The regular session is still thirty minutes away and already gold’s had it’s largest down-swing since August 11th.

Bulls must be stunned. It’s not supposed to be this way.

Of course, the financial press has to come up with some kind of ‘reason’, so there’re off plying their trade.

At this juncture, before the open, December gold is down about 4%.

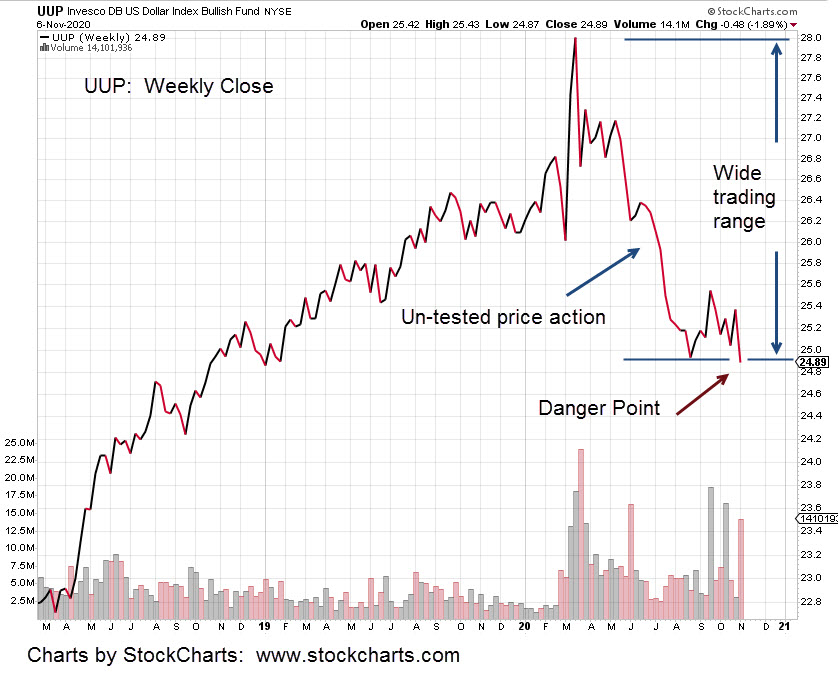

The dollar is slightly higher as forecast but bonds … TLT, down a whopping 2% in pre-market.

How can bonds be down (rates up) with the dollar higher and gold lower?

The question itself, is an error.

It’s not ‘why’ that’s important, it’s ‘what’. Asking why keeps one searching for the wrong answer. It’s exactly what the media and those manipulating the markets want.

The trail of why goes on forever and leads nowhere. The why is constantly changing second by second, minute by minute.

Asking ‘what’ is a different story; what is the gold market doing? Now, that’s a question.

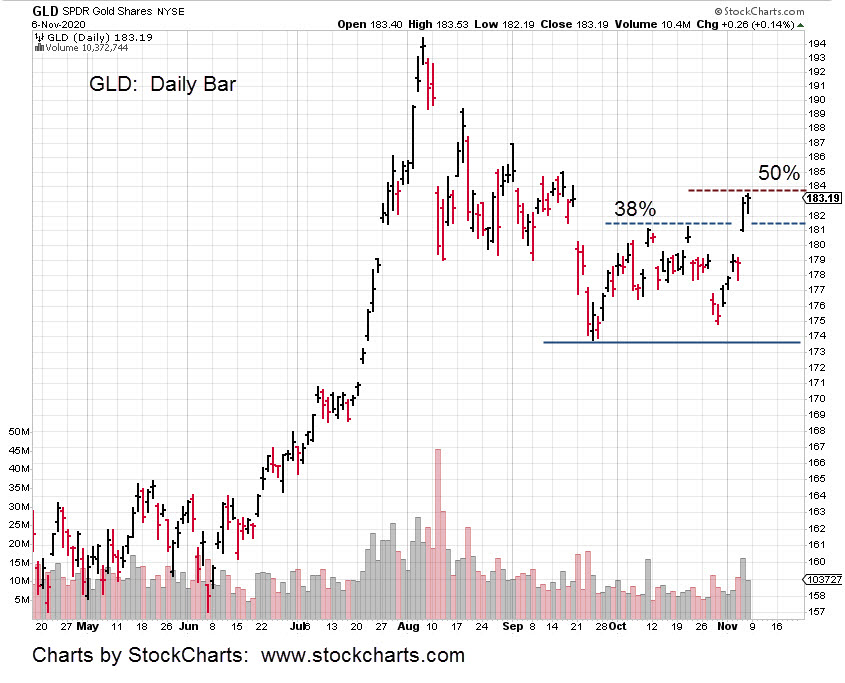

The gold market is down hard; Very hard. Shocked bulls, married to their ‘hyperinflation’ narrative, will have to see it as a buying opportunity.

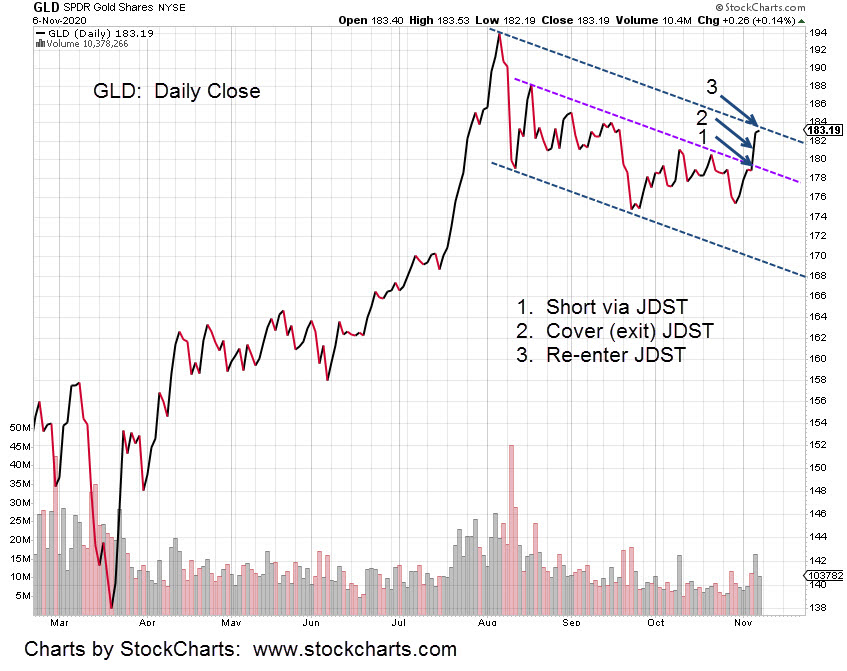

Expect gold to retrace somewhat during this session. However, the damage has been done. Gold (GLD) is below well established support levels … now resistance areas.

In related markets, the Junior Mining Index, GDXJ is down -5.75% in the pre-market session. Correspondingly, the inverse fund JDST, is up a stiff 11.5%.

As stated in this update (not advice, not a recommendation), the position in JDST was re-established during Friday’s session.

Obviously, we’re keeping that position for now and will monitor price action to determine a new stop location.