Another Planned Event ?

So, how’s any business going to operate profitably in an environment that’s systematically being disrupted?

Those that could come up with a plan (for their company or business) in such an environment, i.e., the ‘competent‘, are leaving in droves; letting the slackers, back-biters, corporate gossips, and the incompetent, finally have free rein.

This phenomenon likely applies to all major businesses. We already see the entrenchment.

Then, The Fed

Then, there’s the Fed. Surely, when they see how bad things are, they’ll lower rates; Right?

‘When the Fed realizes the economy’s in a recession, they’re going to lower rates‘.

That’s ‘normalcy bias’. We’re in a new construct: There’s no Fed ‘pivot’, rate lowering, or any ‘accommodation’ in sight.

On top of that, some have figured out, things aren’t quite right at the Fed; looks like different ‘forces’ are at work.

Go to time stamp 10:50 at this link (warning, contains profanity).

Then, The ‘Stackers’

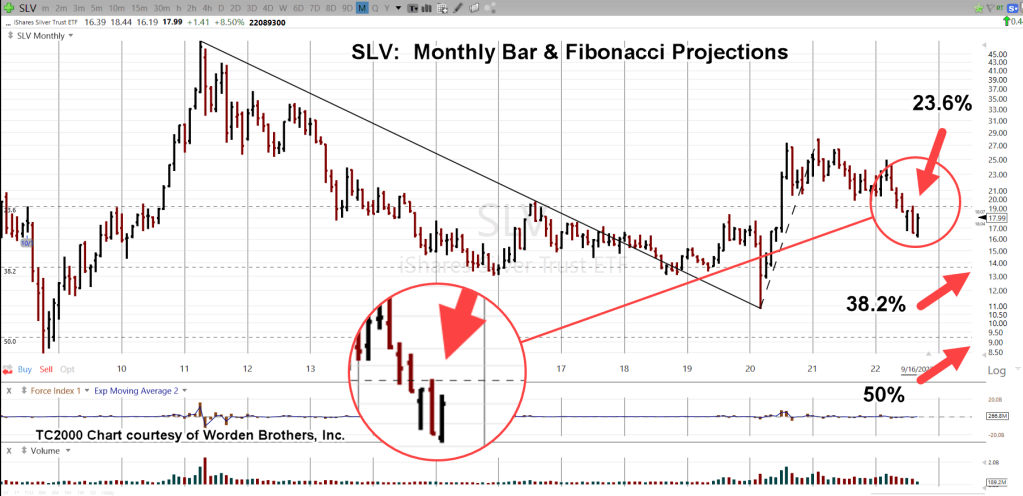

So, we’ve gone from stacking toilet paper to stacking what’s thought to be precious metals.

The question is … are they real or fake?

First, it’s fake silver … and then, even the Perth Mint got into the act with ‘diluted’ gold bars.

As stated, years ago, during the Texas Freeze, when it really hits, the grid goes down, nothing’s working, it’s freezing outside, precious metals are nowhere on the list (not advice, not a recommendation).

Then, The VIX

As if all of the above was not giving us clues that something’s about to happen, there’s the VIX.

Volatility is down … way down … too far down.

All of which bring us to the topic at hand.

Now, The Debt

If you believe the talking heads and ‘finance’ YouTube sites that claim the debt deal will cause massive inflation, well then, let’s pose the following question.

If that was true, why are gold and silver not responding in a huge bull market with upward leaps (a la 1995, S&P) each day, then week and month?

Those close to the market always know something; their actions show up on the tape.

It could be we’ve already past the top in spending …. just by market pressures alone. It’s possible, all that extra allocated ‘pork’ may never get implemented (not advice, not a recommendation).

Lastly, The Miners

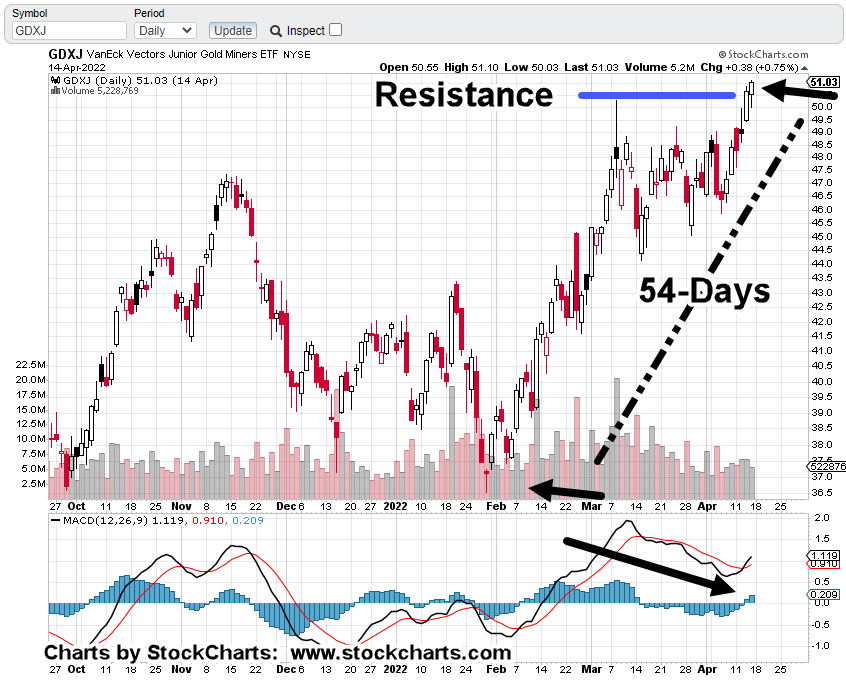

The miners GDX, GDXJ, have been in a bear market for years with all-time highs (GDXJ) during the first half of 2011.

Since then, the sector is down over 72%

It’s interesting, that this high stress, physically demanding industry with risk of danger ever present (here, here and here) reached a bear market peak in mid-2020, just as certain ‘items’ were being mandated.

Junior Miners GDXJ, Daily

As the competent leave the general workforce, would the resulting lack of accountability make itself known first in professions where stupidity causes direct effect in reduced production and/or increased accidents?

The GDXJ is at an interesting juncture.

It’s currently under resistance (blue line) that has already been tested.

At the end of the session today, we’re a Fibonacci 8-Days from the low set on May 25th.

If the index is going to reverse lower from here, this is a likely place to start.

Another attempt at resistance would indicate more upside pressure than anticipated; any existing short positions would be closed (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279