Lessons From Mr. Partridge

From Reminiscences of a Stock Operator, ‘Turkey’, aka Mr. Partridge, was much older than the rest.

The rumor in the broker’s office was that he was rich.

Even so, he was not contributing to heavy commissions (i.e. day and swing trading) as far as Livermore could tell.

The other thing was, that he never offered advice.

If a stock tip worked out, he would thank the tipster … if not, you never knew if he took a position or not.

Losing The Position & Psychological Impact

Turkey’s ‘losing the position’ remarks impacted Livermore the most. He recognized that Partridge wasn’t some old duffer; he was an astute speculator.

Losing the position: Not the same as holding a loser.

Maintaining a profitable position during a correction while at the same time, recognizing a big move could be in the works, requires (mental) strength; let the market itself say when to get in and out.

This link has Prechter’s ‘missing out’ story on big gains.

Continuing on with Turkey.

In the book, he said he ‘paid a high price for his tuition’ and does not want to incur a second fee.

Attempting to ‘play’ the market in and out then repeat, by definition, leaves one out of the big move.

It’s not the move itself; it’s the recognition that fiddling with the position and losing it, has resulted in a lost opportunity that will never come back.

The psychological damage is immense.

It’s worse than taking major loss. Watching a move take off without you when you had planned for months (or years) for the set-up, may have left no way to recover.

Which brings us to the market at hand.

Gold (GLD):

This site is not advice, and it does not make market ‘calls’.

Presented here, are posts documenting how Wyckoff analysis is being used to spot market set-ups.

Those set-ups have shown themselves over time to be potentially profitable (not advice, not a recommendation).

