1:14 p.m., EST

Does it really matter where the ‘speck’ came from?

That seems to be one of the all important topics for the day.

For argument’s sake, let’s just say we find out the speck came from Dubuque, Iowa.

There, problem solved.

Does that make anyone’s life any different?

Well, maybe for those in Dubuque but probably not anywhere else.

Meanwhile, the objective of constant distraction and obfuscation has accomplished its goal; ‘missed opportunities’.

That’s what it’s all about; has been for millennia.

Who decides what goes to press anyway?

Enough said.

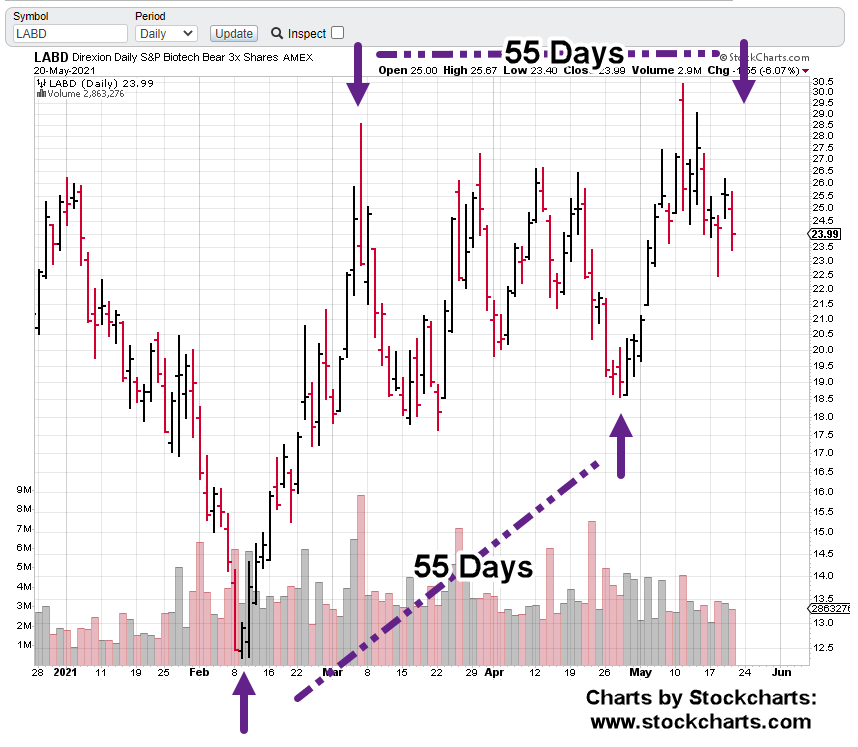

We’re not going to get distracted with the carnival sideshow but stay focused on shorting biotech (not advice, not a recommendation).

Market Analysis:

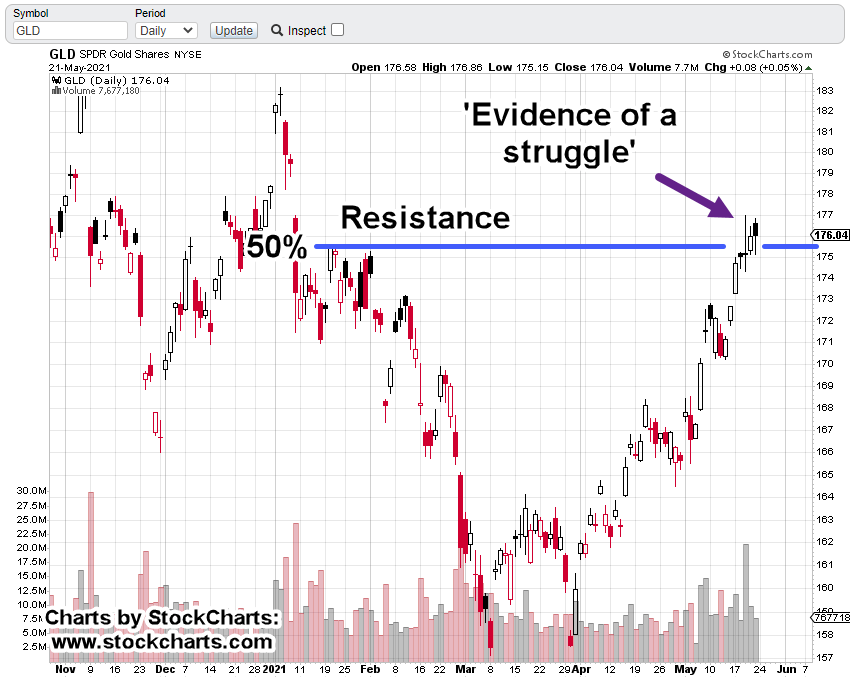

The overall markets are up anywhere from +0.50% – 1.50%.

On the other side, we have biotech SPBIO; down -0.65%, with leveraged inverse fund LABD, up around +3.94%.

