The Real Story

If there’s any one interview that details what’s really going on, it’s this, link here.

The 48-mintue Kitco session with Bert Dohmen, is much needed straight talk.

It’s all there:

Official data is fake. Markets will (likely) ‘trap’ bulls with massive gap-down. It’s 1929 (again). Crypto is an illusion. Silver/Gold will correct (temporarily) along with the markets. We’re surrounded by bought off media. The population (masses) don’t think or can’t think.

Adding to that are ideas and sources discussed for years on this site, like ShadowStats having ‘real’ data on unemployment and inflation.

The list goes on.

With all that said, let’s look at one of the sectors (retail brokers), that could be hit hard during a surprise downturn.

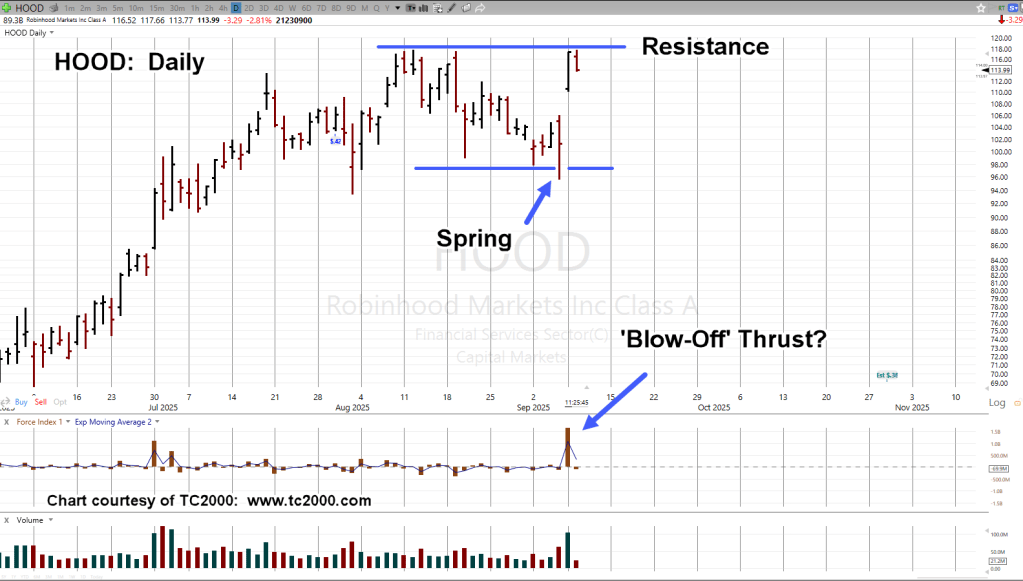

Robinhood HOOD, Daily

It’s important to note, price action late Friday, began to pull away from the lows … rising into the close.

Just after that close, the announcement, HOOD made it to the S&P.

Wyckoff said a century ago:

‘Somebody always knows something. That ‘something’ shows up on the tape’

Well, there it is.

Was yesterday (the start of) a blow-off?

Froce Index (thrust) was the largest since the IPO, trading on August 4th, of 2021.

Price action is currently (as of 11:58 a.m., EST) retreating off the highs.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279