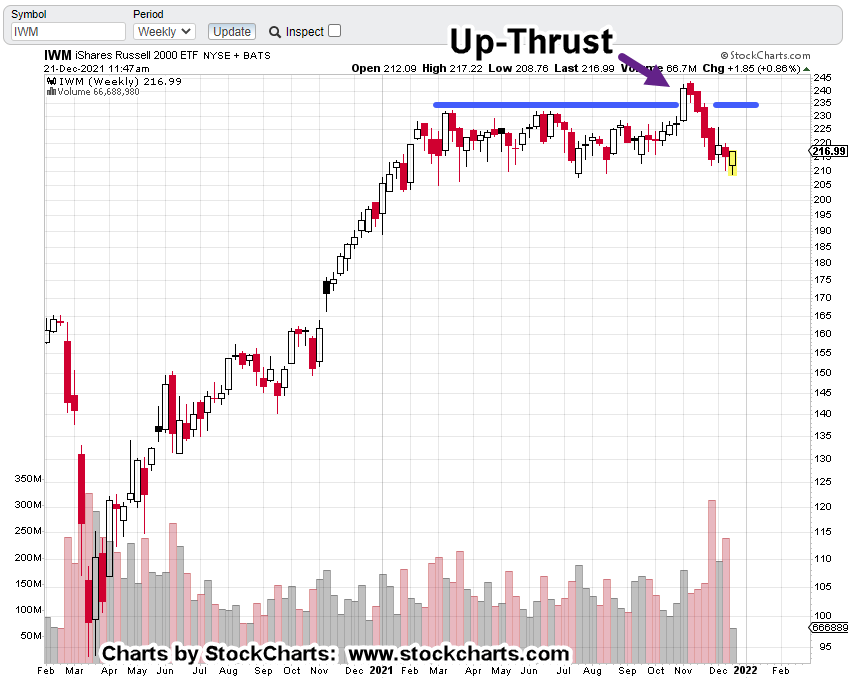

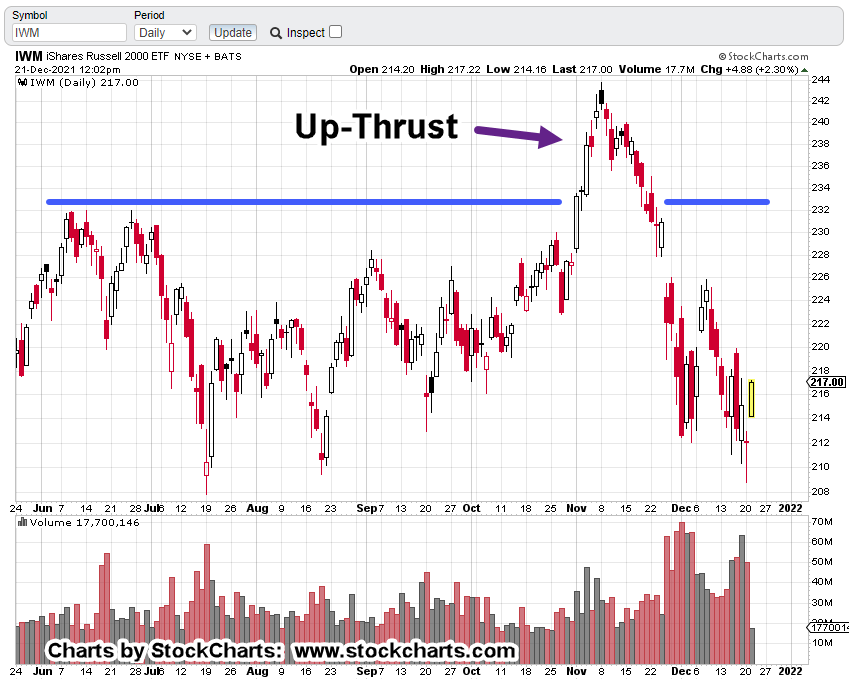

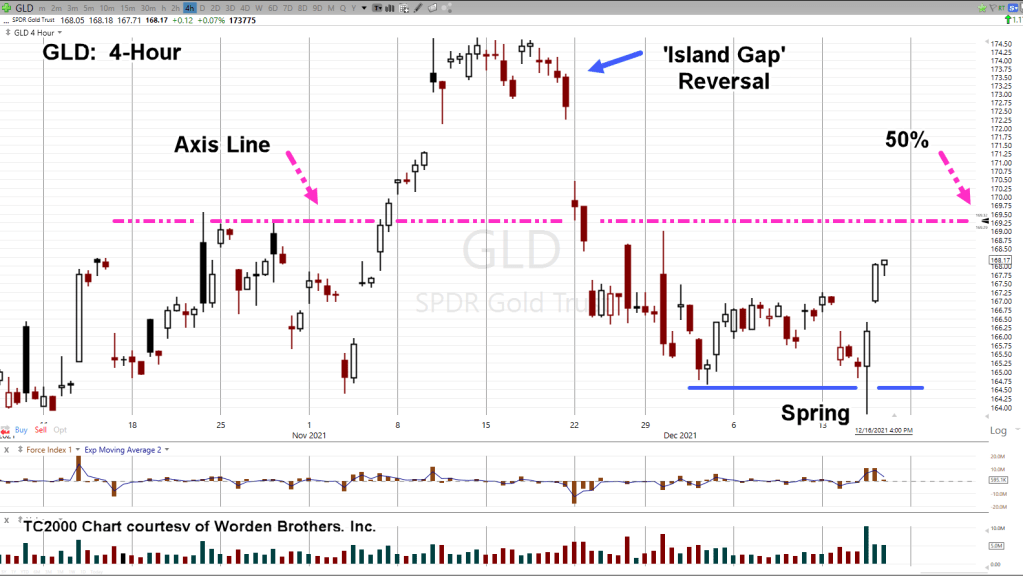

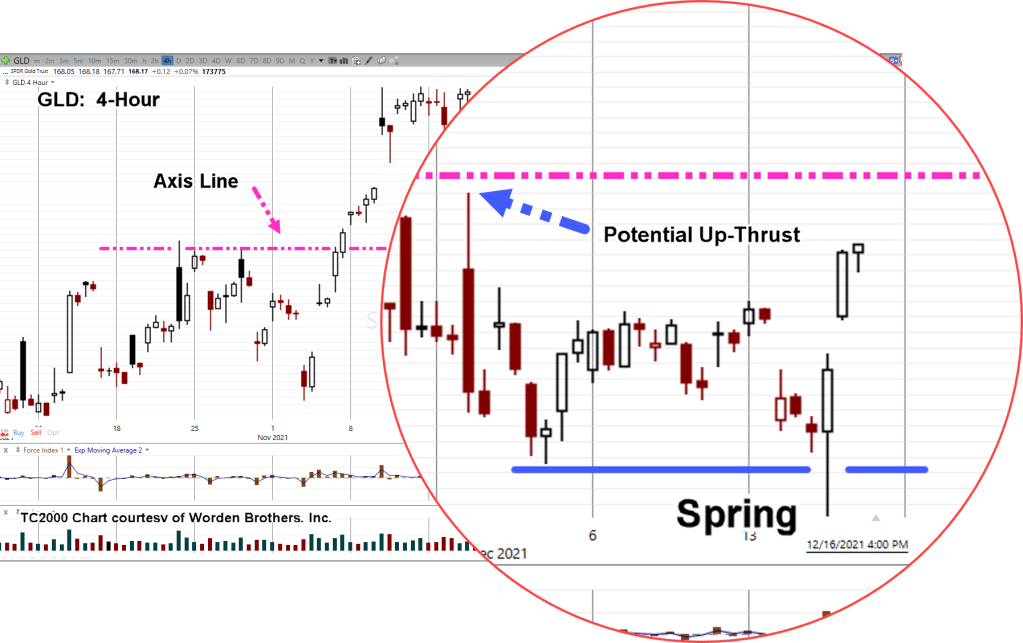

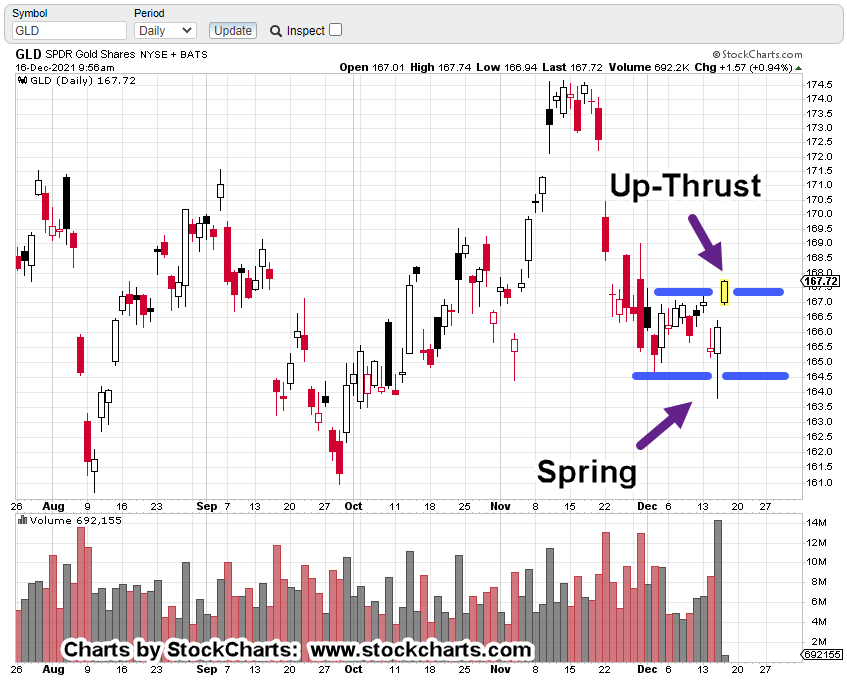

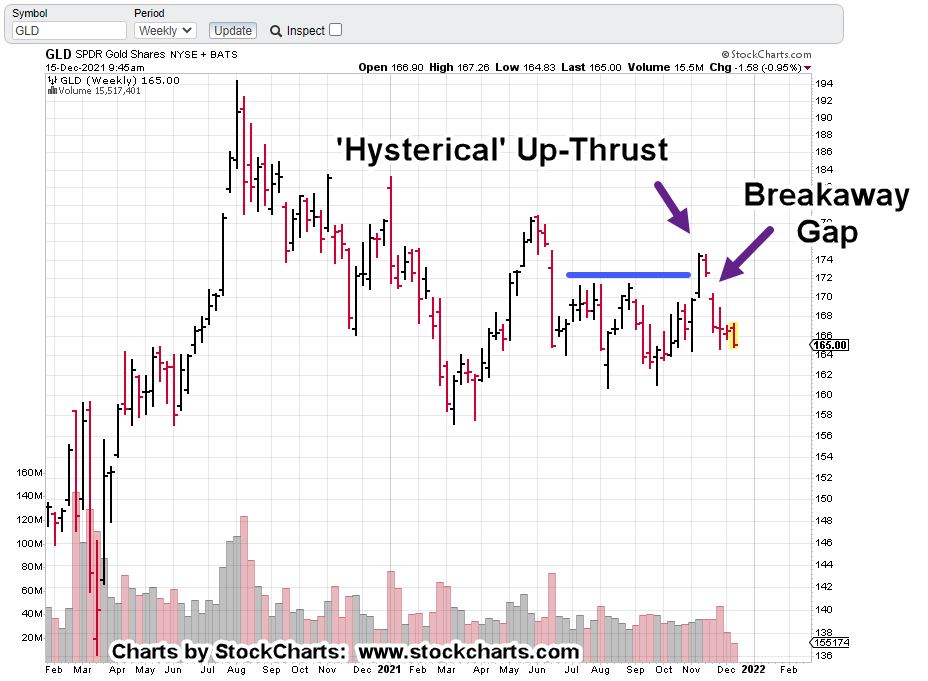

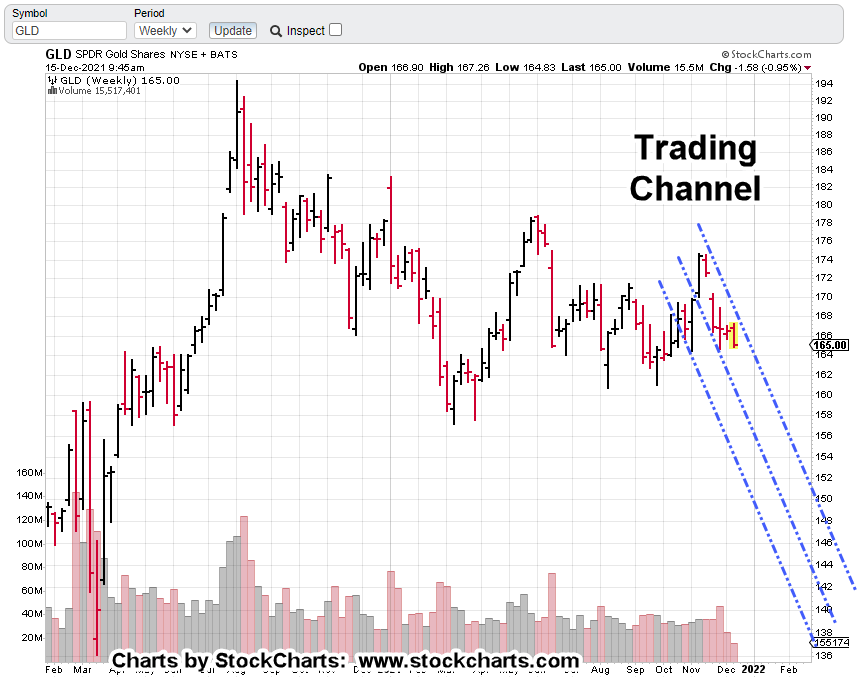

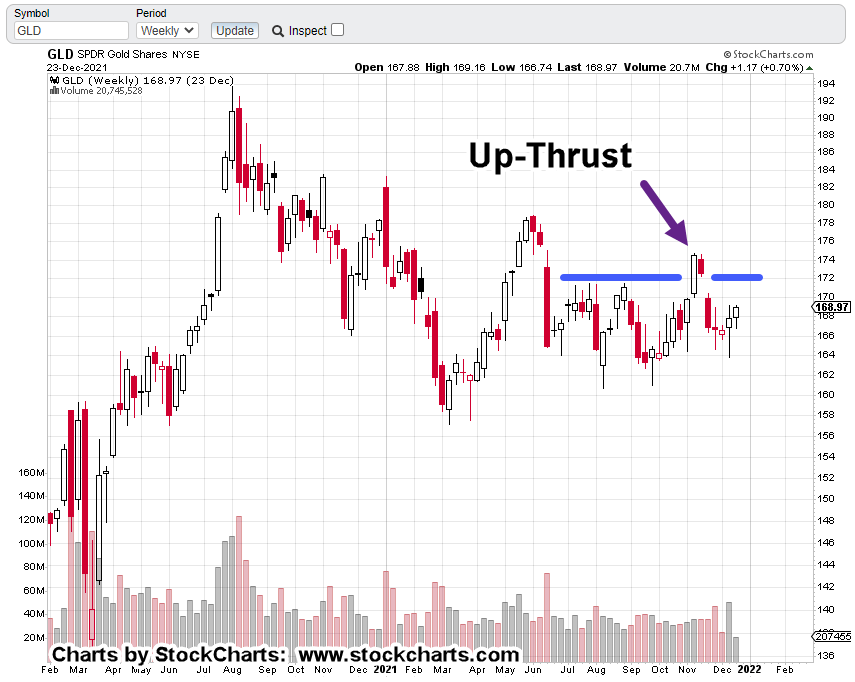

The weekly chart of gold (GLD) shows the up-thrust that was months in the making.

We’re going to invert the chart and so, the ‘up-thrust’ now becomes a ‘spring’.

Note:

Back in the day, when I wasted time posting on SeekingAlpha, I would get numerous complaints about ‘inverting the chart’.

They wanted it spoon-fed and did not have the mental plasticity to look at situations from the opposite perspective.

The ‘inverting the chart’ came from none other than Dr. Elder, himself … discussed in Trading For A Living or Come Into My Trading Room if memory serves.

The main interest on the ‘Alpha’ site seems to be pontificating about how sharp your pencil is; how close you can come to guess what earnings (or some other meaningless fundamental) will be at the next release.

I have not been back in years … they’re probably out there still arguing … only this time, the banter may be about which “masks” are most effective. 🙂

But I digress.

