‘Changing of Hands’

It’s a significant, if not major event, when one market participant (collectively) hands off the trading vehicle to another.

In a decline, that usually means the ‘average investor’, the least disciplined, least knowledgeable, gives up and hands off to the professionals; the ‘strong hands’.

In a blow-off top, the reverse is true.

The professionals lead the ignorant along with whatever narrative is necessary so that enough volume is created to successfully exit positions.

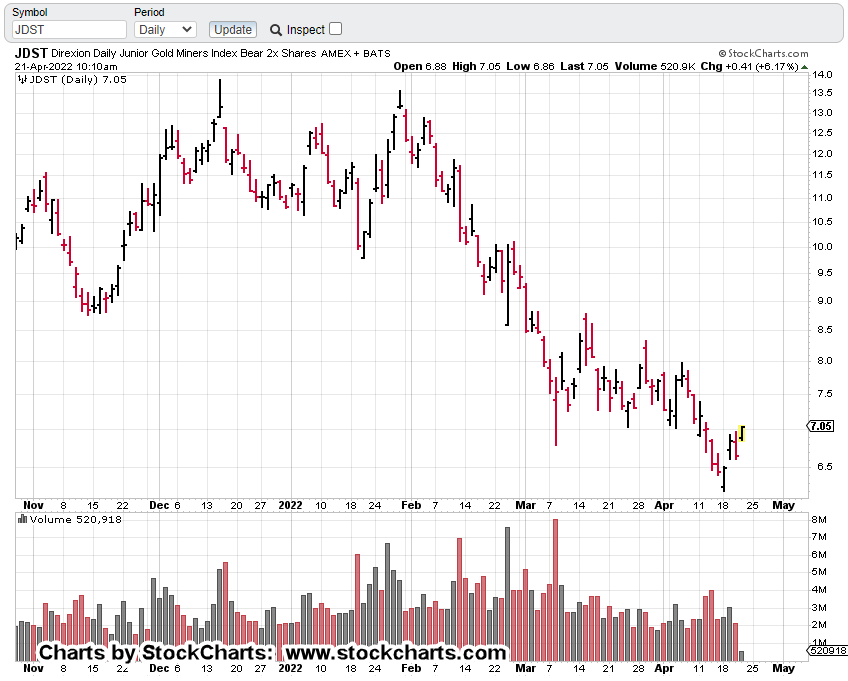

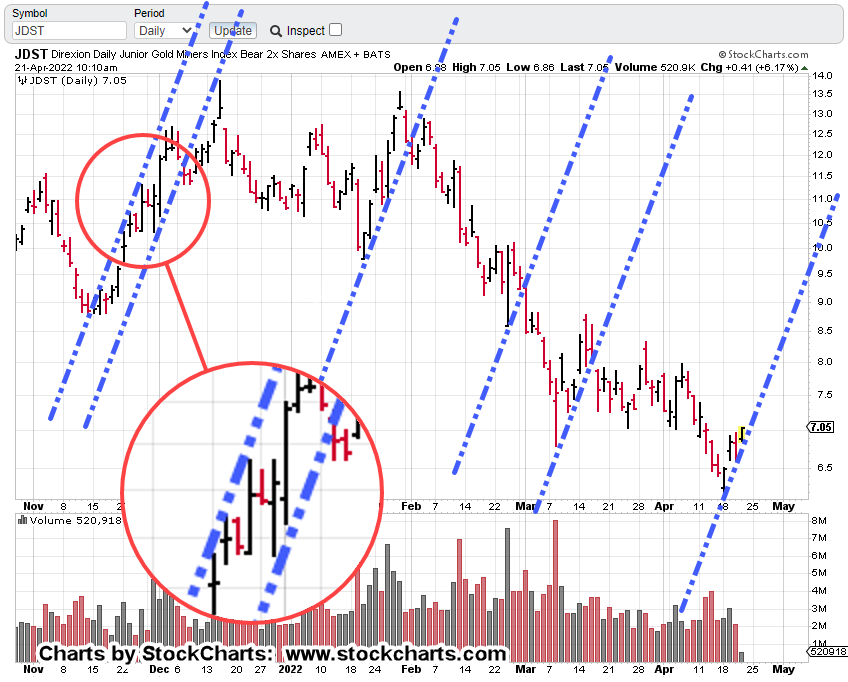

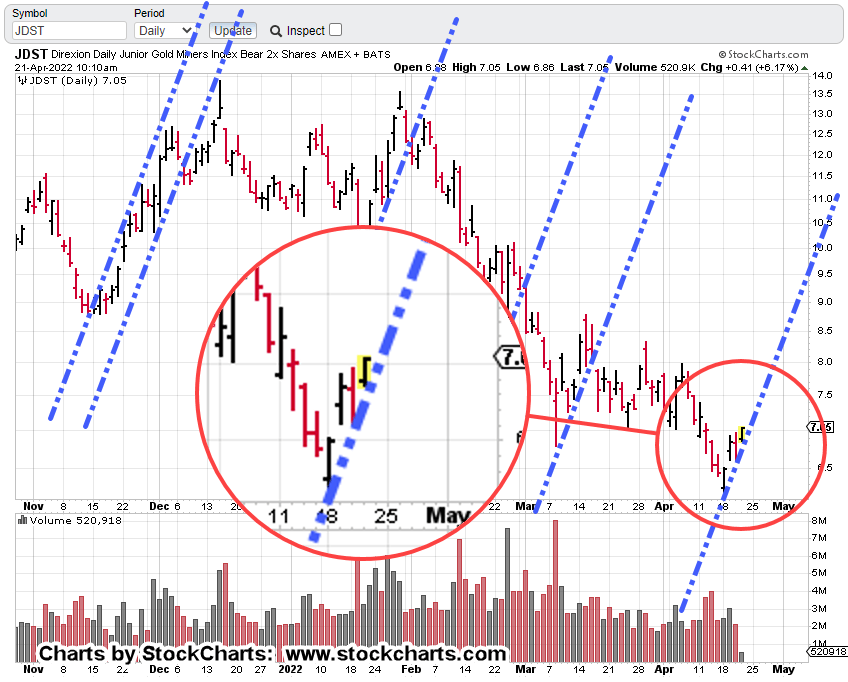

