One Side, is Exhausted

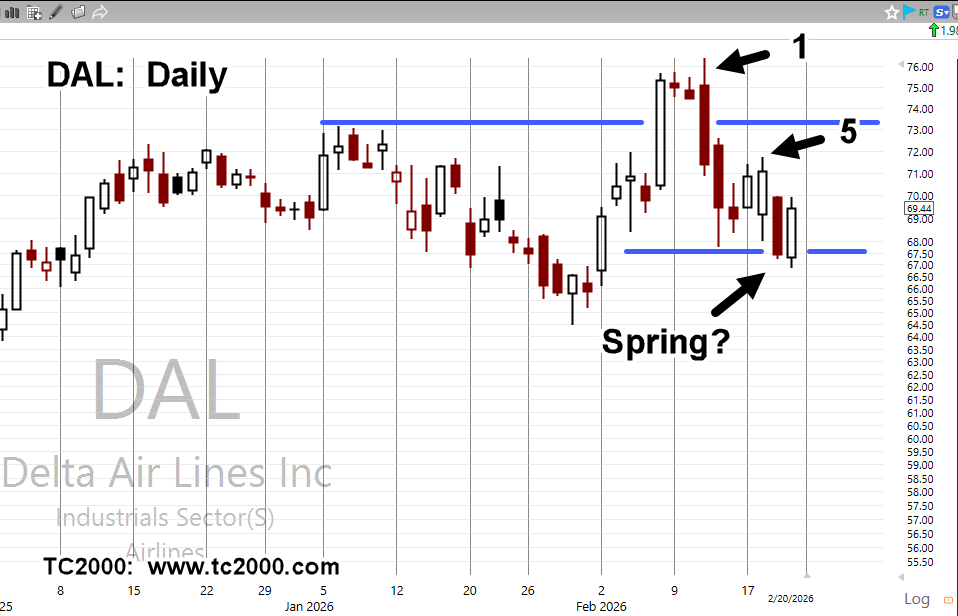

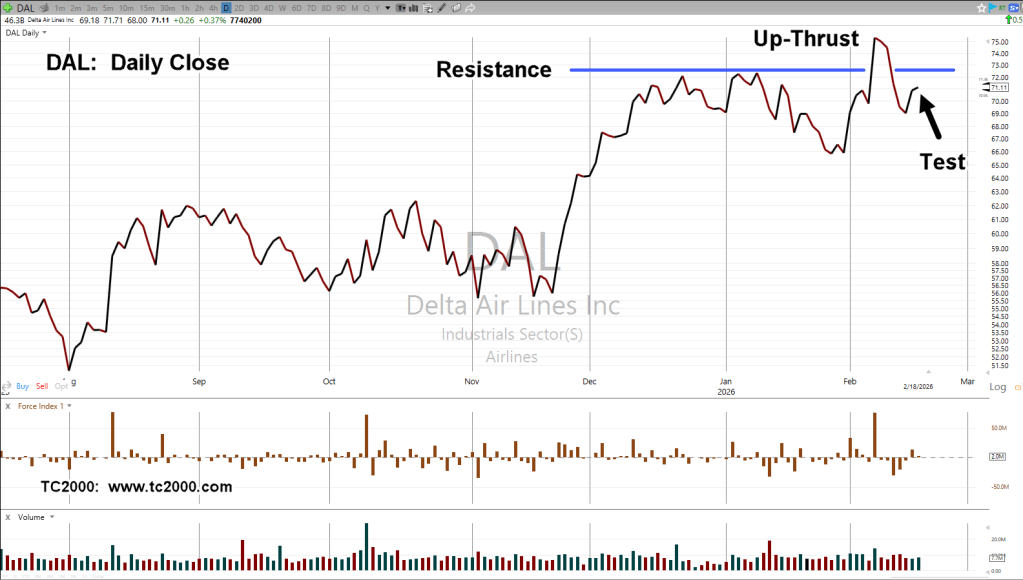

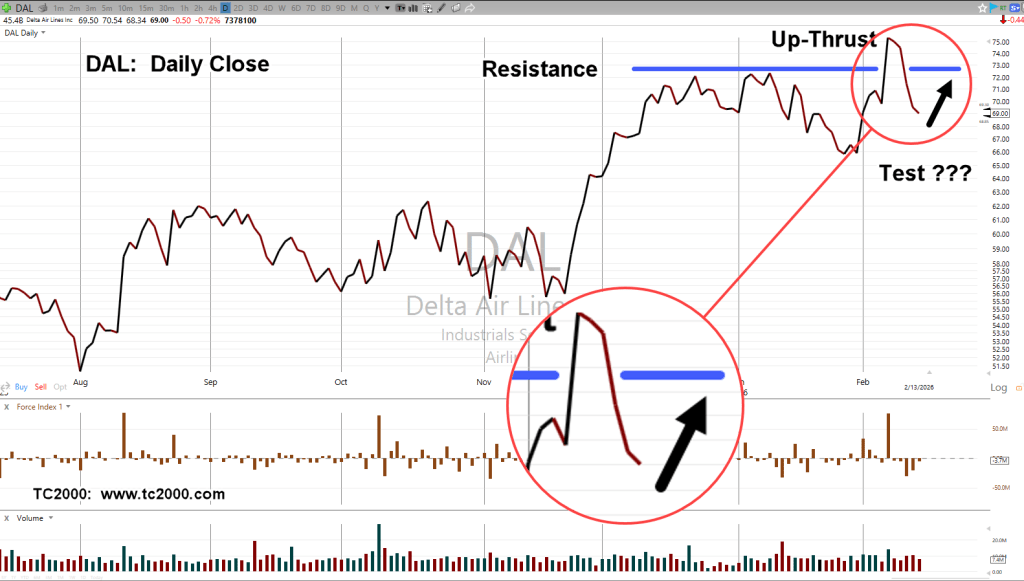

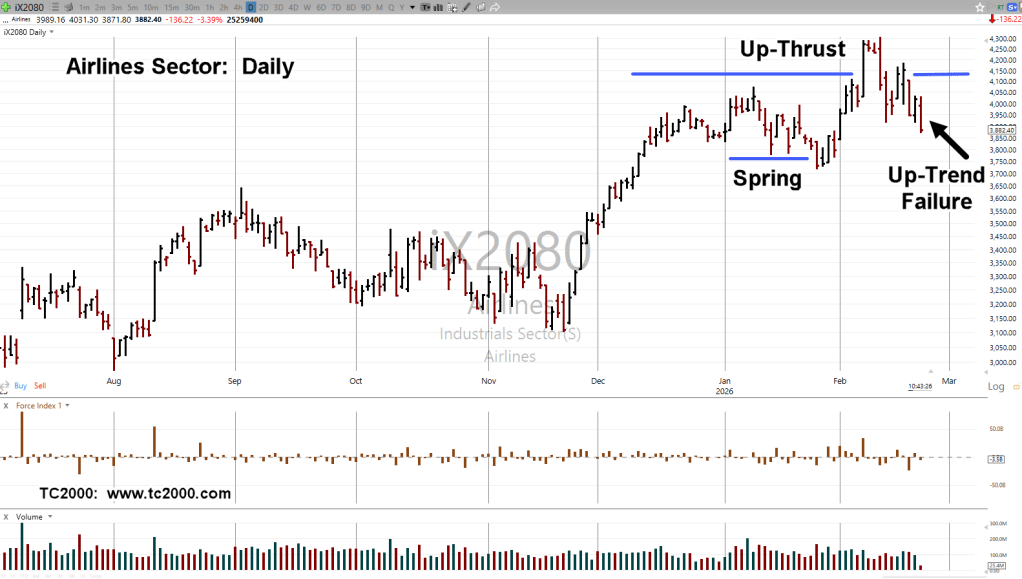

Today was the day when the airline sector was supposed to resume its uptrend into a (possible) new high.

Early in the session, that move has failed (not advice, not a recommendation).

Instead of moving higher, price action printed a new daily low.

