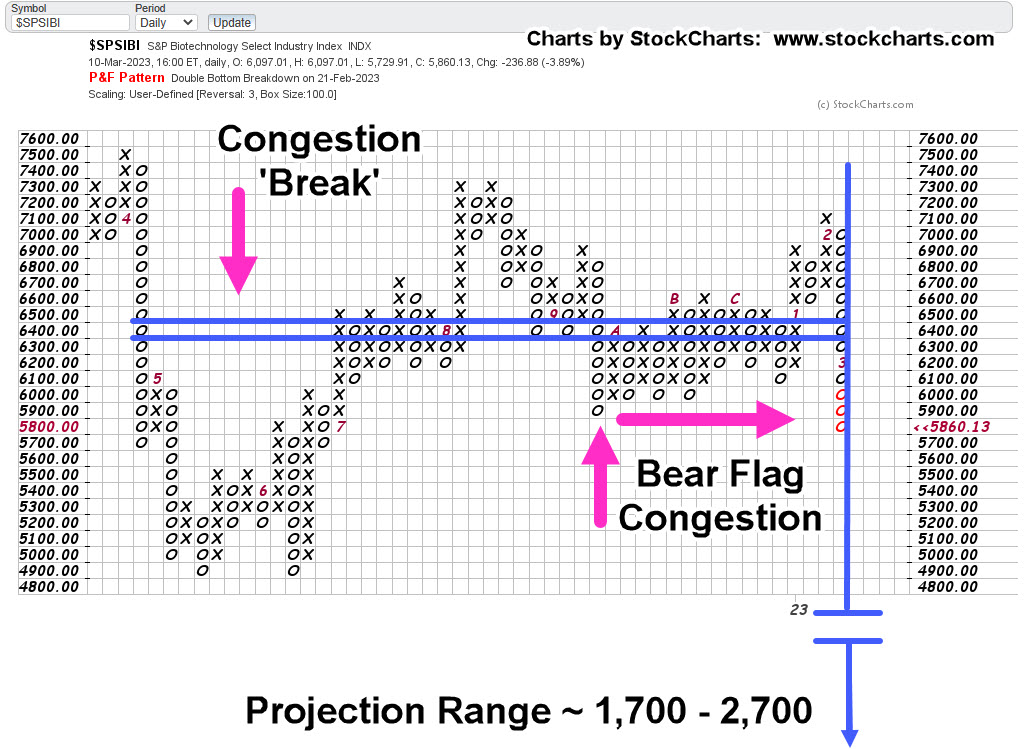

The ‘P&F’ chart has been used as a forecast tool for over one-hundred years.

The idea is to ‘count’ the number of congestion points and then project that congestion either higher or lower.

In our case of a breakdown, the projection is lower.

Biotech SPBIO ($SPSIBI), Daily P&F

The P&F chart comes up with roughly the same lower projection; approximately 1,700 (not advice, not a recommendation).

Looking at the P&F, we can see a steady amount of congestion with few breaks, that is, until we get to the left-most area.

There, we have a break of twelve boxes.

In classical P&F terms, that break of 12, indicates the SPBIO may ultimately reach the 1,700 level, but price action could be choppy after the initial count.

That initial count equates to around 3,000 for SPBIO, which just so happens to be an intermediate support level as shown on the Monthly chart.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279