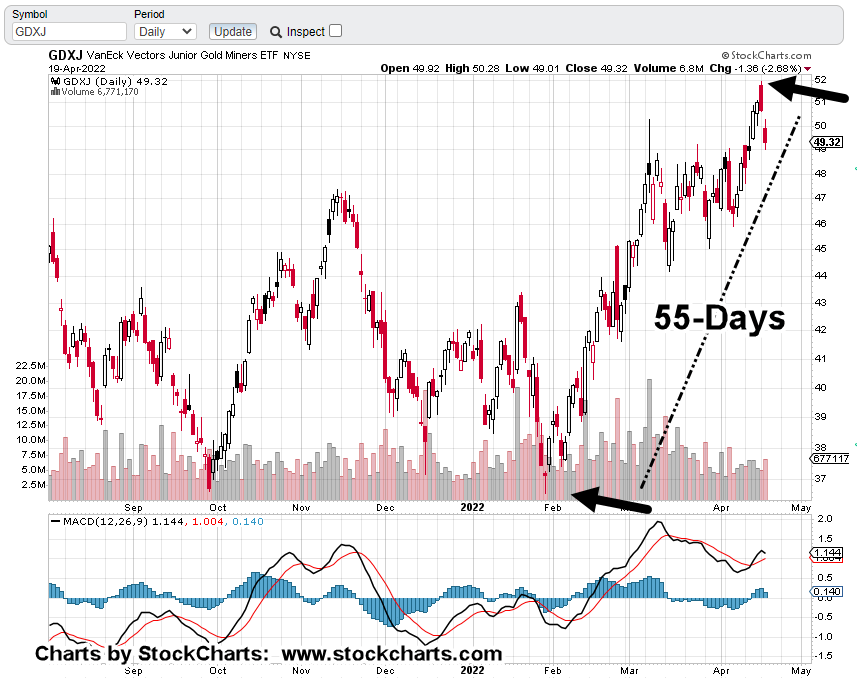

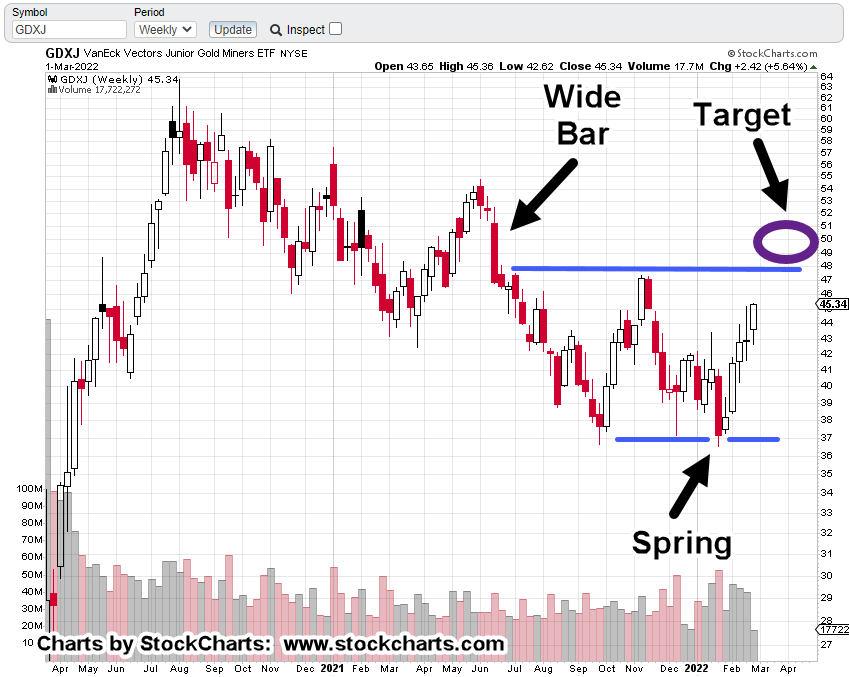

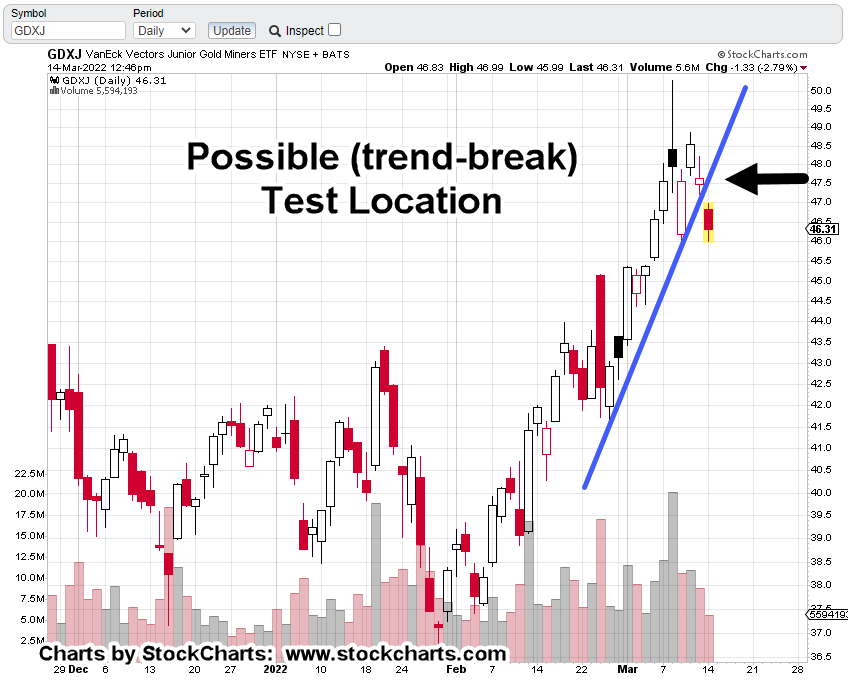

The changing of hands for gold and gold miners, was identified on this site, here, here, here, here, here, here, and here, starting over two-and-a-half months ago.