As Dr. Elder said years ago in ‘Come Into My Trading Room‘, when a set-up fails, at times, it’s best to exit (if positioned) and re-enter in the opposite direction.

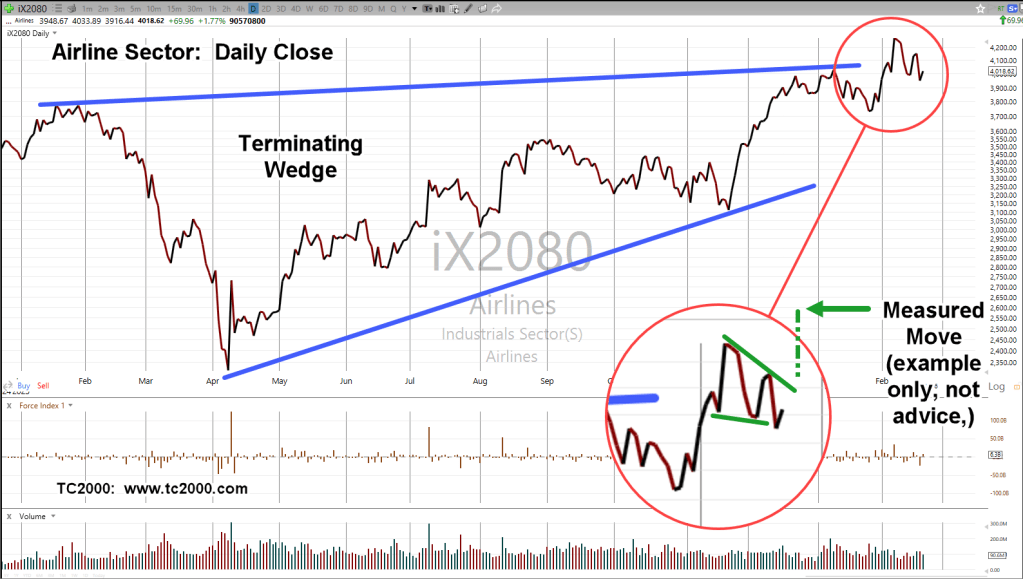

Airlines Sector, Daily

Last Friday’s action was a reversal bar with a higher close. The inference was for continuation to the upside.

As the arrow notes, that move has failed.

The benefit, is a well-defined stop (if short); that is, today’s session high (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279