Potential Danger, For The Upside

It’s still in the early session and gold GLD, is trading higher … for now.

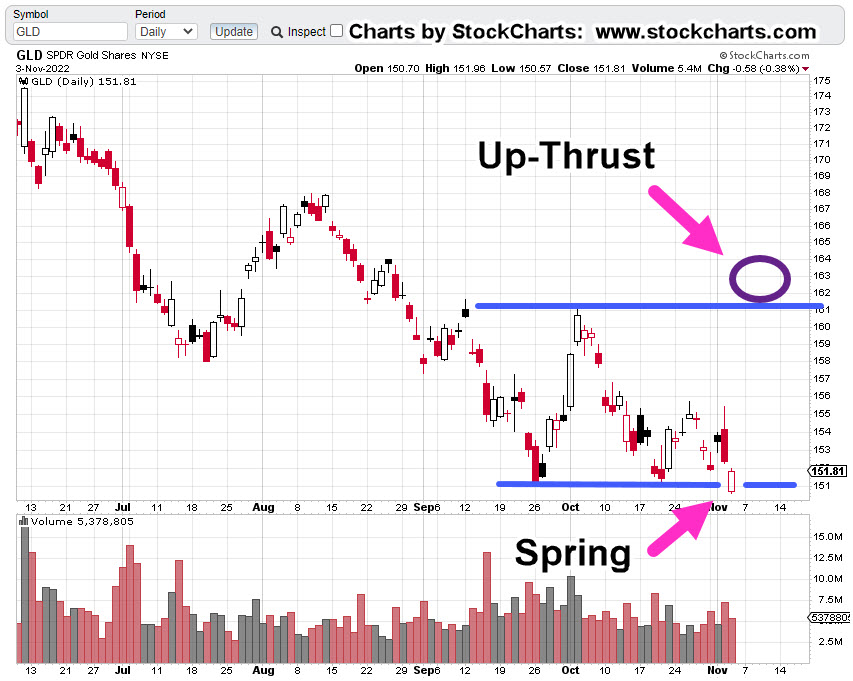

This morning, once GLD started to post on the tape, a new potential up-thrust (reversal) target became apparent.

The reason to think GLD, upside may be short-lived, just after the open, biotech began declining in earnest … signaling potential overall weakness for the rest of the market(s).

No one wants to talk about this sector and what’s really going on.

We don’t know when it’s all going to let loose but the pressures are immense and they continue to build.

Back to gold.

The daily chart of GLD, is below with the area in question, highlighted.

Gold GLD, Daily

Price action must get above and stay above the resistance area. Otherwise, it’s an up-thrust (reversal).

Other Markets & Biotech

Meanwhile, the biotech sector (SPBIO), is the first to post new daily lows. At this juncture, all other major indicies are higher.

Once again, as shown below, the short position via LABD, has been increased (not advice, not a recommendation).

Positions, Market Stance (courtesy only, not advice).

LABD-22-09:

Special Note:

This sector and leveraged inverse LABD are highly volatile. Character of the market can change at any time. LABD may be exited without notice.

Entry @ 19.88, 19.71, 21.23, 21.65*** Stop @ 19.41***

Note: Positions may be increased, decreased, entered, or exited at any time.

***, Indicates change

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279