We’re at The Target

So, which is it?

Silver’s in the long (decades long) awaited breakout to hyperinflationary heaven, or …

Door No. 2

Silver has met its Fibonacci target, ready for reversal, sideways action, or …

Door No. 3

None of the above.

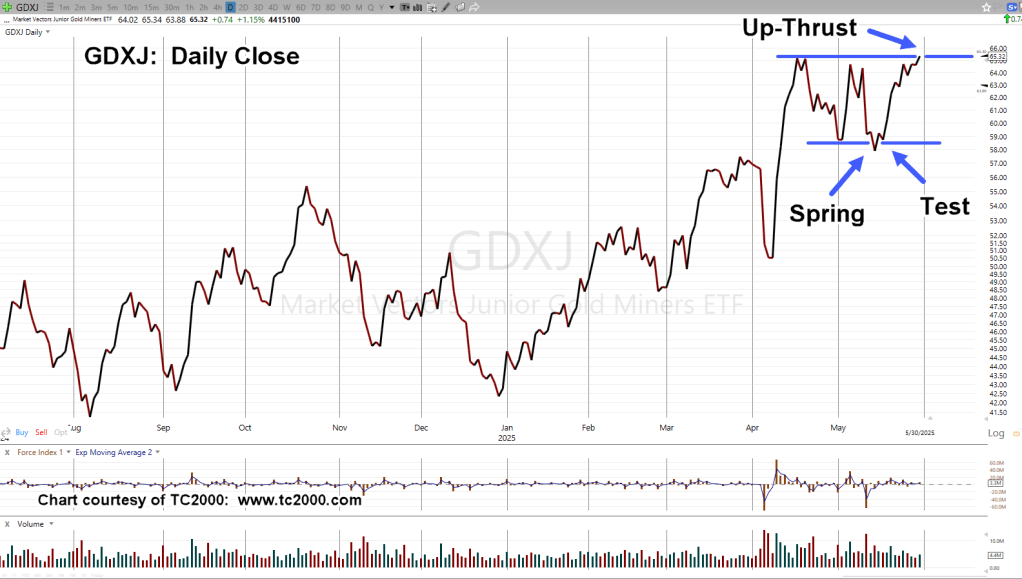

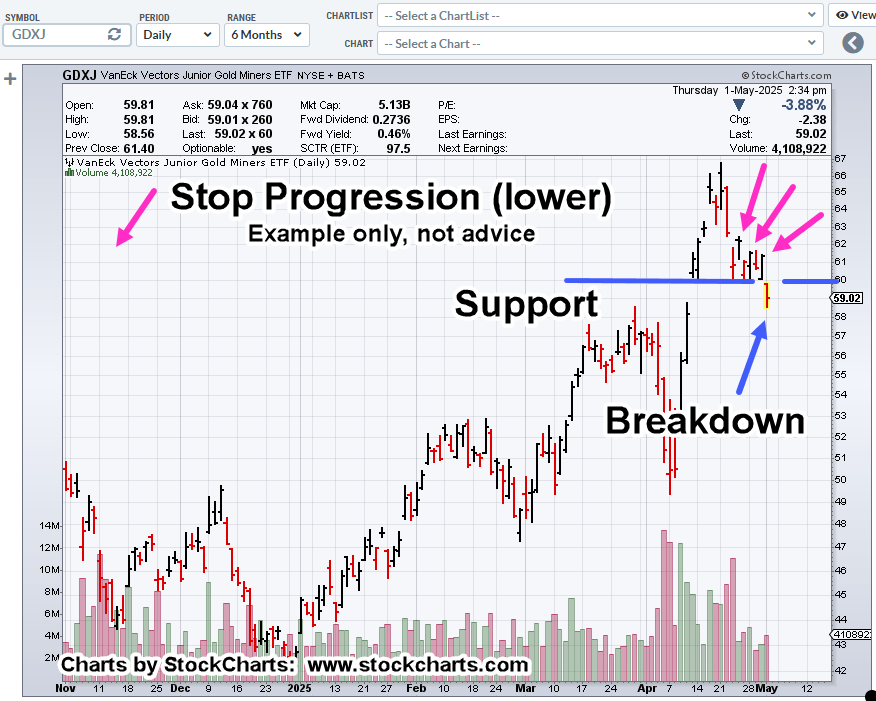

Then, what about the Miners?

It looks like they (GDX) have already decided.

No sooner had Friday’s update been released, they appear to have reversed (not advice, not a recommendation).

Obviously, there’s a lot going on in the markets and it’s happening fast. We’ve already been told what’s (likely to be) coming.

