‘Investors’ Lose Confidence

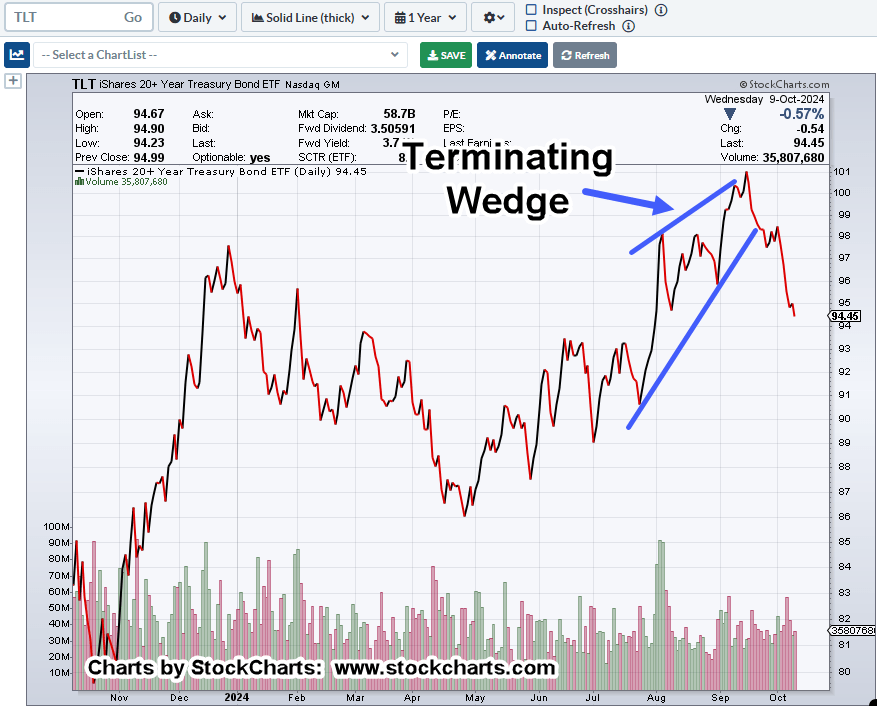

We’re still in the pre-market (9:13 a.m., EST) but already, long bonds (TLT), are trading lower with rates higher.

The current bond reversal was first discussed in this post.

Part of what was said (then) is to watch how the press paints the picture; that is, to get your popcorn ready.

Cue The Press

So, the ‘press’ has decided that ‘investors’ are losing confidence in the Fed.

Instead of highlighting wrong-think about who is leading whom (hint, bonds are in charge, not the Fed), we’re going to ‘let the trade do the talking’ or the analysis, as it were.

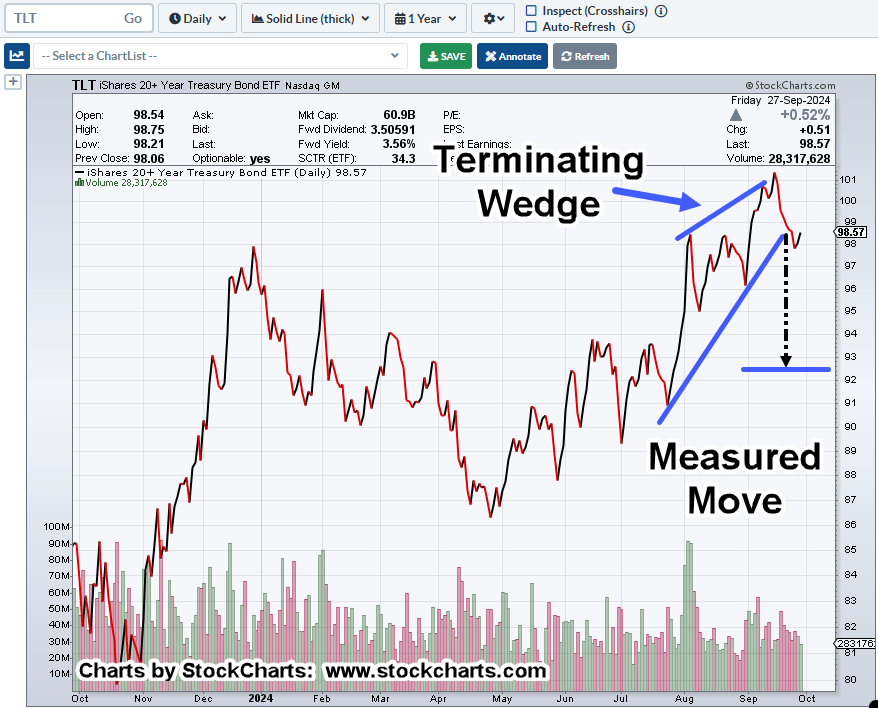

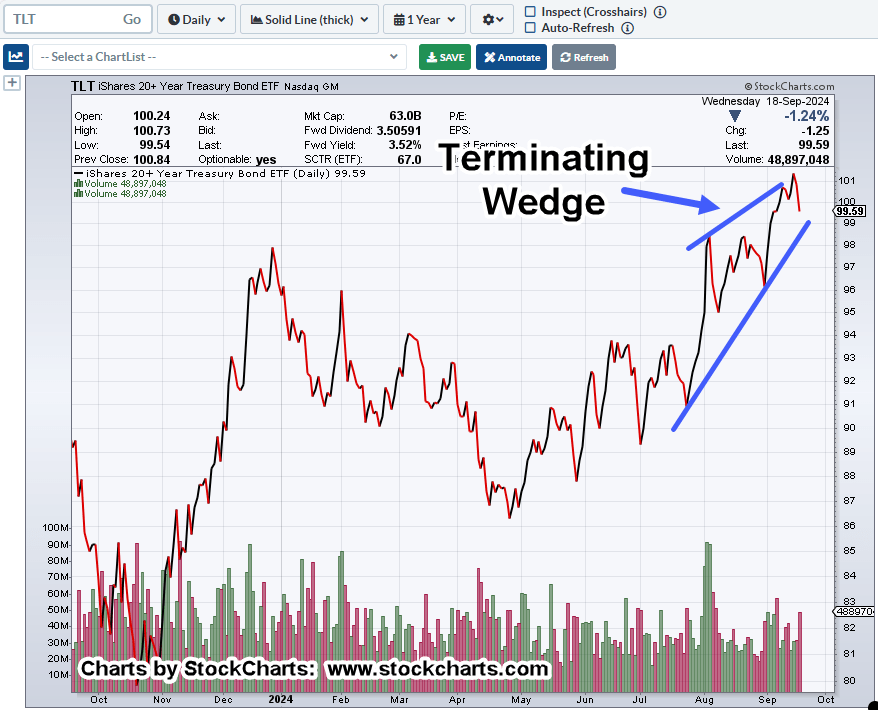

Long Bonds TLT, Daily Close

Back then (September 19th), wedge identified.

Moving on to now.

We’ll propose that investors are not losing confidence in the Fed.

No, we’re in a new paradigm, catching many off-guard; unsure as to what data to believe and how to position.

This site is using the method described in the About section. You’re watching in real time, how that method fares under the current chaotic market conditions.

As Buffett is attributed to saying.

‘When the tide goes out, that’s when you find out who’s been swimming naked’.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279