Will ‘Inflation’ Hit The Actuaries?

Since no-one tells the truth anymore, why not have ‘inflation’ be the excuse for the ‘excess‘ surge in mortality.

A surge that’s likely to result in wholesale changes to the actuaries (not a forecast).

Life insurance, a boring industry; nothing (unexpected) ever happens, until now.

As shown at this link, it’s all about to change.

Previously discussed here, life insurance could be the biggest ‘under the radar’ event for the year (not advice, not a recommendation).

Going back to the link, it had this to say:

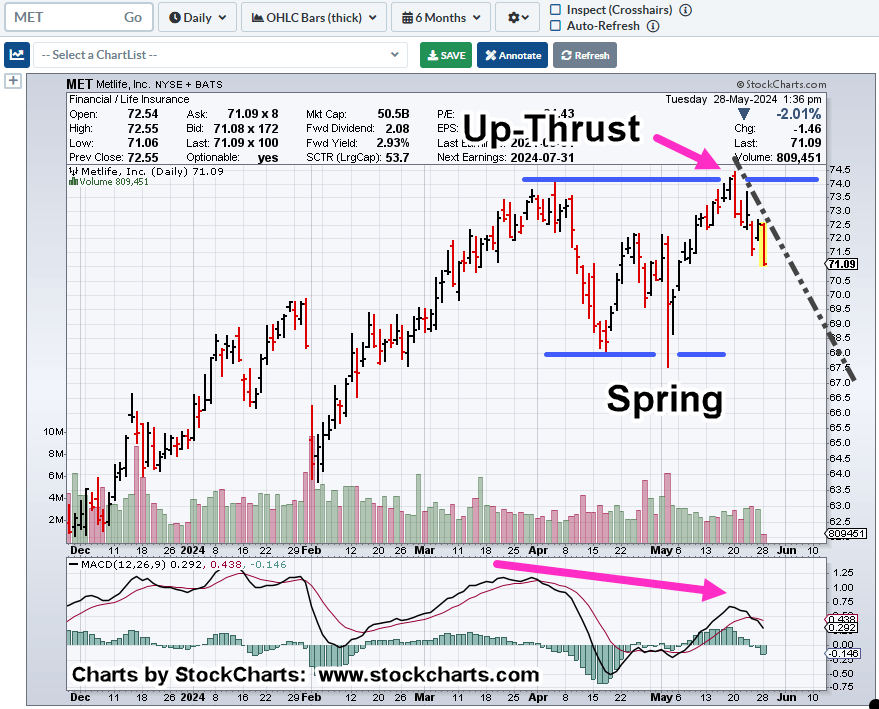

“We may find out as early as next session, if MET is in a downtrend or spring position, ready to move higher … “

From that point, MET indeed launched off the spring set-up. Then, it posted an upthrust, a repeating pattern.

MetLife MET, Daily

The spring was generated off of the earnings release that progressed into the up-thrust set-up.

The result was a decisive outside-down bar on May 20th.

Note the dashed grey trendline; currently declining at approximately -70%, annualized.

To Short or Not

Everyone has their own risk tolerance.

From a personal standpoint, I have no plans to short MET directly (not advice, not a recommendation).

Instead, it could be a proxy for ‘unexpected events’ coming to light about a sector which up to now, has been ignored.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279