3:37 p.m., EST

Injections, Deadliest Ever

Forced Compliance

Biotech Danger Point

By this time, it’s no secret.

The ‘speck’ injections as we call them, have been proven to be the deadliest in world history.

Even with manipulating data by deleting deaths, delaying updates, pressuring medical professionals not to report, the data at this link paints a stark picture.

For reasons likely to be revealed later, major corporations are ‘requiring’ their employees to comply.

Not only that, in the link above it’s the clients as well. One has to wonder, who are ‘clients’ beneficiaries?

Before we leave the topic and move on to the chart, one of the ‘features’ of the injection, is sterilization.

No more employees. No more clients. No more future clients. Somehow that’s an effective business model.

Finally, a cursory review of the local ‘certified’ financial advisers and their websites has not one word about what’s really going on.

Do these people think by avoiding the truth, somehow they’re going to increase their business?

One major nationwide adviser/broker even has (in print, mind you) that ‘we’re going to have the best recovery ever!’

What are they going to say when there’s a “no bid” market and nobody can get in or out?

Crisis will create opportunity for leadership; at this point, there’s not much if any in the financial sector (i.e. ‘best ever’, above).

When the big melt-down hits, leadership’s not coming from the ranks of the ‘compliant’ or the enforced mediocrity of the ‘fiduciary’.

Therefore, we can all take our cue; like this Irish couple who took it upon themselves, to separate from the crowd and escape quarantine.

With that in mind, on to the markets:

Analysis, Biotech

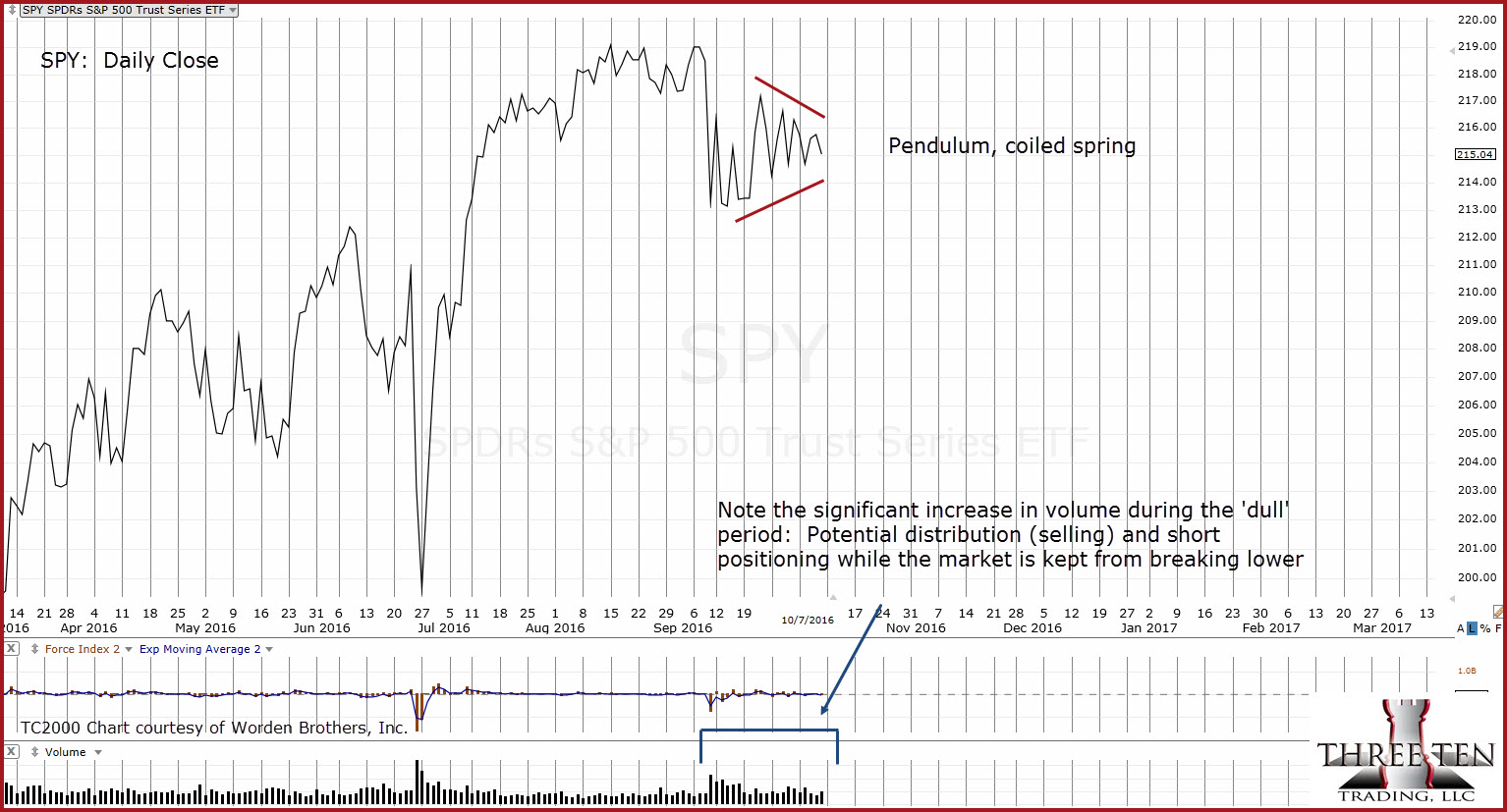

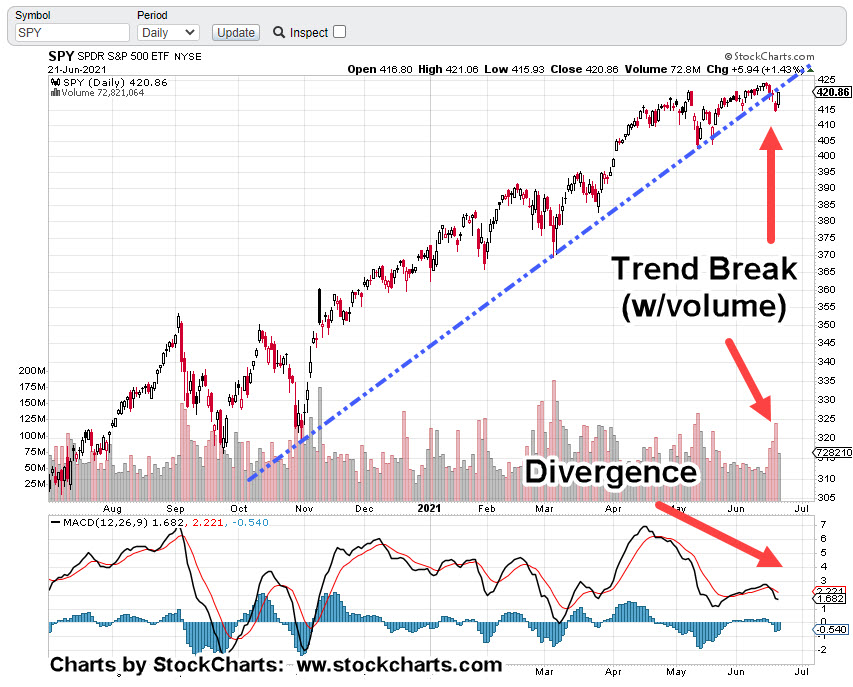

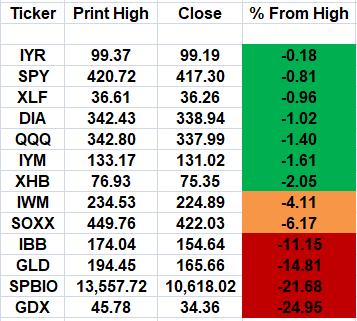

As we head towards the close with about twenty minutes left, the S&P 500, has posted an all-time high.

Biotech, SPBIO and IBB, are still well below their highs but are nonetheless at a point of instability with today’s action.

As the Hourly chart of LABD shows, we’re at the danger point and in spring condition:

A push back into the range above support, is significantly bullish for LABD and bearish for SPBIO.