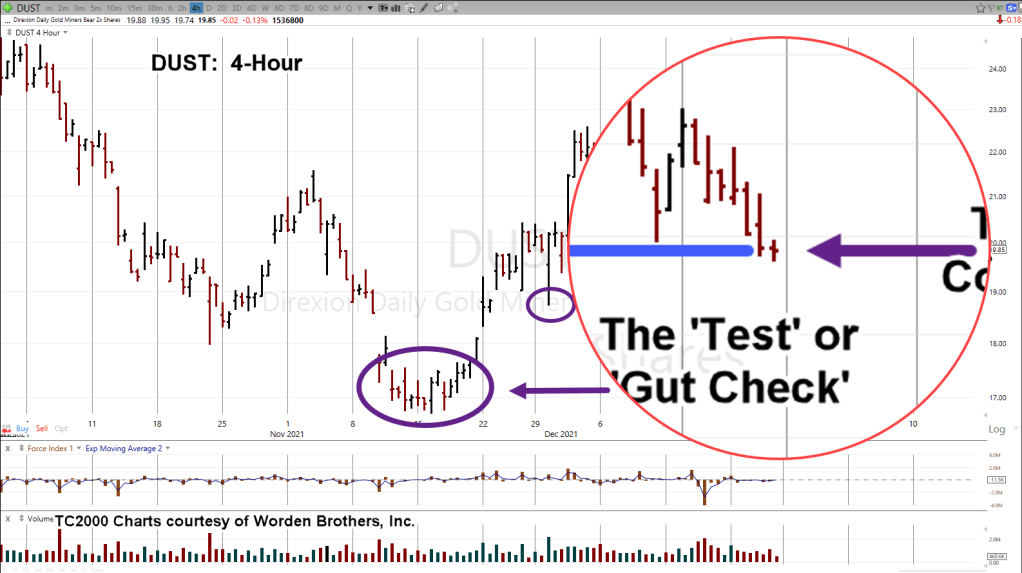

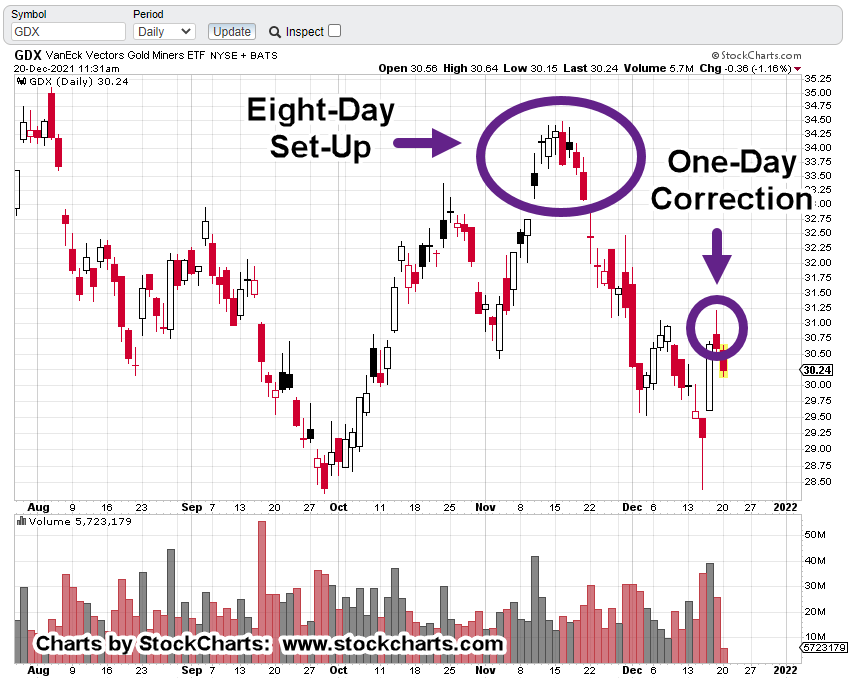

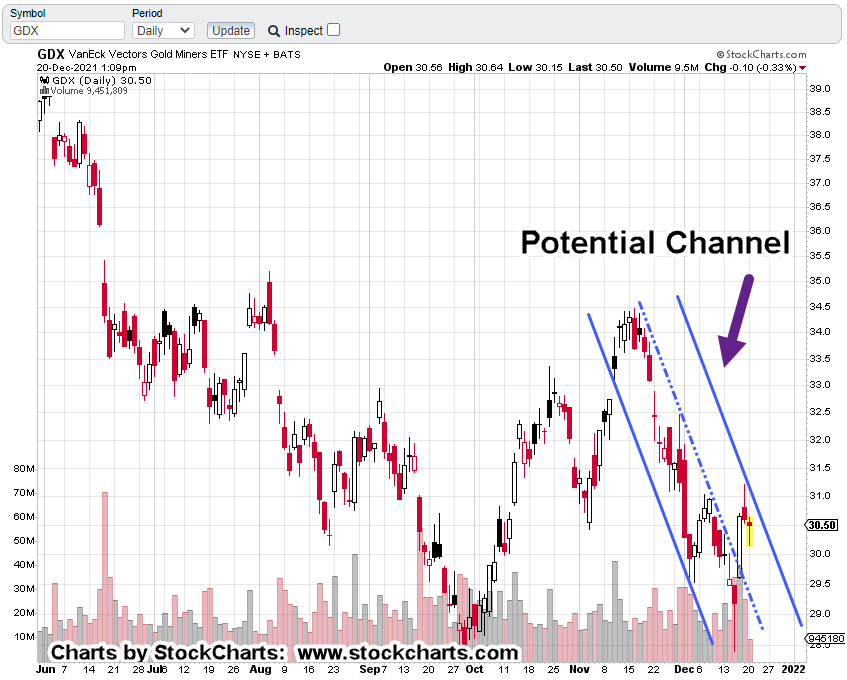

Months To ‘Spring’, Weeks To ‘Test’:

The inverted chart of GLD shows it took months for price action to penetrate support and create a spring condition.

Since then, we’ve had a move higher and now lower coming back near support.

Is this a test or a failure of the move?

