What’s Price Action Telling Us?

Is Moderna telling us to get ready for another round of ‘shenanigans’?

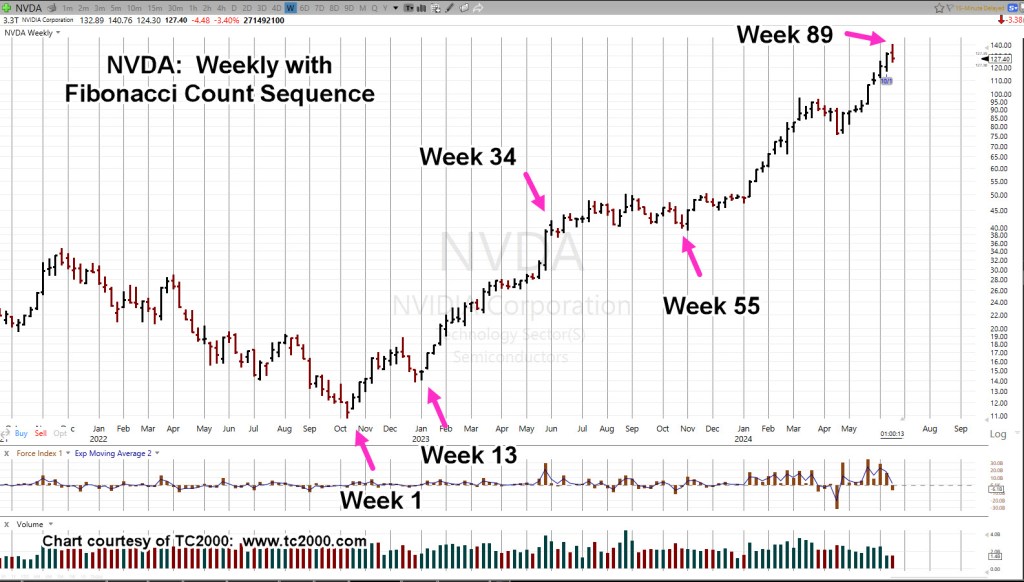

The last update showed how action was adhering nearly perfectly to Fibonacci levels.

The take-away; MRNA, most likely is headed lower (not advice, not a recommendation).

Well, that was then.

We’re going back to the daily chart, looking at potential for higher action.

Moderna MRNA, Daily

As with the prior update, two Fibonacci projection tools are shown; standard retrace, and ‘a-b-c’ projection from November 2nd, 2023, lows.