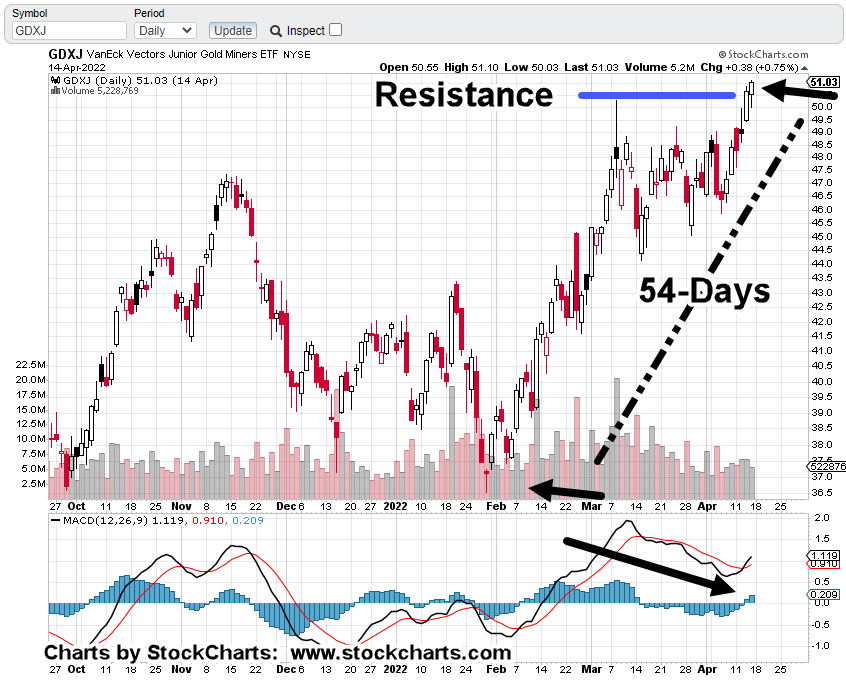

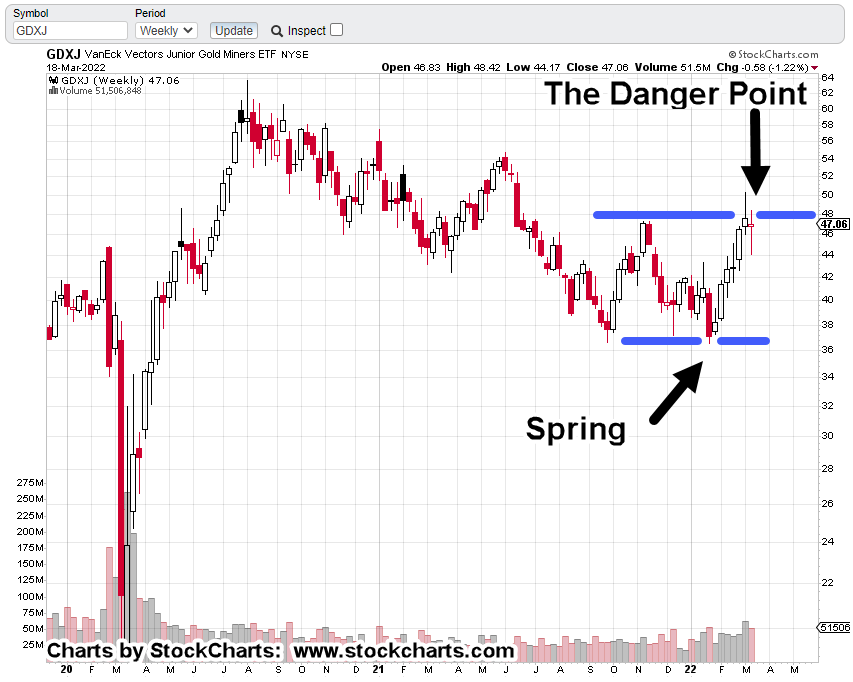

The analysis was consistent throughout; we are not in a long-term, sustainable, bull market. That stance applied most specifically to gold miners GDX, and GDXJ.

For that assessment to change, price action itself would have to change character; not the lagging momentum indicators, moving averages, price oscillators and so on that are themselves, defined by price action.

