DRV pushed through our stop early in the session; position closed (not advice, not a recommendation).

1:50 p.m. EST:

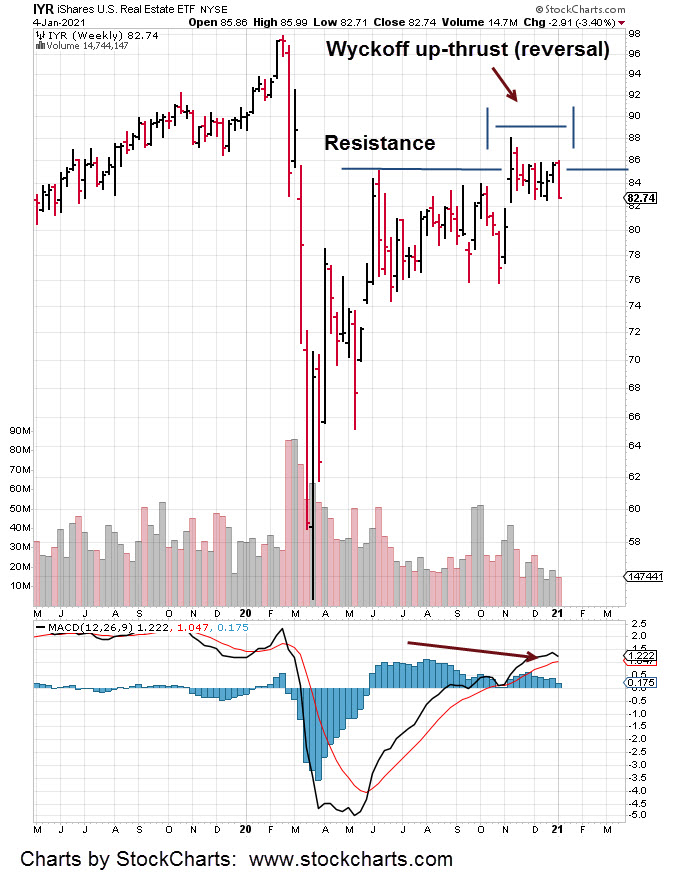

Despite all the analysis, IYR is showing continued buoyancy.

Something else is going on; possibly related to Uneducated Economist’s link provided in the last update.

Taking his cue, a functioning mortgage market is all important to the financial narrative, it’s possible this market will be more heavily manipulated than others.

At this juncture it would make sense. All indications are for reversal … yet it’s not happening in any significant way.

Time for another trade.

We’re going back to a market that in retrospect, should’ve been the focus all along; Biotech.

This site’s coming from the perspective those reading, are well aware the ‘speck’ as we call it (to avoid censorship) was a fabricated event.

Just a reminder that we’re not some ‘Johnny come lately’, here’s the link from way back in May, last year.

That post proves the situation was figured out well before the May 17th publish date (interviews, observations conducted a month prior).

What’s not fabricated however, are the repercussions from the so-called cure for the speck.

Unfortunately, those are happening now and are quite real.

Moving on to the trade.

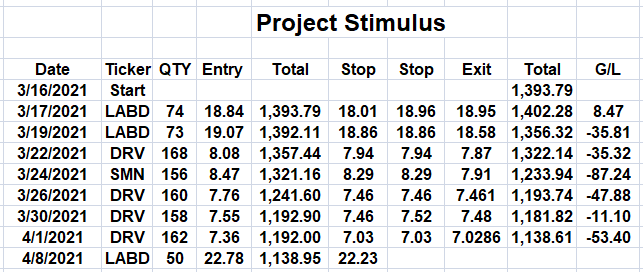

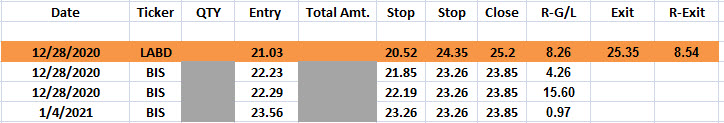

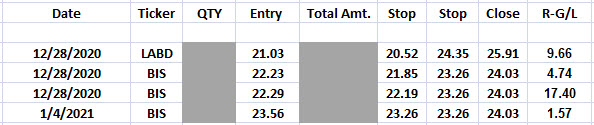

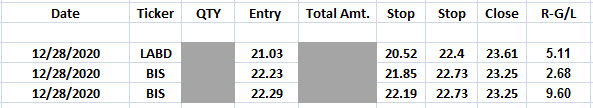

Despite the number of transactions shown in the Project Stimulus table (below), the objective is to minimize activity. We’re looking for a mid, to long term sustainable move; gain potential, 100% to 1,000%.

