Testing Underside Resistance

There’s no shortage of bullish prognostications for gold.

Said many times, as soon as there’s a blip higher, it’s near lunacy.

One of the latest installments is linked here and go figure … it’s the Russians, again!

Let’s get real.

Remember, the last time it was the Russians and the time before that?

From the date of the second link above in April, this year, gold (GLD) is down about -8.5%.

Not exactly a crash but definitely not a ‘paradigm shift the world has yet to fully process’.

Just from a contrary standpoint, if ‘everybody’s doing it’, there must be something else going on.

Let’s take a look at the actual facts, the price action, and see what it’s telling us.

Gold (GLD), Quarterly

Looking at the big picture first; the quarterly chart.

Elder’s Force Index (shown in the middle section) has been expanded to detail the thrust energy behind the move(s).

It’s important to note, for at least the past 10-Quarters, two and a half years, the upward thrusts have been successively declining in energy.

That decline is highlighted below.

Next, we’ll drill down to the monthly chart.

It shows GLD, trended (slightly) higher for at least sixteen-months, before breaking down.

GLD, Monthly

Now, as the right-most magenta arrow shows, we’re at the test of underside resistance.

Tests may pass or fail; obviously, what happens next is important.

Also note, as with the quarterly, upward Force Index on the monthly, is declining.

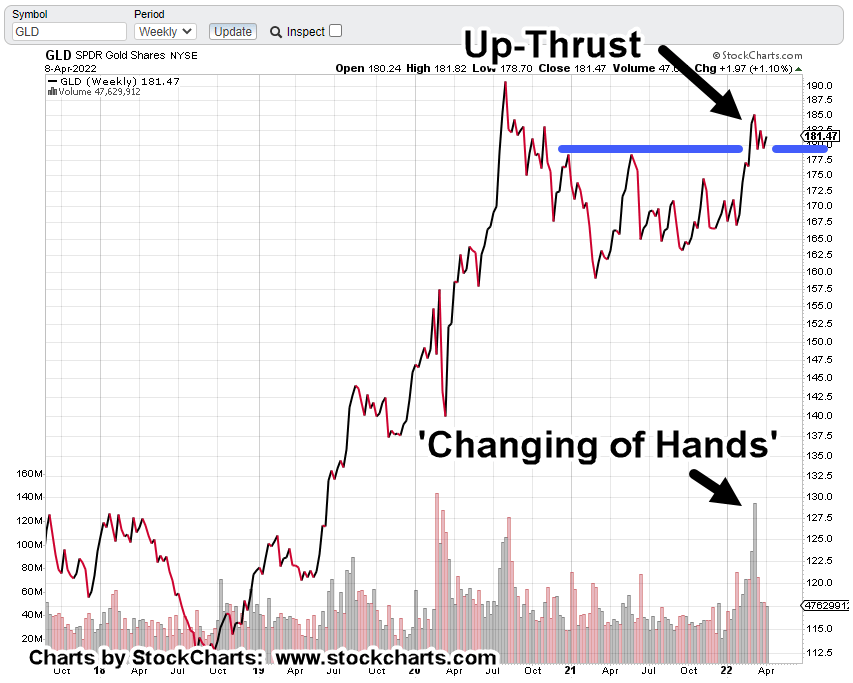

We’ll take it one step further and go the weekly … it too, has declining and also diverging upward thrust.

GLD, Weekly

Ok, you talked me into it. 🙂

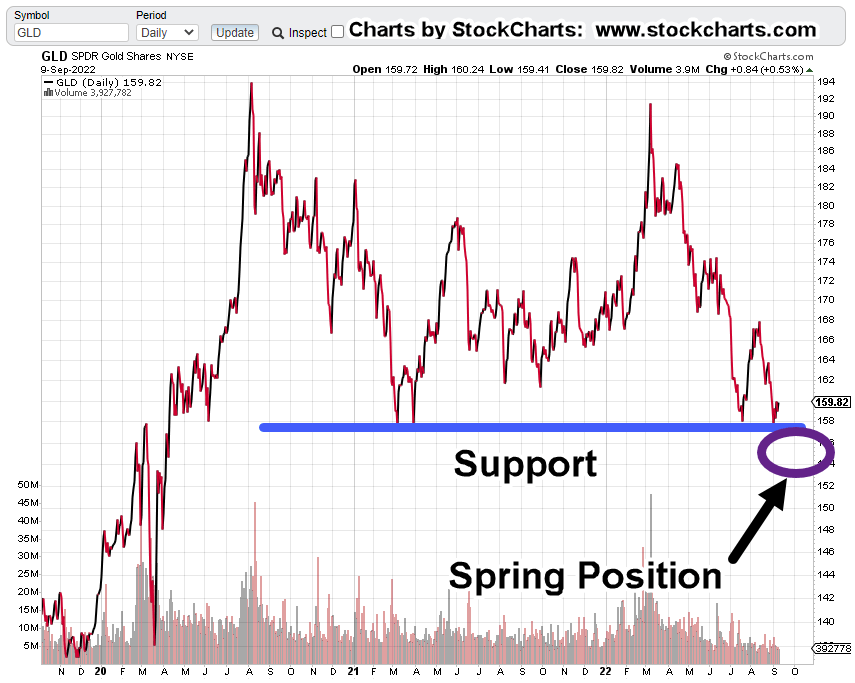

Let’s go to the daily and see the same thing.

GLD, Daily

Does all this mean gold will immediately go lower at the next open?

The short answer … it’s not known. However, from a probability standpoint, lower is more likely than higher.

No ‘Capitulation’

There’s nothing to indicate downside capitulation.

Nothing like the ‘changing of hands’ that took place this past March 8th, here and here.

It appears we’re still in the initial stages of a long-term downside reversal.

Downside? … How’s downside, even possible?

‘What kind of idiot comes up with that type of analysis?’

Moving Parts, A-Plenty

Every day, we see things going on in the background that could not be known or fathomed; like missing $80 Trillion?

All it takes, is for some kind of sovereign debt or derivatives blow-up, requiring that country to sell its assets like gold, silver, oil, grains and so on.

A huge dump on the gold market, would of course trigger stops and that in itself, could result in a contagion of selling.

If or when it happens, the downside might be temporary like the Flash Crash of 2010, or oil going negative, or it could be longer.

The ‘powers’ don’t seem to be too concerned with precious metals demand, prices, and low stock of physical at the commodities exchange(s).

It’s as if they know, it will work itself out.

They’re on to something else more basic. Something ‘crude but effective‘ like destruction of the food supply.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279