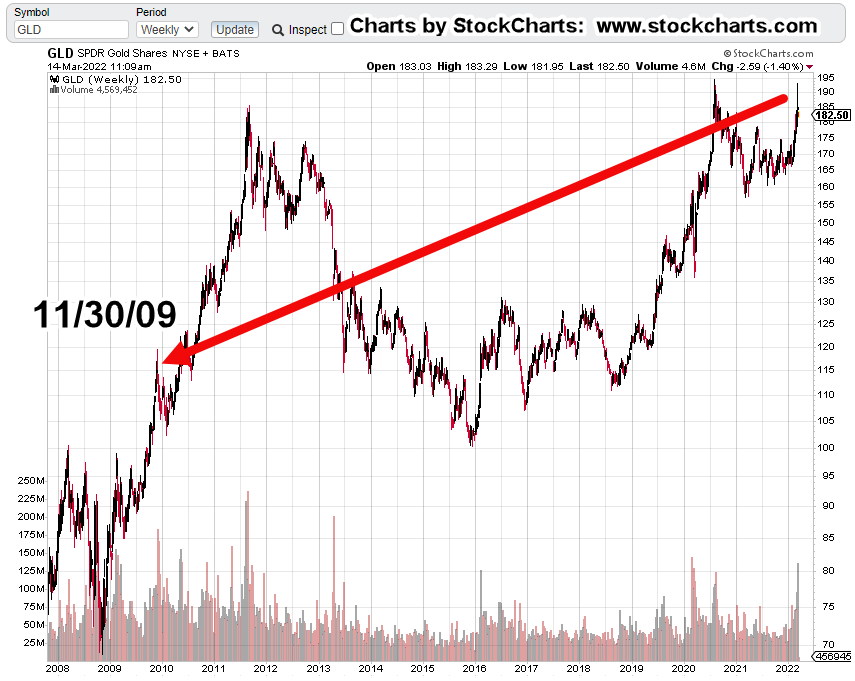

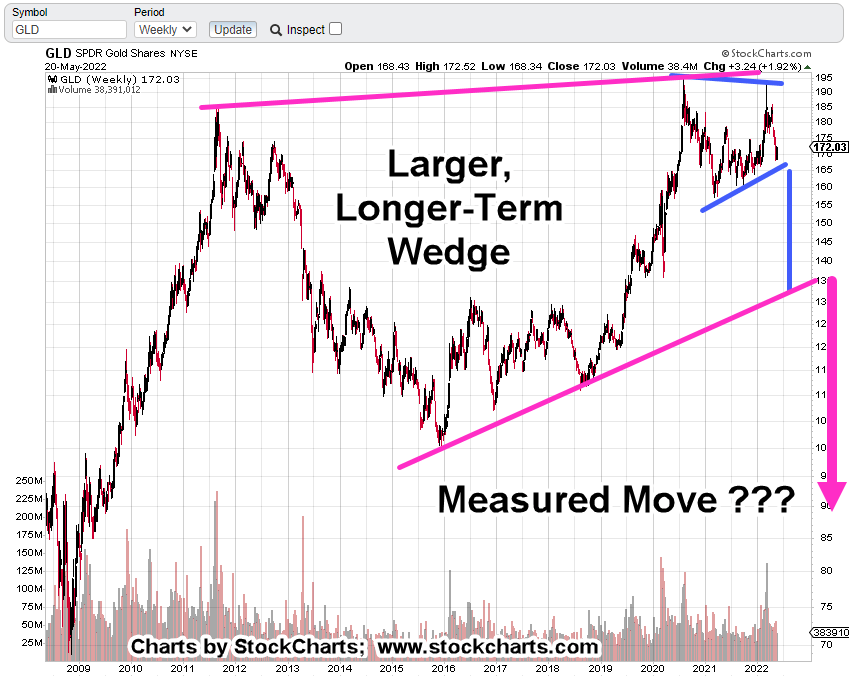

So, let’s take a look at what gold (GLD) is saying about itself.

Gold (GLD), Weekly Chart

First, the un-marked chart.

Next, we see a medium to long term trendline that’s been decisively broken and tested.

Getting closer-in, we can see the oscillation about the line, the break and subsequent test (with reversal).

What’s Next?

Well, that brings us to Harry Dent.

Love him or hate him. Here he is, offering up a perspective that’s not going to be popular.

How can gold (GLD) decline from here?

Let’s take a look.

If the wedge above is in-effect, if it’s the dominant factor at this point, then a break depending on location would take GLD down to about 130-ish.

If that happens, it will be a big event … down to approximately $1,300/oz.

However, it’s what may come next, that will be totally unexpected.

It’s interesting, the wedge in blue has a measured move target right to the bottom of the larger wedge in magenta.

To get below $900/oz, will be a very different place.

With that in mind, this site has presented time and again, we’re in an unprecedented world-event.

‘Normal’ is not coming back … ever.

Awake, or Not

Jerimiah Babe, in one of his latest videos hints there’s a strange vibe to what’s happening: Time stamp 5:20,

‘There’s something going on here …’

The Fed may actually be telling us the truth … just not in the way we expect.

You have to be awake to read between the lines.

Inflation may indeed be ‘transitory’ as they say because consumer demand is going to evaporate.

Evaporate not because the consumer can’t afford it, but because there are, or will be, no consumers.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279