Does The ‘Correction’, Start Now?

More than a few ‘engineering’ types trading the market, will talk about getting over the need to know, ‘why’.

Why does Fibonacci work?

Why does price action alternate?

Why is the market moving, or not moving; why, why, why?

The media of course, wants everyone to focus on why.

If you’re focused on why, then you’re at least two steps removed from the truth.

Asking the wrong question (why) and then, looking for the wrong answer.

Both Livermore and Wyckoff, did not concern themselves with ‘why’ … but ‘what’?

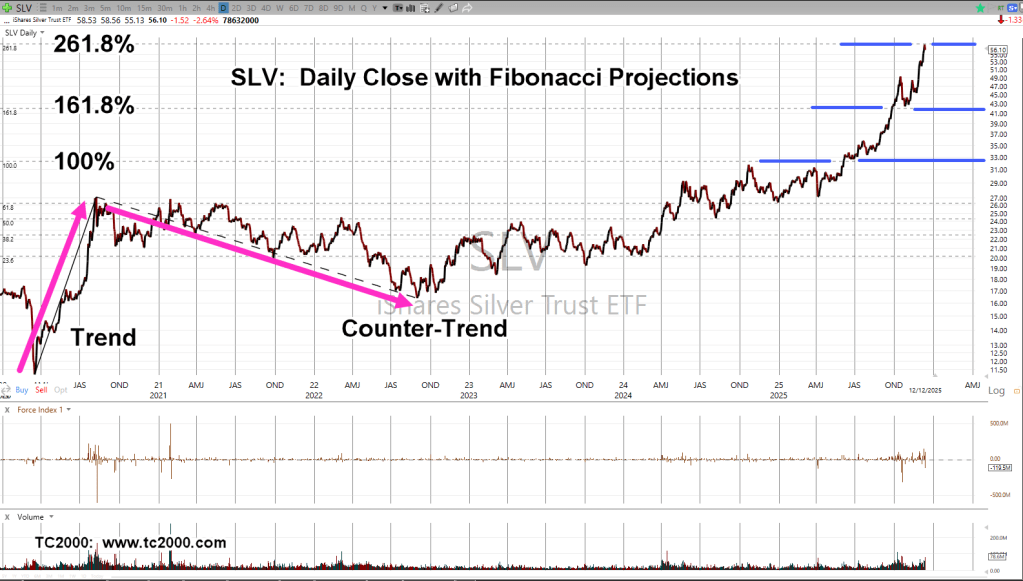

With that said, let’s take a look at ‘what’s’ going on with silver, SLV.

Silver SLV, Daily Close

Shown, are the lows of August 2020 to last Friday’s close.

A whole week of updates (maybe more) could be spent on this one chart: there’s that much going on.

We have Wyckoff springs, up-thrusts, price action alternation, Fibonacci levels, time correlations, volume spikes, and the list goes on.

For today however, the main take-away is that Friday was outside-down (key reversal) on heavy volume.

That reversal (so far) took place at the exact 261.8%, Fibonacci projection (not advice, not a recommendation).

As said in yesterday’s update, we could also be in a new paradigm where silver just keeps on going.

Next upside Fibonacci projection (423.6%) is near 83.50.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279