Stay Tuned

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

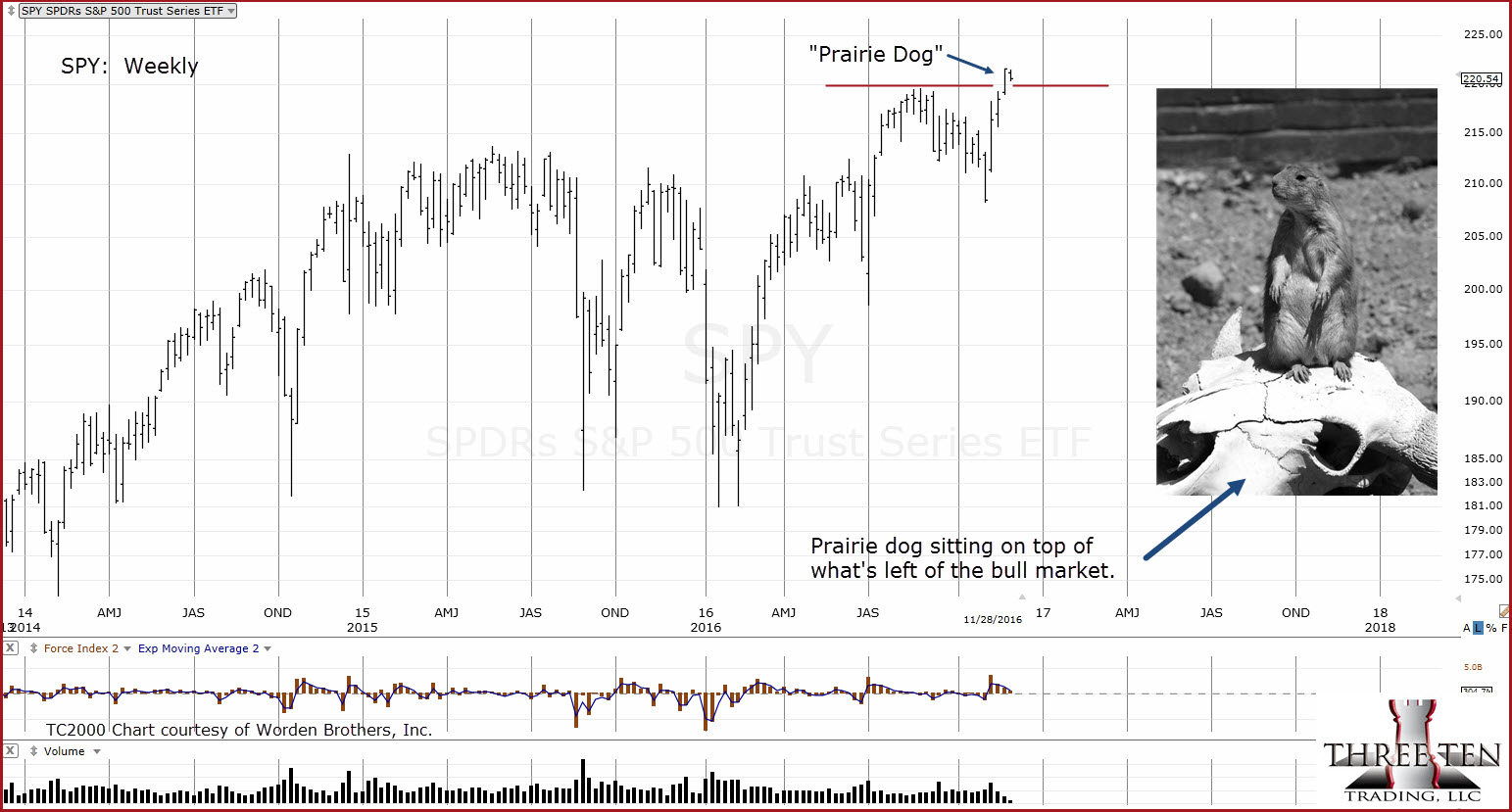

That’s the direction of the Dow Jones 30, the S&P 500 and the Russell 2000.

That’s the direction of the Dow Jones 30, the S&P 500 and the Russell 2000.