Brother, Can You Spare a Dime?

What if there’s not enough money in the coffers, for a bank bail-out?

Last week’s chaos is still in the ‘next shoe-to-drop’, stage:

Auto Loan Delinquencies Surge 50% As Cracks Deepen Across U.S. Credit Markets, link here.

The Bizarre Bankruptcy At The Heart Of This Week’s Regional Bank Meltdown, link here.

“This Is Crazy”: Goldman Stunned By Regional Bank Meltdown; Its Clients Demand Answers To These 3 Questions, link here.

Wyckoff Had The Edge

The market itself told us ahead of time, something’s up.

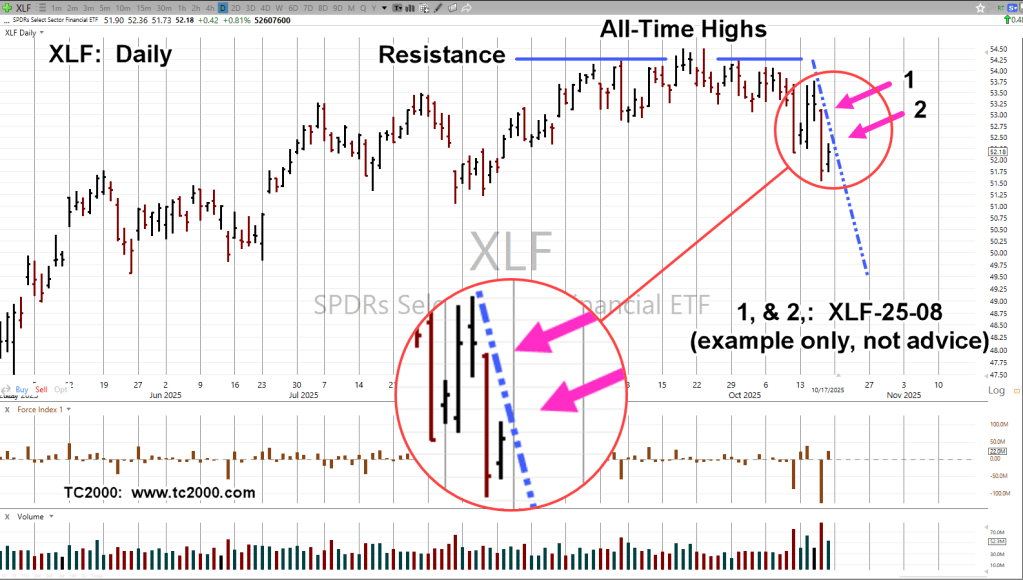

The top in XLF, identified here. On the heels of that, literally hours before the Dow melt-down, this post.

Note: The Dow post even suggested potential action:

“From a Wyckoff analysis standpoint, it’s all there; a push through resistance to all-time highs, a struggle, then new daily low and now today, a possible upside test.”

The Dow pushed higher in the first fifteen-minutes of trade and then collapsed.

Focus Amidst The Chaos

The analysis links above are a reminder; as the chaos increases, focus is to remain on price action itself.

Let the market tell us its (own) next probable direction.

All of which brings us to the chart.

Financial Sector XLF, Daily

The zoom area shows at least three contact points on a possible trendline (Wed, Thu, Fri).

Short position XLF-25-08, entered early on Thursday, and pyramided late on Friday (not advice, not a recommendation).

Expectations, Next Week

Obviously, the expectation is for continued downside. We’ll probably know late on Sunday, if that’s likely to happen.

The XLF is labeled as EXTO (extended trading hours) eligible. If there’s even a hint of (sustained) upside pressure, the exit may come as early as Sunday night (not advice, not a recommendation)

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279