Know Your Market

There’s been something wrong with the precious metal’s, gold and silver, for years.

Gold and silver used to move essentially in tandem, over the long term; not anymore.

This link shows there’s a huge divergence in the correlation between the two metals. Gold has launched higher, while silver has lagged.

Right around June of 2020, the correlation began to break down. What else was going on (or being ‘rolled out’) around June of 2020?

Recall, silver’s primarily an industrial metal; affected much more (than gold) by manufacturing demand.

Strategy First

Shown by the market itself, direct correlation between silver and gold no longer applies (or has somehow changed into a new construct), silver’s not confirming the ‘inflation’ shtick, possibly influenced more by industrial demand.

Thus, we have the following.

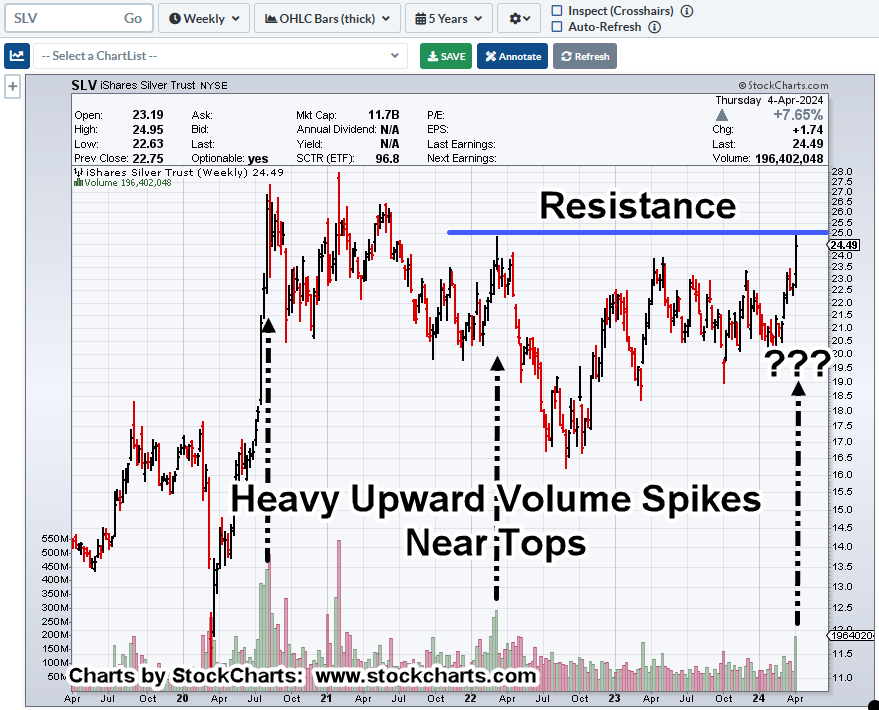

Silver SLV, Weekly

Just listening to what the market’s telling us, it says, when SLV, reaches a top and inflection point (to reverse lower), it tends to print heavy upside volume bar(s).

Looking at the chart, price action’s all over the place. Wide bars, volume spikes, the gamut.

Markets like this are unstable and usually can’t mount a sustained move in either direction.

Typically, if there’s going to be a breakout (or breakdown), price action tends to get tight, or get itself into a ‘coil’.

Even so, we need to account for the market itself.

Having traded silver futures contracts during the last run up and meltdown from 2011 – 2014, the silver market is thin and likes to ‘spike’.

That (spike) behavior is confirmed by Ed Seykota in Market Wizards and David Wies in his (formerly) daily market updates.

We may be at the beginning of a set-up for a Wyckoff up-thrust (above resistance) and then reversal.

A possible measured move for SLV (to be covered in another update), puts the tracking ETF, right around 25.60, about 2-pts. from where we are now (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279