Popcorn Ready … Asylum Freaks Out

You would think everybody’s escaped.

We have this link and this one and probably many more.

Those who’ve been monitoring this site already know, today has been in the planning stages for months.

This post was the first one to discuss the target area for a reversal in gold (GLD).

So, here we are.

So-called inflation is running rampant and it looks as if everybody’s in agreement.

Well, almost.

Turns out there’s a guy in the Pacific Northwest, a ‘boots on the ground’ type that sells lumber for a living.

Uneducated Economist never waivered on the fact, prices are rising as a result of supply constraints and not inflation.

There was one more as well.

Steven Van Metre has given his take on current monetary policies; they’re deflationary.

It’s a minority view.

Either way, we’re about to find out the truth.

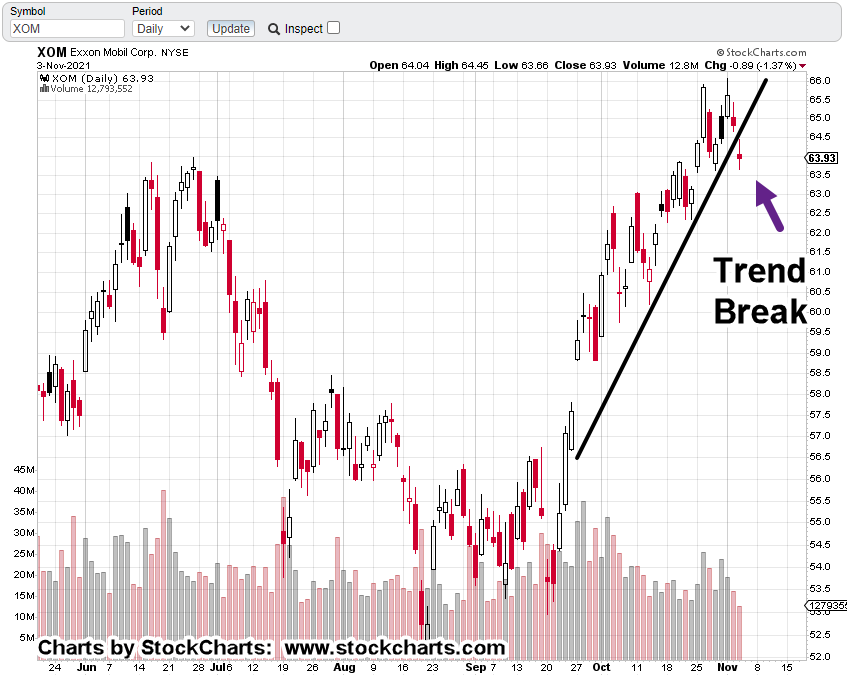

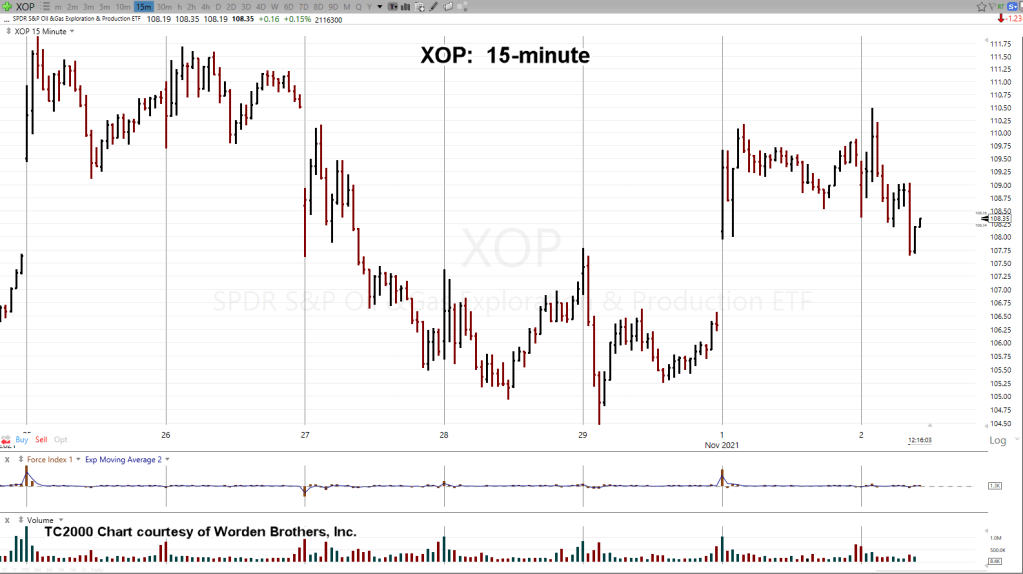

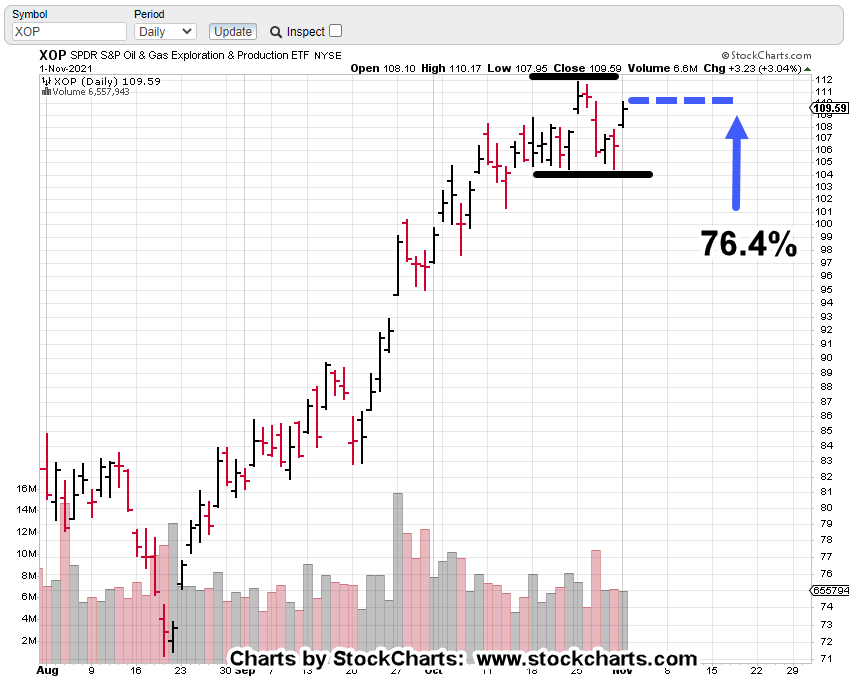

Gold (GLD) Analysis

