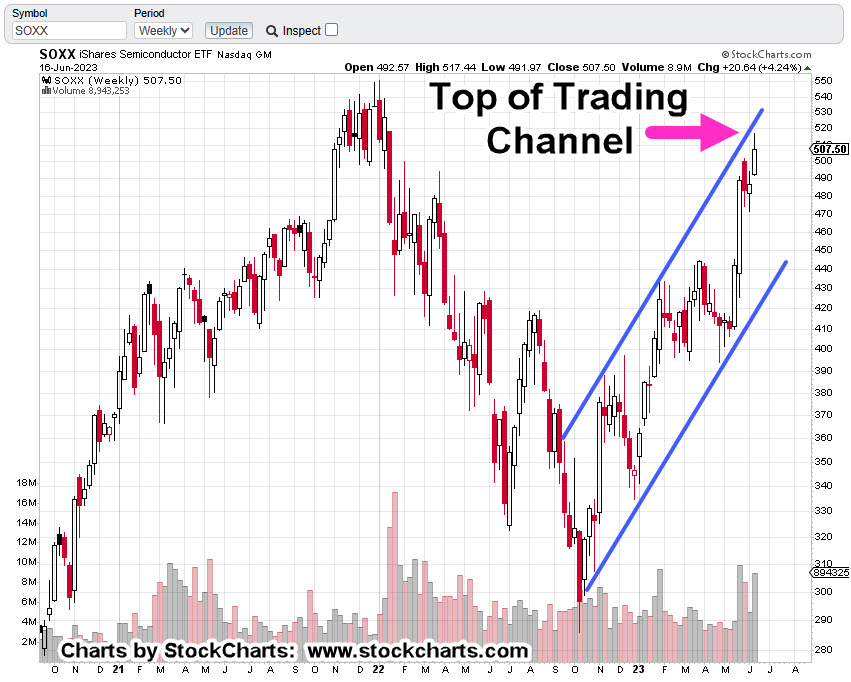

Where’s The Continued Upside?

If it’s a screaming bull market and not a potential reversal, after yesterday’s SOXX launch, you’d expect more upside.

After all, we’ve brought out the big guns for added ‘credibility’:

Dan Loeb, David Tepper, and Paul Tudor Jones piled into Nvidia stock last quarter – and other elite investors joined them

Throw on top, the promise of massive IT budgets:

AI set to unleash an unprecedented wave of spending.

Well, with all of that, we must hike our price target:

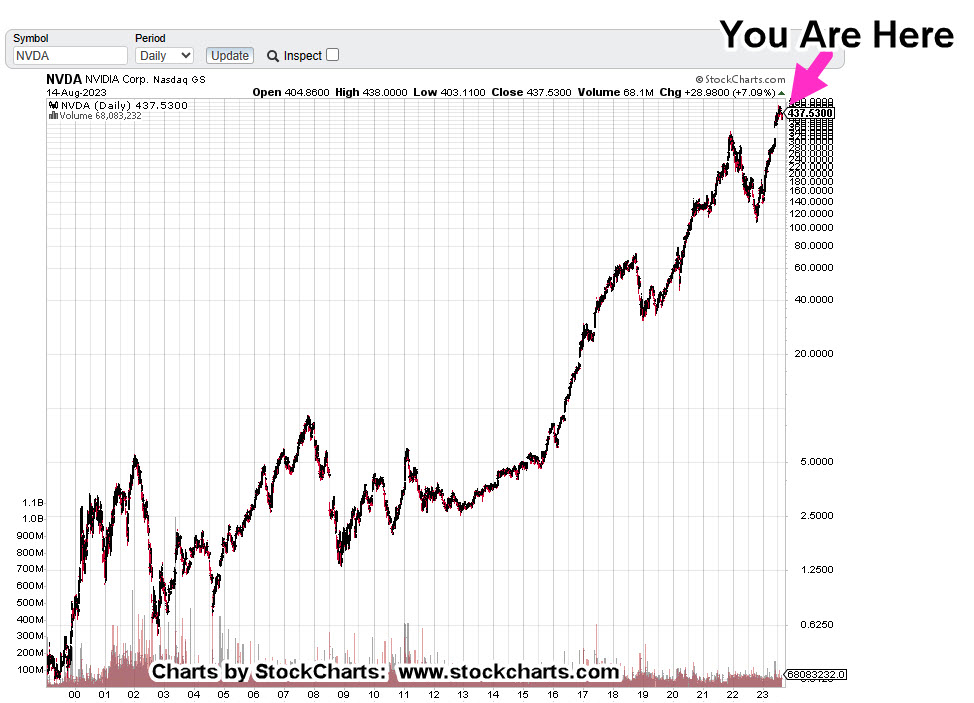

NVDA Stock Alert

The hysteria increases ever more when we read, NVDA could move the entire market … just days from now.

That part may actually be true but not the way anybody thinks. 🙂

So, let’s move past the mee-too-ism and focus on what the price action’s actually doing.

You know, like looking at reality.

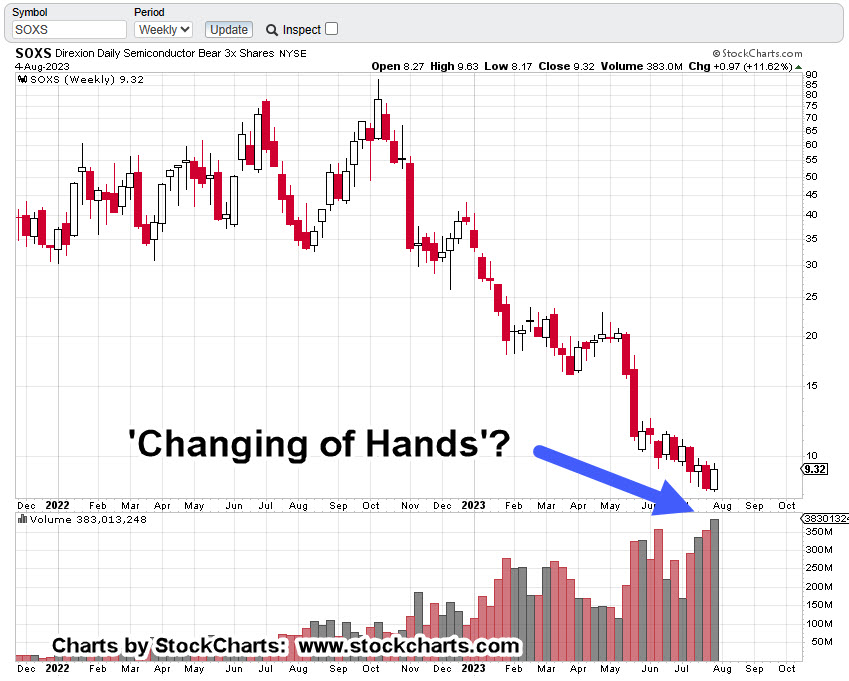

Semiconductor Leveraged Inverse SOXS, Daily

The short position via SOXS remains intact so the focus is on the SOXS daily time frame (not advice, not a recommendation).

As is typical with the markets, it can be read both ways.

Today’s action was higher (lower for SOXX) but there was no new SOXS daily high.

At the same time, it looks like a trend is being confirmed.

Positioning

Taking the recent analysis all-together, links here, here, here, here, especially here, I’m going with the SOXS trend confirmation.

That is, Inverse Fund SOXS to move higher with Sector Fund SOXX lower (not advice, not a recommendation).

Hard Stop remains at SOXS 9.42.

However, we now have a Soft Stop (trader discretion) @ SOXS 9.93 (yesterday’s low).

Tomorrow’s session has the Fed meeting minutes released at 2:00 p.m., EST.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279