That Didn’t Take Long

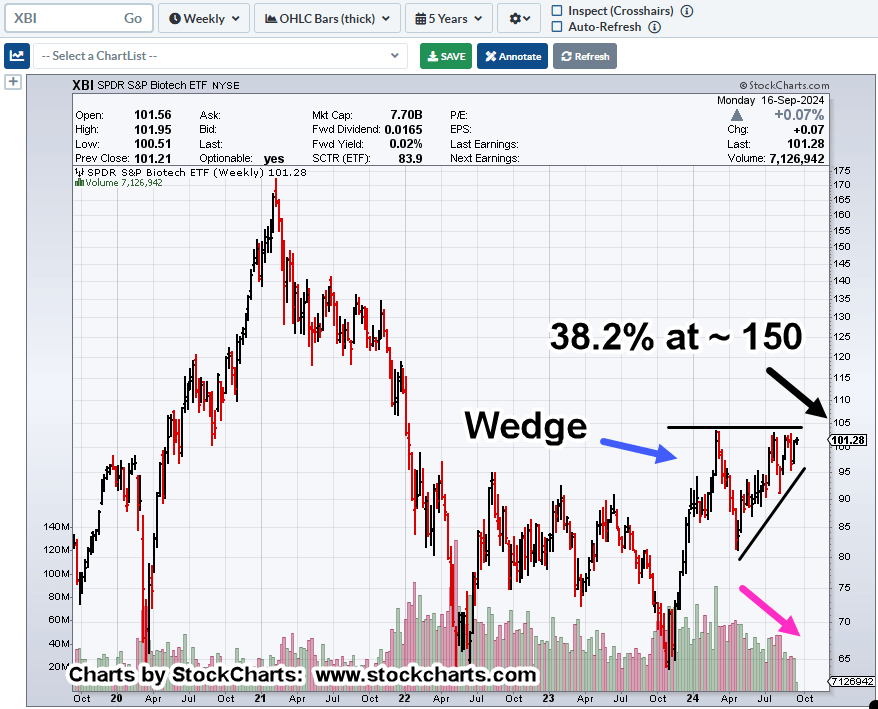

It was just four days ago, the mainstream (in this report) was telling us, be on the lookout for a biotech breakout.

That was then … here we are now.

Price action in XBI, attempted to break higher at the Fed announcement.

That move appeared to fail by the end of Wednesday’s session … then came Thursday’s launch higher.

However, that move may have failed as well.

Biotech XBI, Hourly

At this point, we’ve posted a Wyckoff Up-Trust (reversal).

If this is a significant reversal, we’re still in the very early stages; at The Danger Point®

Positioning

As can be seen in the sidebar, a short position was opened (yesterday), LABD-24-18.

That position has been increased in size during this session (not advice, not a recommendation).

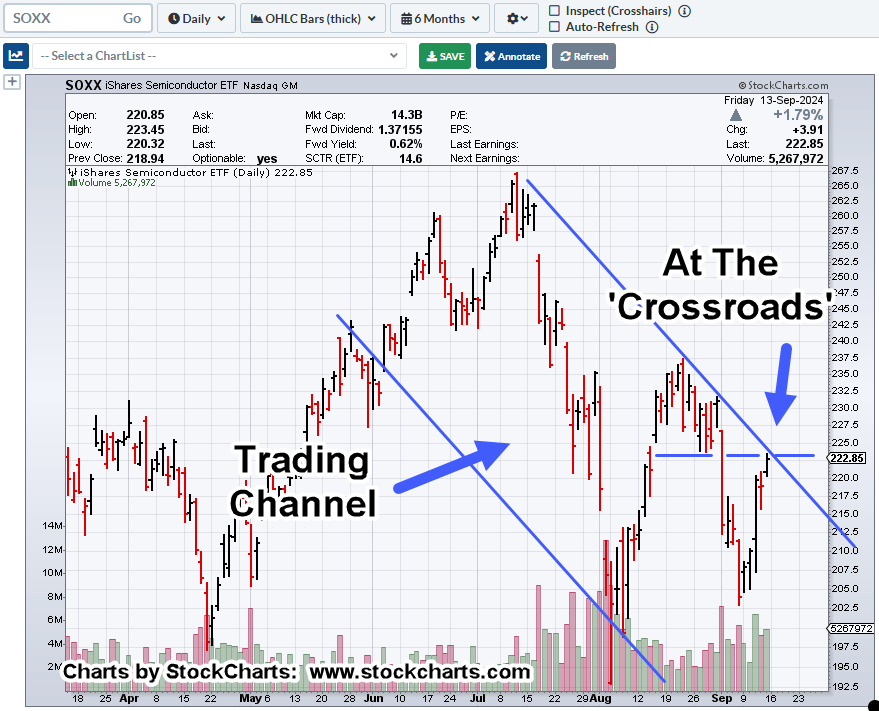

The SOXX (short) Exit.

Yesterday, SOXS-24-16, was exited with an -11.6%, hit; so, everyone can see the effects of breaking one’s discipline (not respecting the position stop).

Don’t force the trade … sounds so simple.

Getting back to work, the XBI false breakout was recognized early and the trade opened.

Today, so far, we have follow-through, confirming the reversal.

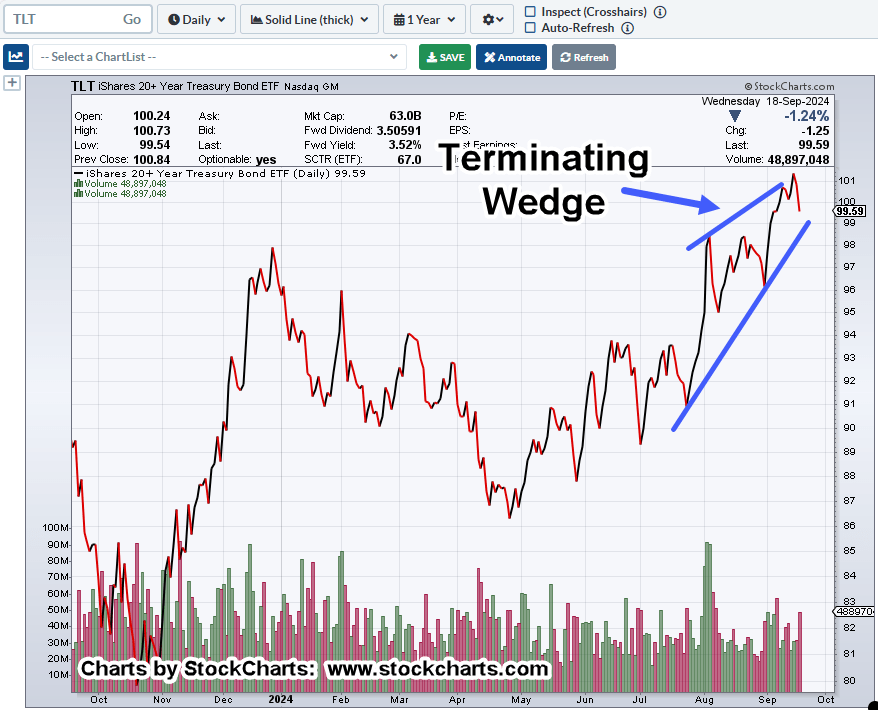

Bonds Continue Lower

Bonds, TLT, are currently posting an outside-down (reversal) on the weekly timeframe.

The last time there was an outside-down on the weekly, was over two-years ago; week of August 5th, 2022.

After that, bonds declined a whopping 32% before (slightly) recovering.

Now, they’re posting outside-down … again.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279