Is This, The ‘Go-Forward’ Model?

In just one day, Globe Life closes down – 53.14%, on historic volume, over 35-million shares.

No matter the narrative, it shows just how fast a market can implode.

Years ago, while watching an episode of Wall Street Week, with Louis Rukeyser, one of his guests commented on a corporation that released (unexpectedly) bad earnings.

He said … ‘I believe in the cockroach theory. Where there’s one, there’s more’.

Does anyone think Globe Life is, or will be, an isolated incident? This could even be a ‘Lehman Moment‘ and we just don’t know it (not advice, not a recommendation).

Up-coming (potential) problems with life insurance have already been covered; best described in this brief four-minute clip, link here.

The Biotech Connection

The connection between biotech and life insurance can be correlated with this link and this one.

Biotech, XBI, Daily

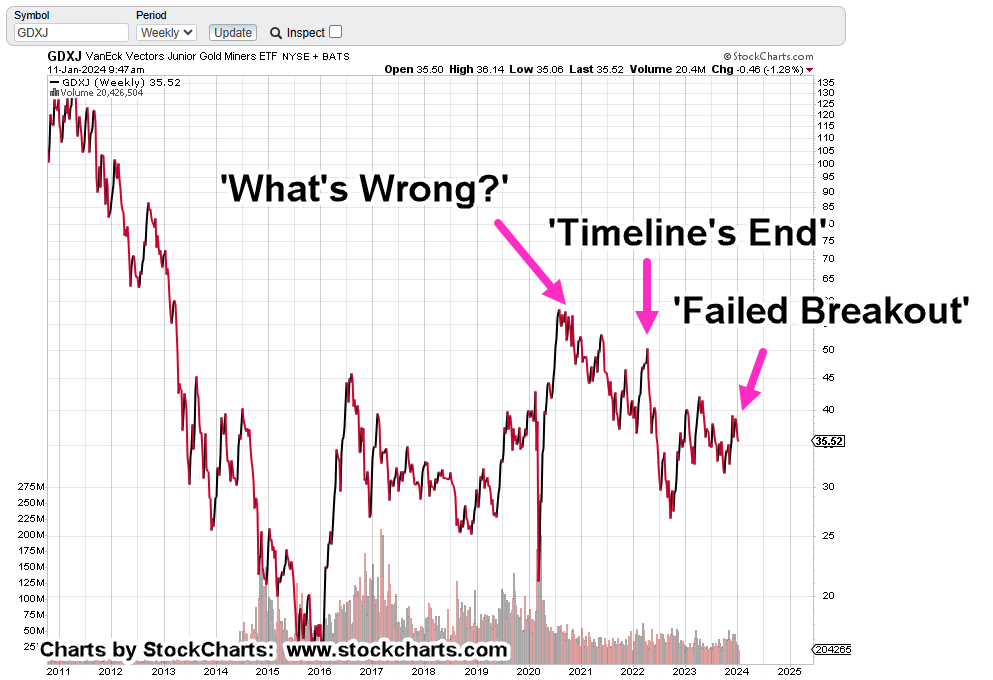

The chart below, is slightly different from one’s typically presented on this site.

It’s on the daily timeframe but it’s compressed to better show the sector sub-dividing lower.

Yesterday’s Fibonacci analysis may still apply but we won’t really know until we see tomorrow’s action.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279