After The Close

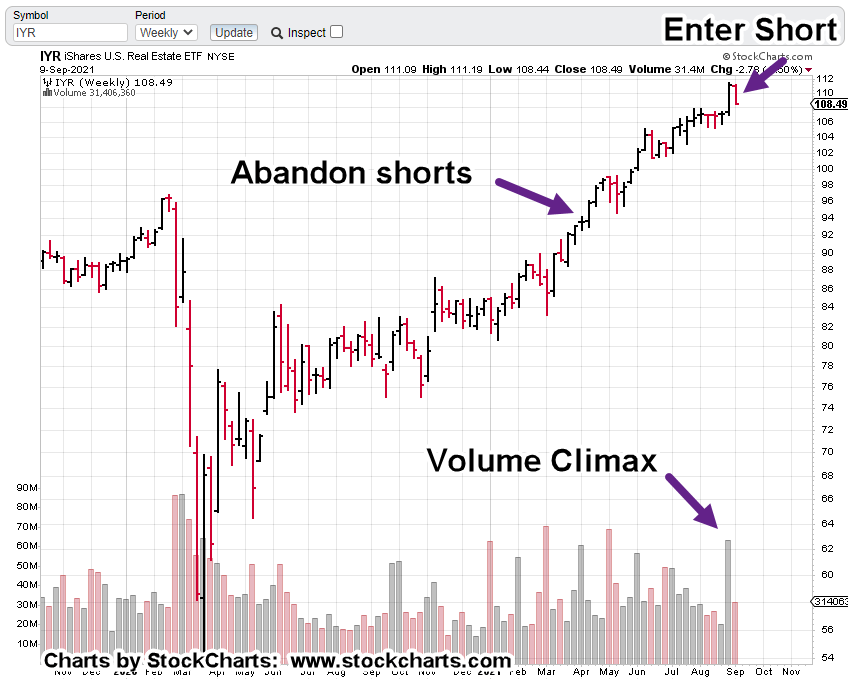

Attempts To Short Abandoned Last April

The last update on real estate (IYR) was at the ‘abandon’ arrow. At that time, the assessment was, even though conditions appeared set for reversal, it just was not happening.

Something else was going on.

It came out weeks later, that ‘something’ was entire subdivisions were being purchased (above asking price) out from under qualified potential homeowners.

Well, has that trend finally exhausted itself?

Last week’s climactic price rise and volume, which is quickly being eroded suggests were at some type of transition.

An initial position in DRV (3X inverse IYR) was opened today as shown (not advice, not a recommendation).

Pushing below the support level around IYR 107, would help confirm there’s something more going on than just a breakout and test.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.