Collapsing On Several Fronts

‘Retail’, selling silver, link here.

Jewelry whacked, link here.

Loan Shark, link here.

You know it’s bad when booze takes a hit, link here and here.

Producer prices launch higher, link here.

Lumber prices collapse, again, link here.

Travel restrictions, link here.

Then, there are ‘valuations’, link here.

Also then, there’s this, link here.

Lastly, short squeezes and liquidity traps … bear market behavior, link here.

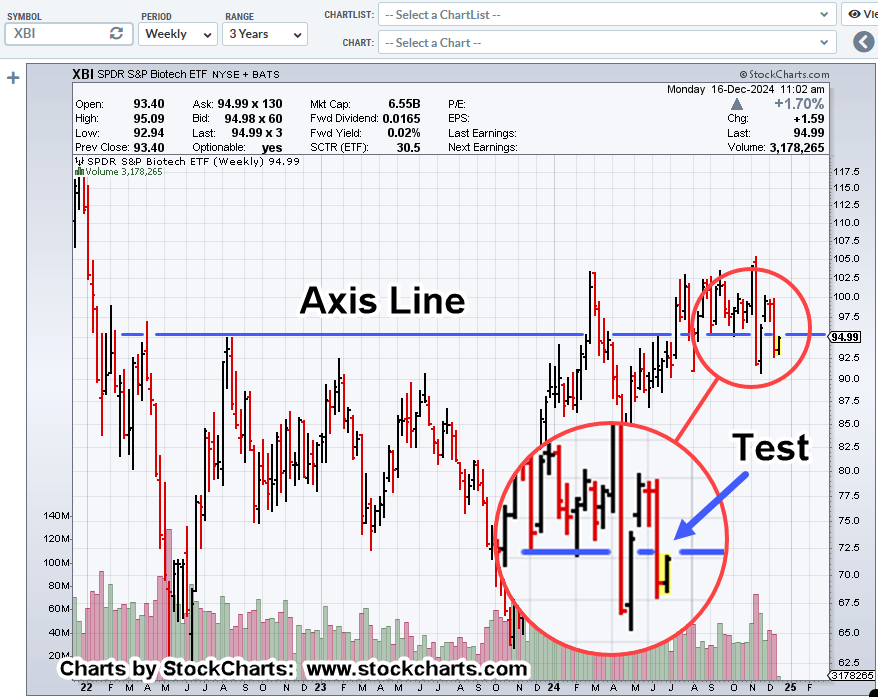

Speaking of ‘short squeeze’, we had biotech do just that in the pre-market (and regular) session.

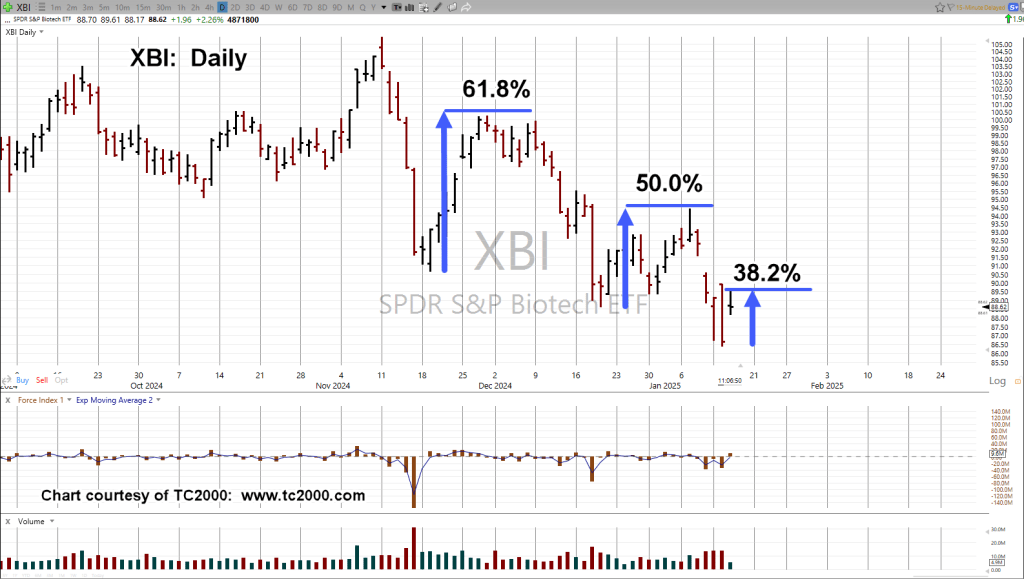

Biotech XBI, Daily

If it really is/was a short squeeze, once shorts are covered, the expectation is for price to continue lower (not advice, not a recommendation).

Included in the chart, is a bit of insight you’re not likely to find anywhere else.

Note the distance of each retrace after a leg down. Less each time and Fibonacci multiples.

As stated yesterday, XBI posted outside down. That means price action penetrated the lows of the prior session and closed lower.

As wild as it may seem, penetrating the lows and closing lower, put XBI in Wyckoff ‘spring’ position.

That’s what we saw with today’s action.

As this post is being created (11:45 a.m., EST), XBI action continues to erode to the downside currently trading at the 87.60 – area.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279