Reversal of Significance

Wyckoff (tape reading) analysis identified the potential reversal in XBI.

In the past two days of trading, biotech XBI, is decisively lower (not advice, not a recommendation).

However, there’s more to this story.

As we’ll see below, Fibonacci is at work as well.

Biotech XBI, Daily Close

From closing high on 2/27/24, to closing high on 9/19/24, was a Fibonacci 144 days (minus one).

Ladies and Gentlemen, it doesn’t get much better 🙂

The black lines show resistance penetration, up-thrust and reversal.

Livermore, Wyckoff & Loeb

The trading methods of the three market masters above, can be summarized as:

Strategy, Tactics and Focus.

Livermore’s method of ‘what’s going to happen in a (potential) big way’, pointed to biotech.

Wyckoff’s analysis was used to identify (to the day), the potential for a significant reversal.

Loeb, who is less known, was the former Vice Chairman of E.F. Hutton, disparaged ‘diversification’ as the ‘averaging of errors’; meaning, if you don’t know what you’re doing (in the markets), you ‘diversify.’

We can see all three at work in the selection to go short biotech via LABD (not advice, not a recommendation).

Fixing Errors

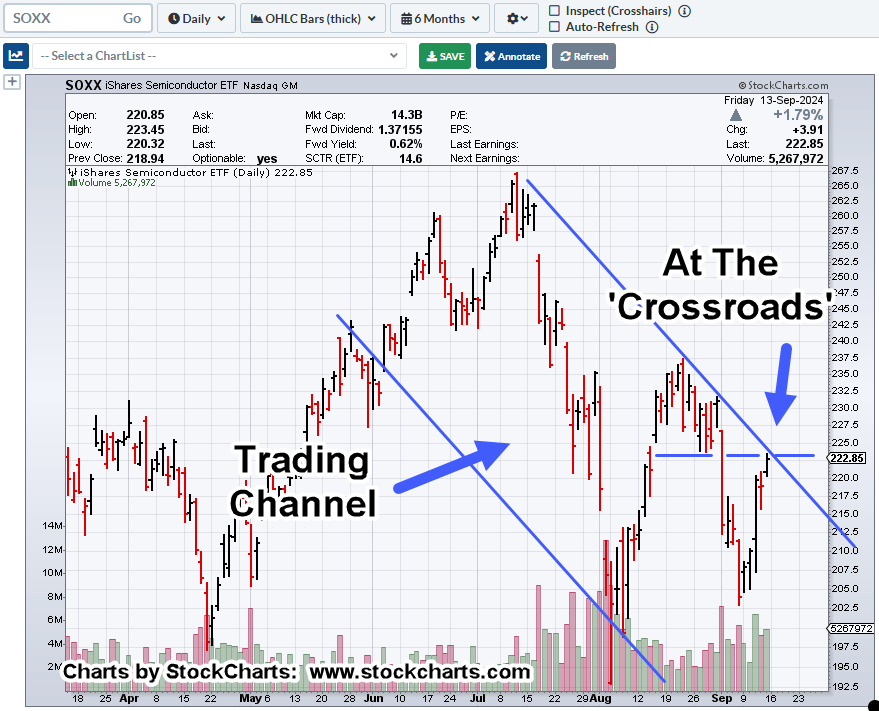

For those watching, you got to see up close and personal a trading error on shorting the SOXX; specifically, an -11.6%, hit, link here.

As of this post, four trading days later, that loss has been fully recovered and then some.

This is how should be done.

Clear the mind, look for (don’t force) another opportunity, get to back to business.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279