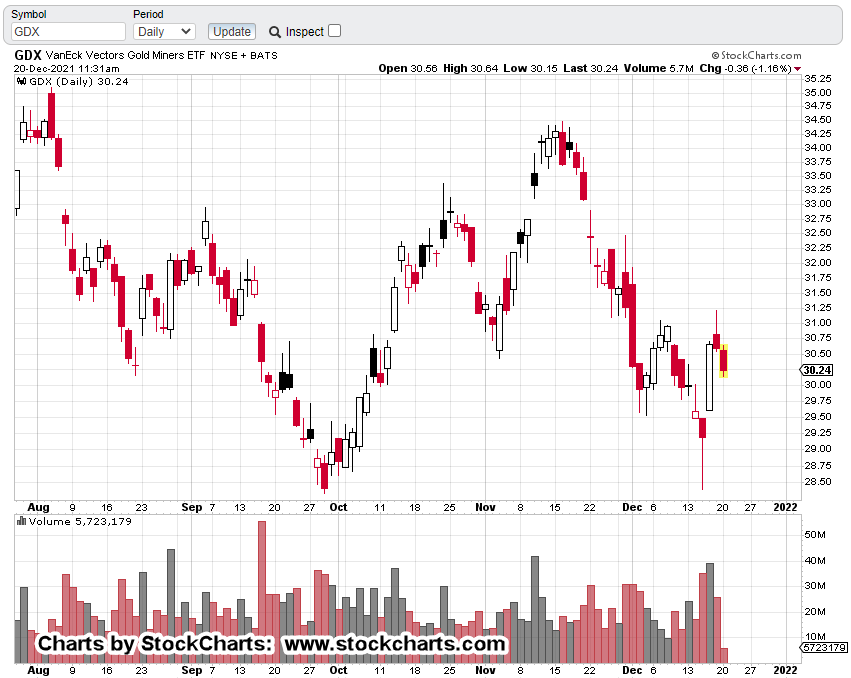

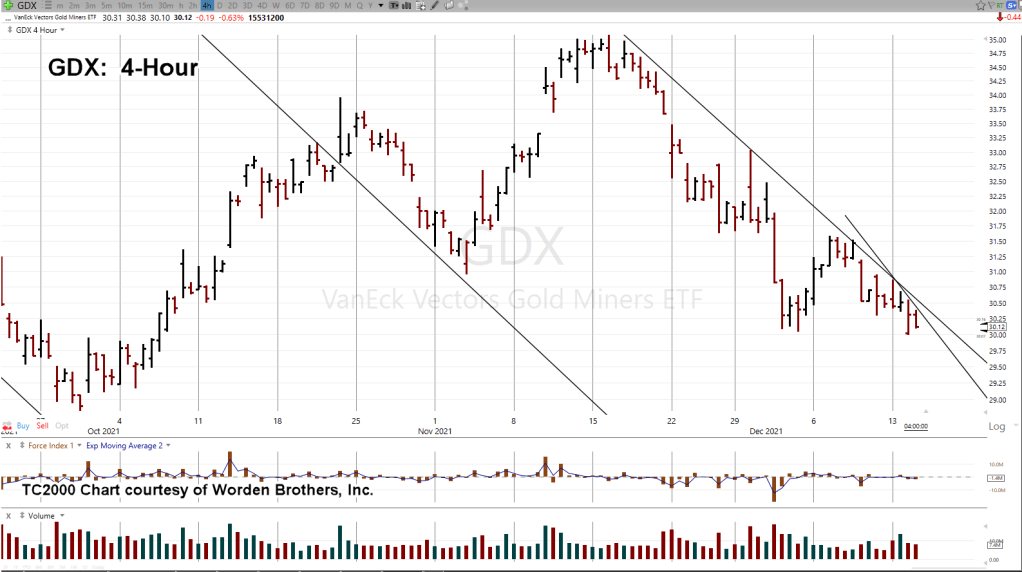

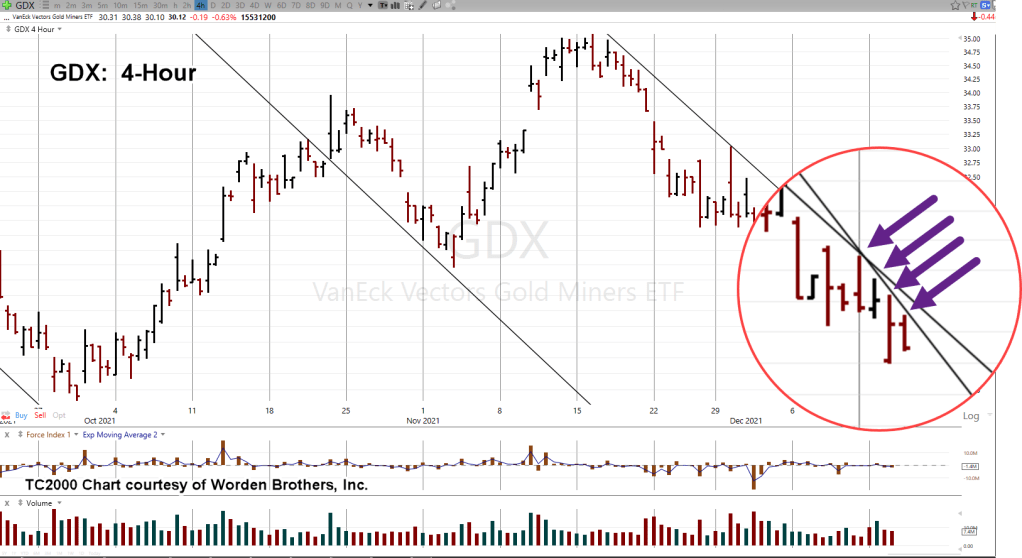

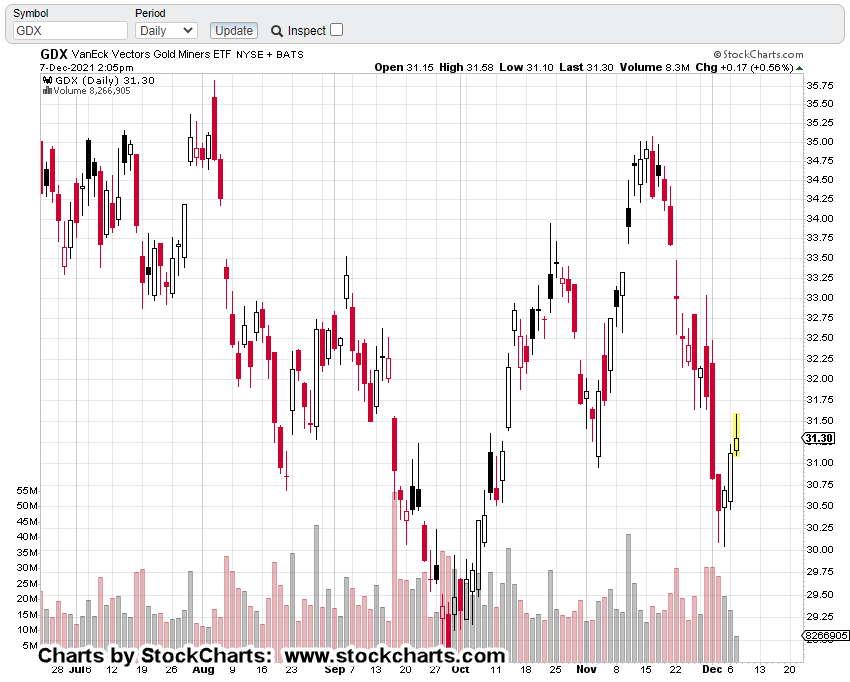

It was a short week. However, it may still provide actionable data. For example, range of GLD, GDX and NEM, all narrowed. Volume contracted as well.

The inference is, thrust energy is weakening and thus weights the probabilities to a ‘test’ and not a ‘failure’.

Deflation Pivot:

Interestingly, we’re starting the see the consumer has finally reached the limit of their spending. Price are staring to edge lower as reported here and here by Economic Ninja.

Another data point, a bit esoteric, is ammunition. Pices are starting to taper off as well. Most notable is 22-LR.

A couple of months ago, 22-LR was about 0.10 per round (bullet). Looking at this site, we see the cheapest price has dropped to .080/round.

That does not look like much but it’s a 20% decline.

Summary:

Everyone has their own time frame and market approach.

Taking a cue from Turkey, referenced above, I would rather sit through a correction, incur the erosion of profit than exit and ‘click my heels’ as Prechter puts it; then watch the original position move for a huge gain without me aboard (not advice, not a recommendation).

We’re likely to find out very soon if this is a major pivot lower or if somehow, gold (GLD) bulls gain control and drive prices higher.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279