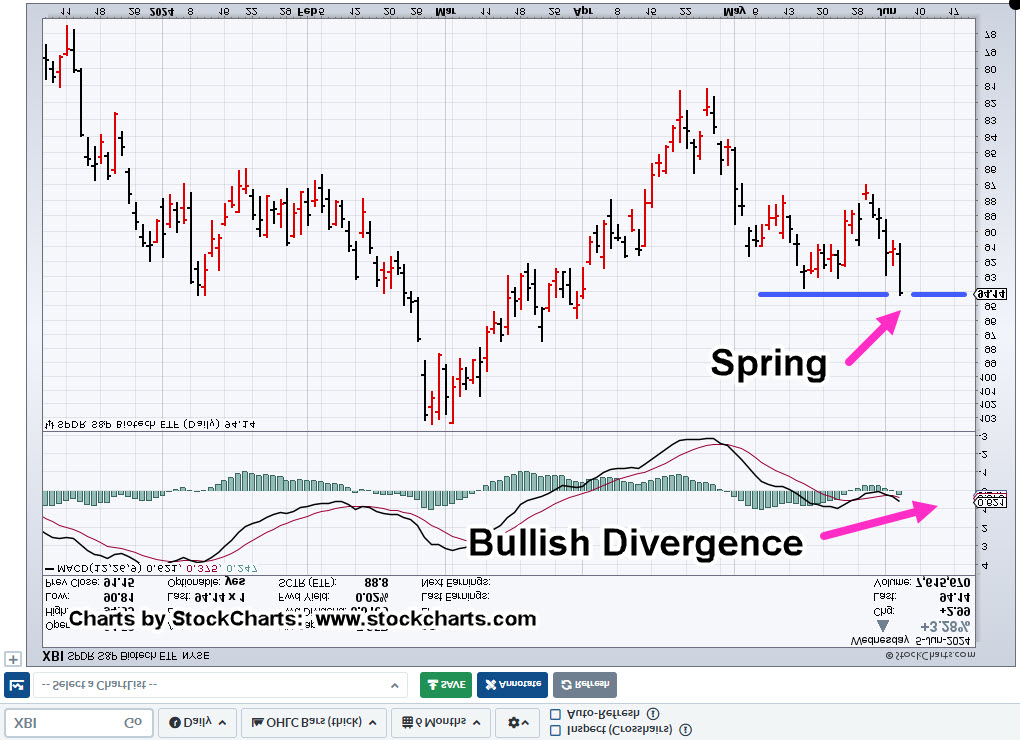

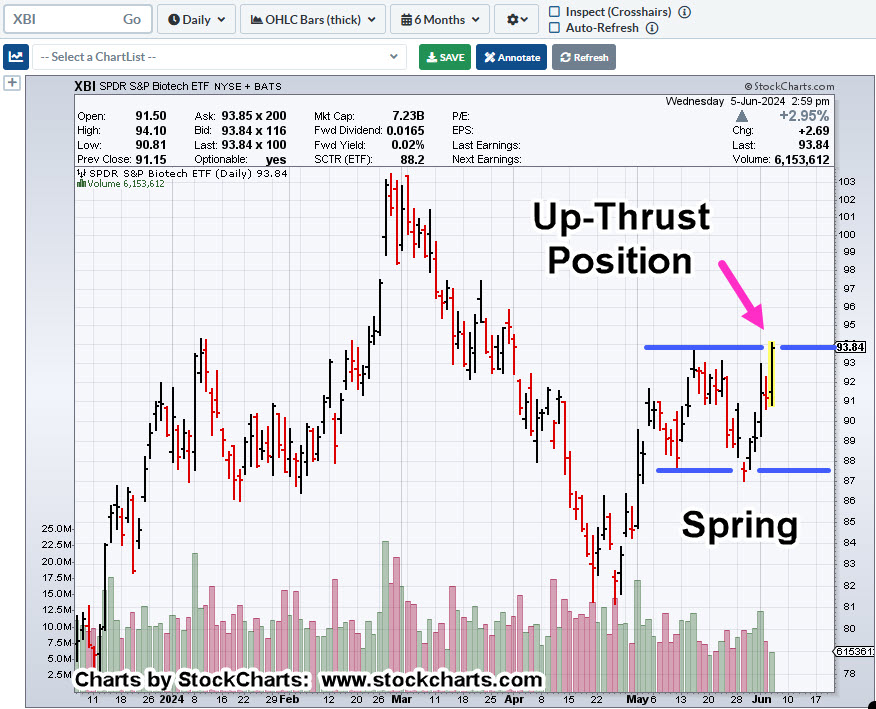

We can see, price action’s at The Danger Point®, in ‘spring’ position, ready to move higher.

Is this buoyancy and absorption of the sellers?

As Weis said (in his video), absorption is difficult to detect until it’s obvious.

If we’re headed to new highs, past the 23.6%, retrace, there’d have to be a ‘reason’ or (money making) ‘catalyst’ for such an event.

Something like this, perhaps?

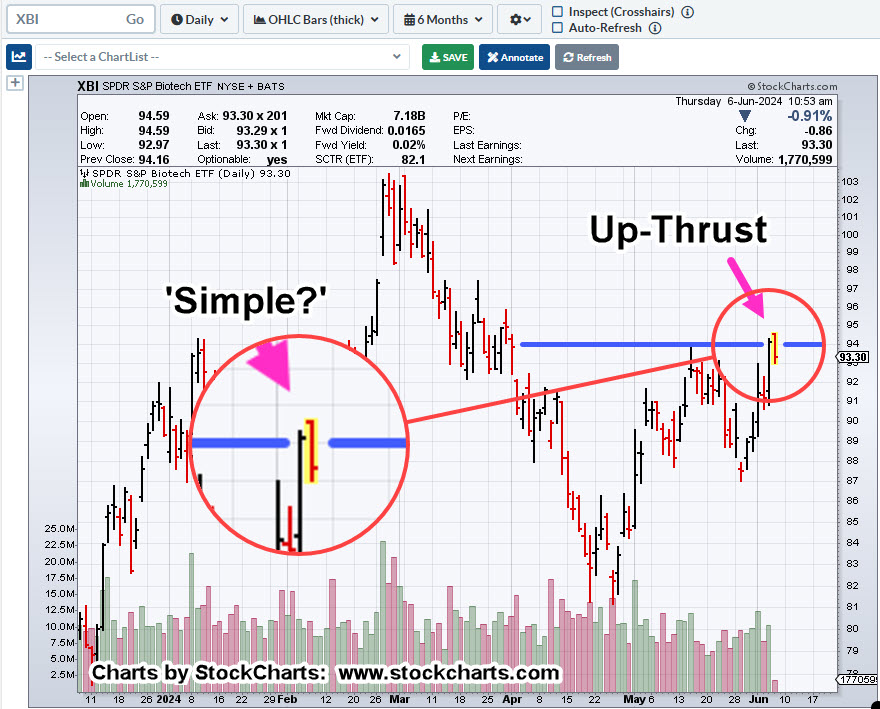

If MRNA is gearing for a move higher, that explains buoyancy in the biotech sector as a whole, the refusal of XBI, to head decisively lower.

As stated earlier, XBI short position via LABD, noted as LABD-24-12, in prior updates has been closed (not advice not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279