Was Friday, The Day?

Is the tide (finally) going out for biotech?

The end of the prior update, shows a lot coming to the surface.

So much, that it can’t be ignored.

Also coming out on Friday, was this report.

Is it all too much, price action has finally reversed? We’ll analyze that potential below.

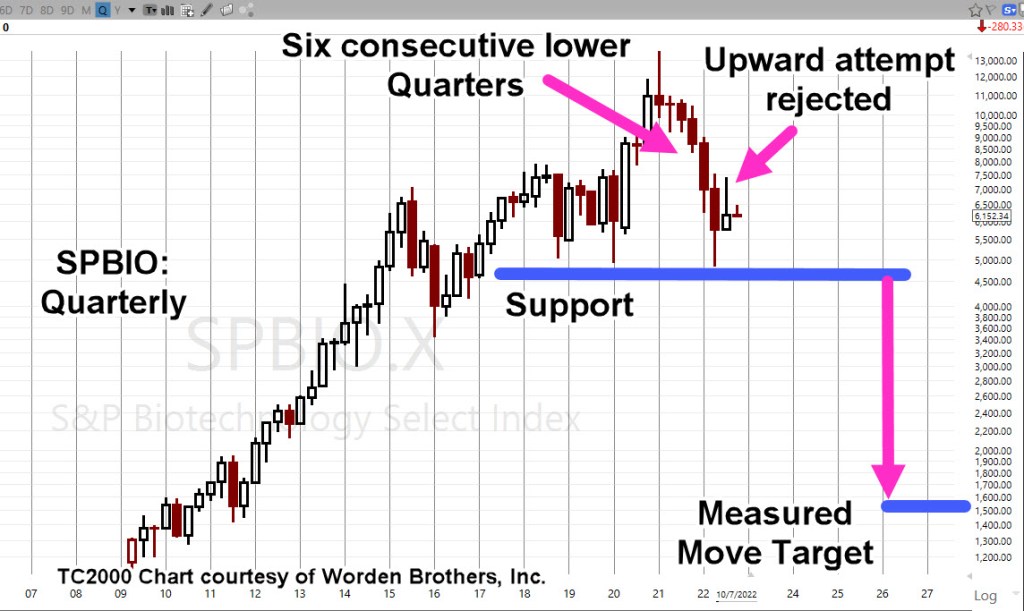

Biotech SPBIO, Quarterly

First, the big picture.

There have been six consecutive lower quarters … the most of any major index

What’s not labeled above, is an apparent Head & Shoulders pattern forming; the arrow showing the rejection of the upward move could be the top of the Right Shoulder.

The left shoulder is considered to be the eight quarters that span, 6/29/18 – 3/31/20.

If it’s an H&S, and if the support is penetrated, the measured move target is shown.

That’s a lot of ‘ifs’.

Moving on to the weekly, we see confirmation of the right-side trendline. Also shown is the potential trading channel.

Biotech SPBIO, Weekly

Price action could still break out to the upside from the channel line.

For that to happen, there would need to be some kind of huge catalyst.

So far, nothing out of the ordinary other than the typical Ebola outbreak and/or, radiation poisoning 🙂

Downside Reversal Probabilities

So, last Friday was decidedly down. If we’re in a reversal, what’s the next likely thing to happen?

For that answer, we go to the daily chart.

Biotech SPBIO, Daily

The blue lines are a minor support zone.

If we are in a reversal, a lower open at the next session (into the support zone) weights probabilities to the downside.

If that happens, expect price action to attempt to ‘test’ Friday’s wide bar by moving higher … at least temporarily.

If there’s a higher open instead, it does not necessarily negate the reversal, but it does weaken the case.

It may mean there’s more upside testing and/or, the beginnings of a move to much higher levels.

Stay Tuned

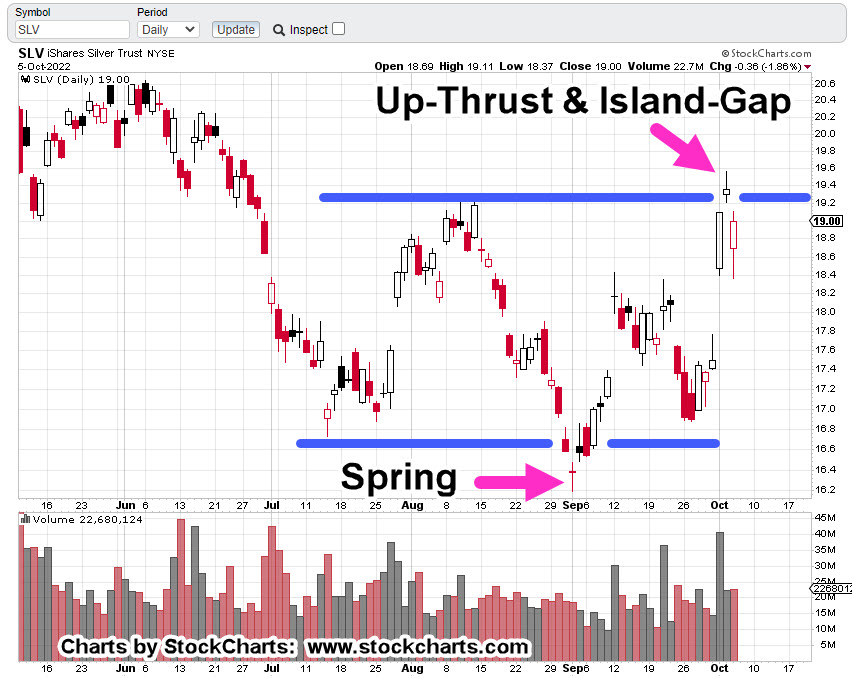

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279