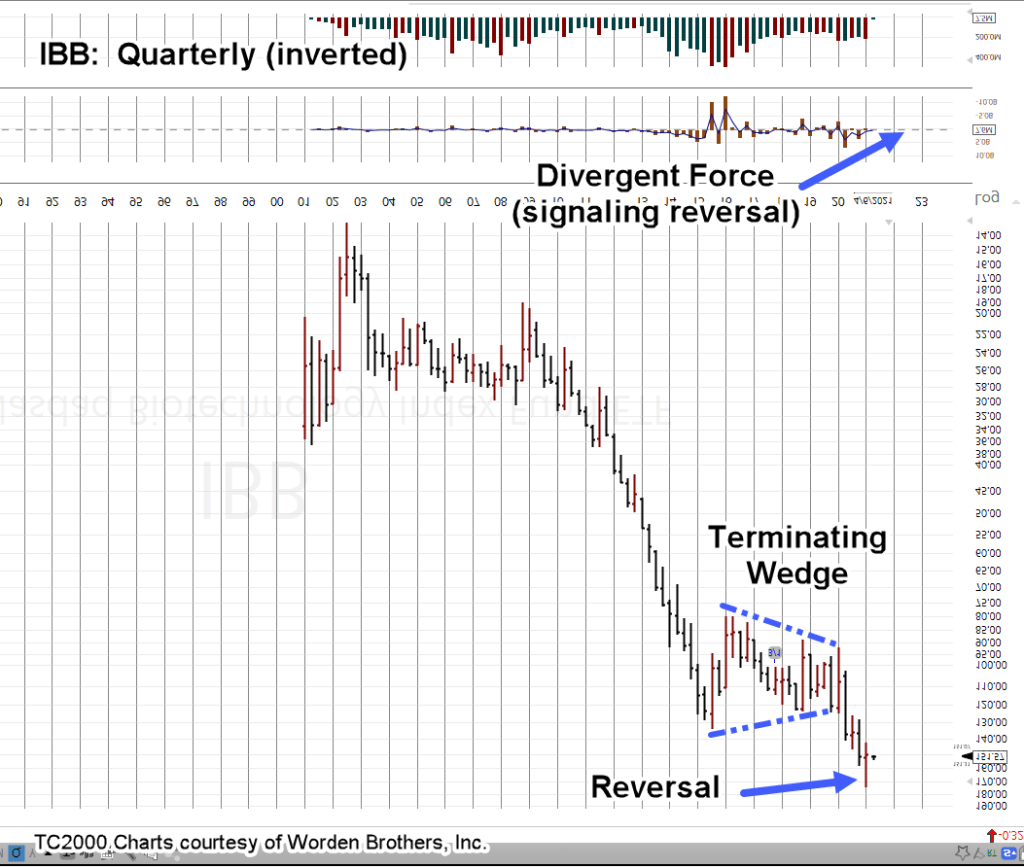

Updated previously, very long term (Quarterly) IBB has reversed.

Monthly and weekly have reversed as well; both the monthly and weekly MACD indicators point down. Daily is essentially flat.

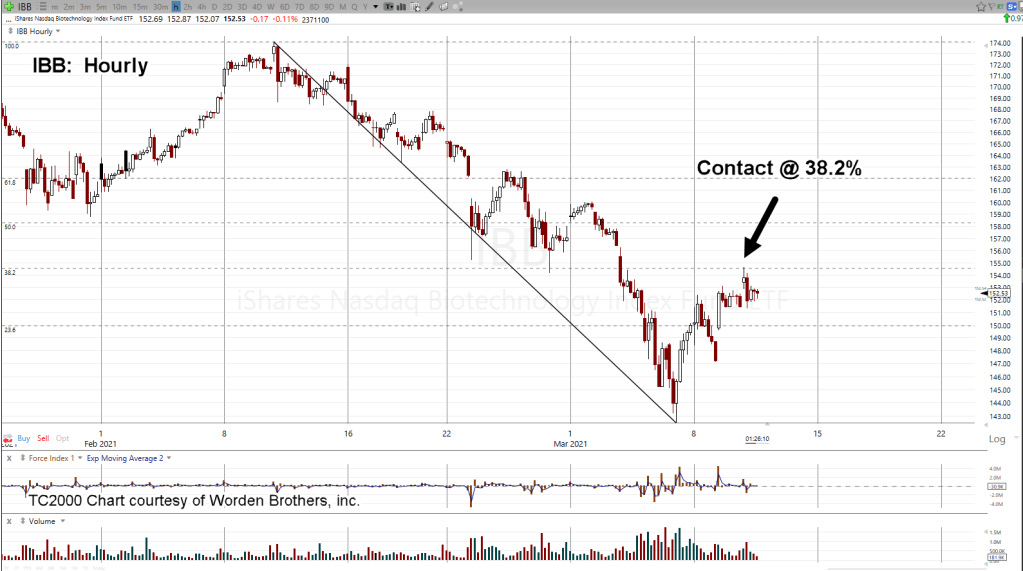

The hourly chart of LABD (3X inverse IBB) shows the entry location and subsequent price action. Stop is the session low @ 22.23 (not advice, not a recommendation).

It’s worth repeating, the false narrative on the speck and consequences of speck protection may blow up in the media (and biotech) at any time.

As J.P. says, getting people to do something they know is bad for them (or lethal) is the ultimate ‘elite’ high.