Follow The Action

Carvana’s moving higher into the next potential short set-up (not advice, not a recommendation).

The last update had CVNA, testing resistance, with potential downside reversal.

It didn’t happen.

As seen from that chart, any time we’re just below support, ready for breakdown, we’re also in Wyckoff ‘spring’ position, ready to move higher.

It’s the type of stuff that drives (real) scientists and engineers ’round the bend’ as the Brits would say. 🙂

Why Focus on Carvana?

Possibly the best answer, can be taken from the comments section of this update:

“There’s such a huge gap between the performance of CarMax and Carvana. And the short interest in Carvana has dropped a lot as of late.”

With that, let’s move on to the chart.

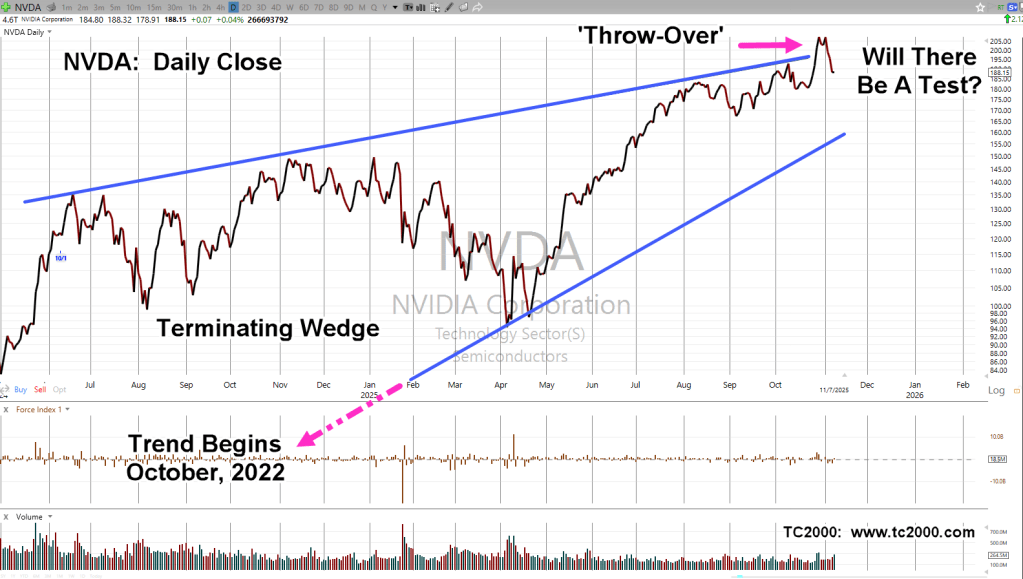

Carvana CVNA, Daily Close

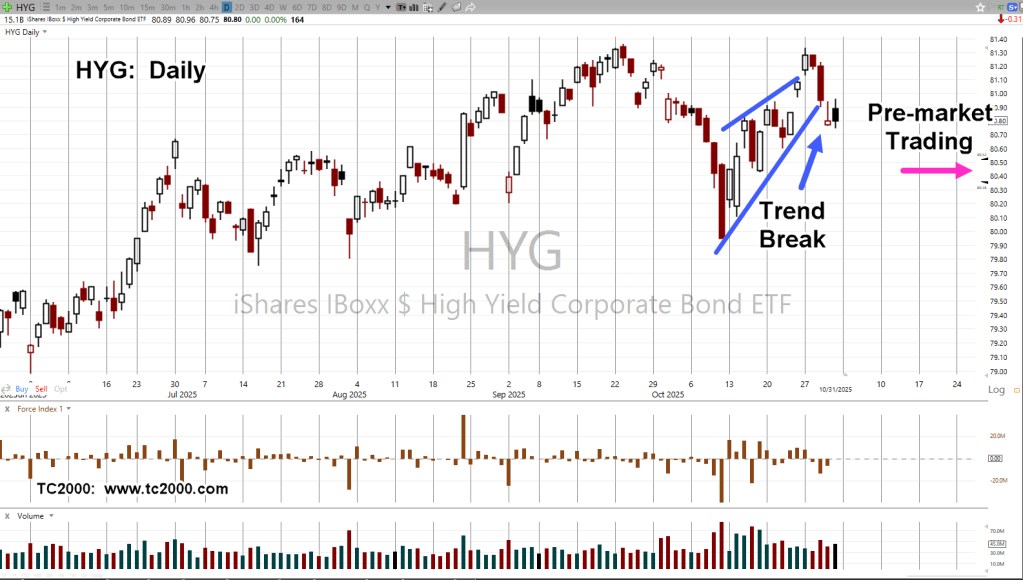

We have the ‘big picture’, a terminating wedge spanning over two-years along with a breakdown.

Now, it’s the ‘test’ phase with one, and possibly, two.

The level highlighted (insert), is the close of November 3rd, at 332.33 (you can’t make this stuff up).

A (test) close above that level, puts CVNA in another up-thrust position, with potential for downside reversal (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279