Mid Session

Spring, To Up-Thrust, Completes

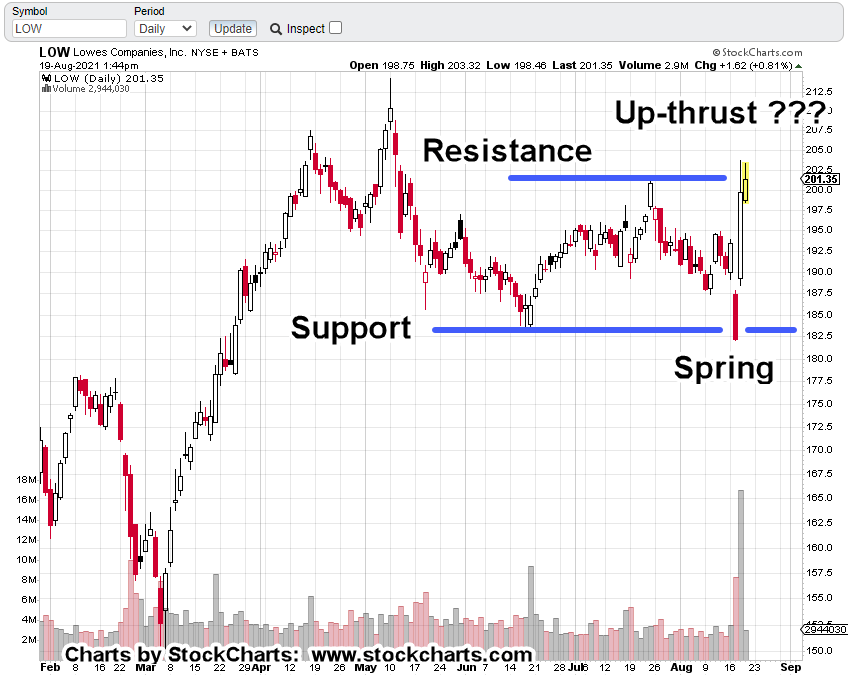

The daily chart of LOW (above), is how it looked one month ago. This report highlighted, certain market behaviors repeat.

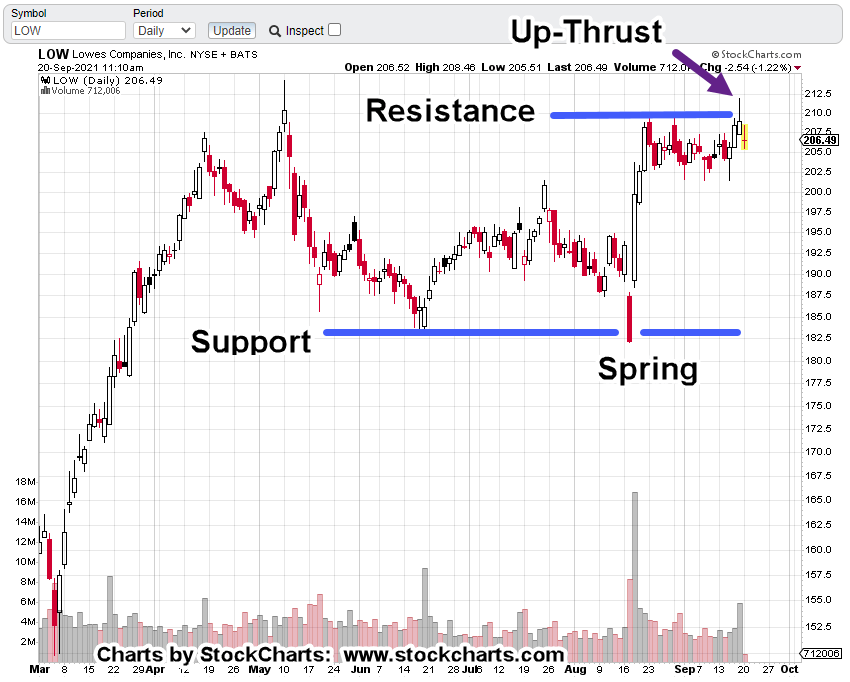

Now, we have an apparent up-thrust completion.

There may be other equities in a similar (up-thrust) position as of this post … One such potential is Carmax (KMX).

Opinion:

Successful trading, is a game of attrition.

The LOW set-up, that looks to be complete (for a short position) has probably lost all market participant interest at this point.

The i-phone crowd, looking for the next fix, is not going to wait around and monitor for a month to see if price action follows a well tested set-up pattern.

After things get moving though … they’ll be back, as Dr. Elder states; ‘being both lazy, and late.’

Summary:

We’re not shorting LOW (not advice, not a recommendation) as there’re plenty of opportunities with leveraged inverse funds (again, not advice, not a recommendation).

The point of this update is to show, once again, the market, LOW in this case, has gone from ‘spring to up-thrust’; a repeating price action phenomena.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.