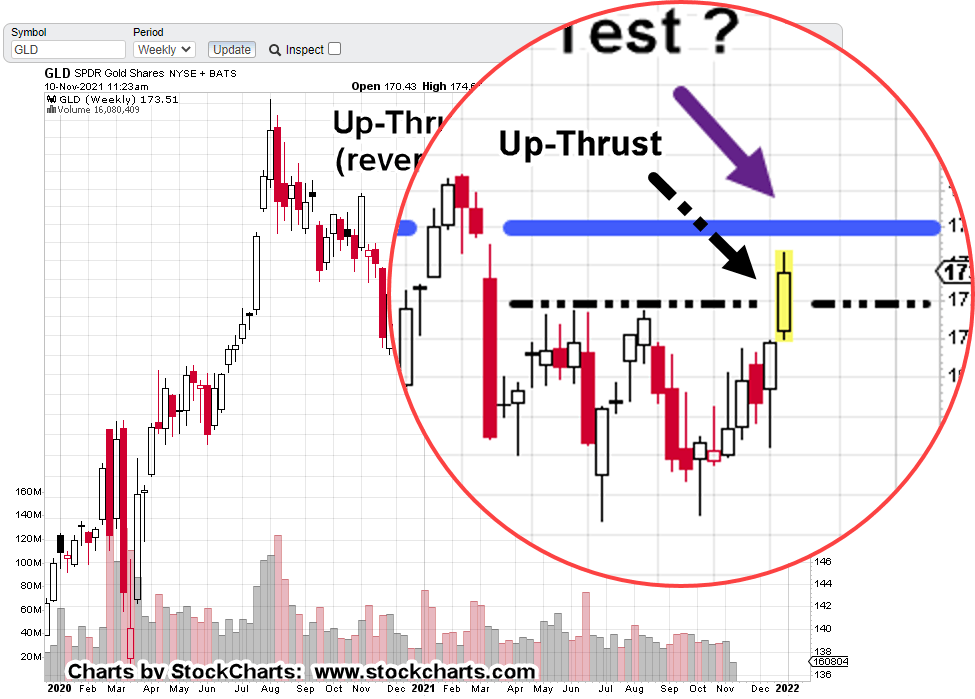

The fact GLD, has reached a target identified two months ago, gives credence to a potential reversal.

We’ll start first, with the un-marked weekly chart of GLD:

Now, the mark up:

It looks like we have a test of the original Up-Thrust (reversal).

In addition, today’s action (above black dashed- line) is another Up-Thrust.

Is this a reversal, within a reversal ?

The chart below zooms in on that area:

Everyone has their own investment/trading time-frame and method.

There’s no doubt, gold (GLD) is at the danger point. Price action can go either way.

Positioning:

The ‘inflation’ links above highlight current psychology and sentiment. The bull trap may be set.

As of this morning, we’re already positioned short this sector via DUST (not advice, not a recommendation).

Note:

A push below today’s DUST low of 17.27, does not necessarily negate the trade but it does (or will) bring it under scrutiny for potential exit (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279