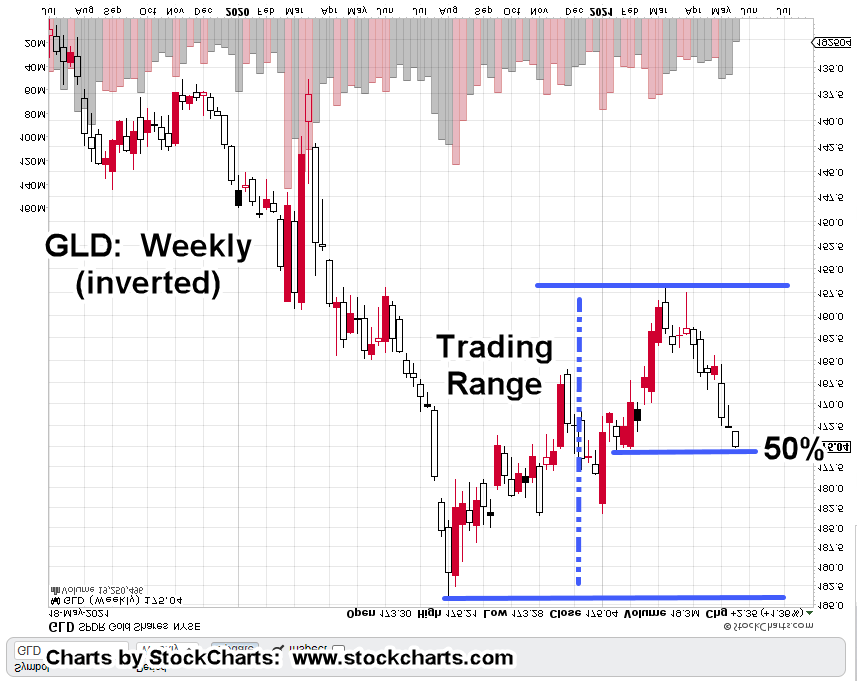

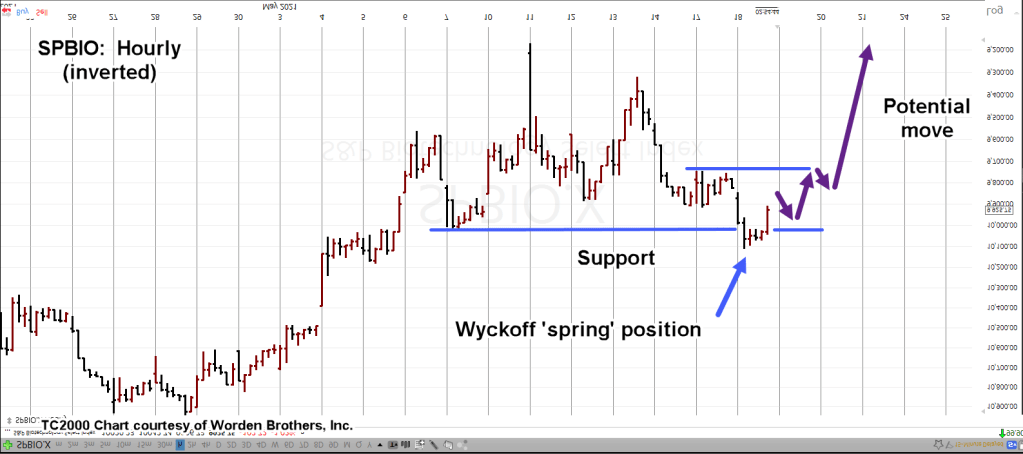

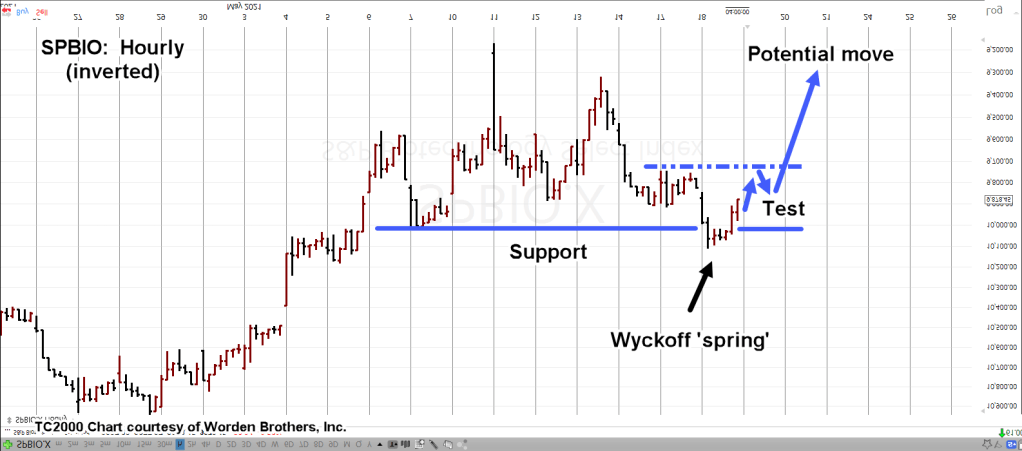

The original forecast chart for SPBIO (hourly inverted), has been updated to show where price action is at this juncture.

We’ll include all (three) charts for an easy visual on how the short (via LABD), is progressing

Newest chart first:

Price action looks like its finished testing and is now rising into the resistance area shown as the dotted line (chart above).

Reminder: It’s a forecast and it can fail (or morph) at any time.

However, thus far price action’s adhering well to probability behavior under the ‘spring’ set-up conditions.

Stay Tuned