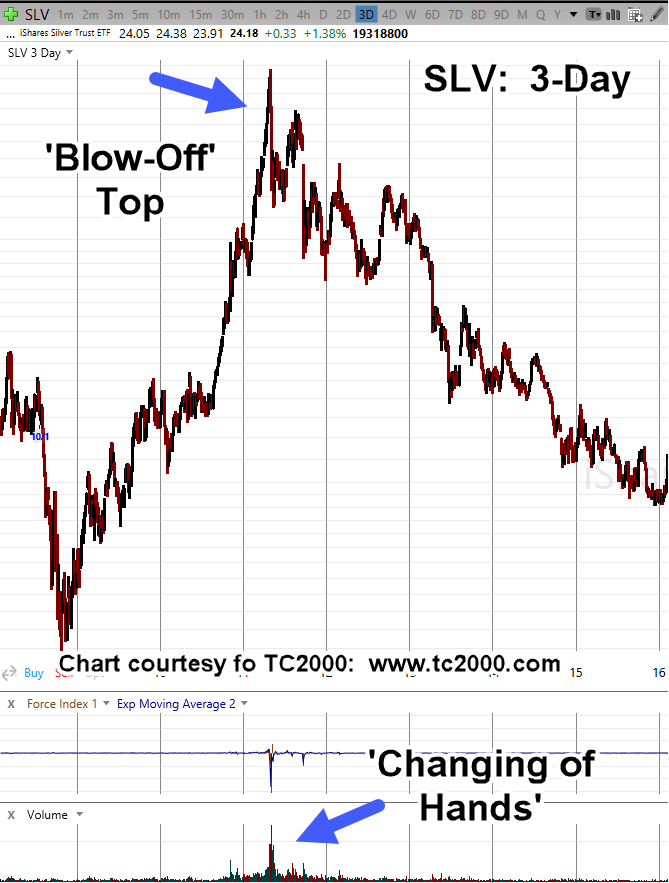

Back to silver, SLV.

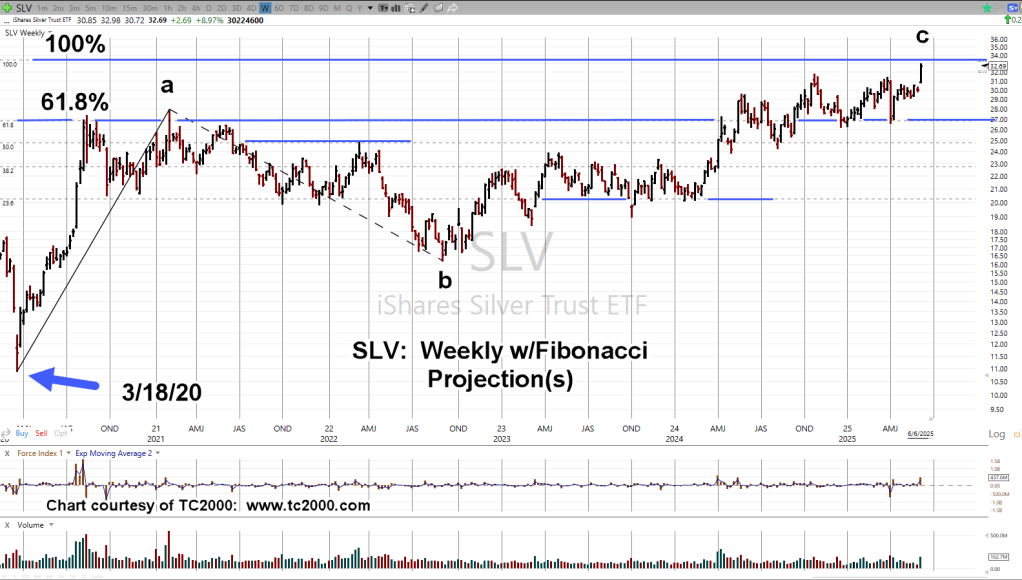

Silver SLV, Weekly

The chart shows what looks to be a corrective a-b-c (against the trend) move that’s lasted several years.

Note the ‘alternation’ of the moves.

Wave ‘a’ was dynamic, straight up. Next wave higher, wave ‘c’, is choppy and overlapping.

Moving in closer, we have the following.

The chart itself, says we’re back to the volume ‘spikes’ that typically occur (for SLV) at, or near, the end of a move (not advice, not a recommendation).

To add intrigue, note the massive downward thrust of Force Index during the ‘Tariff’ uproar.

Is this another hint of (pending) reversal?

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279