Biotech, And The Next ‘Event’

Now, it all makes sense.

The solstice was yesterday.

Hard reversal in the market, today.

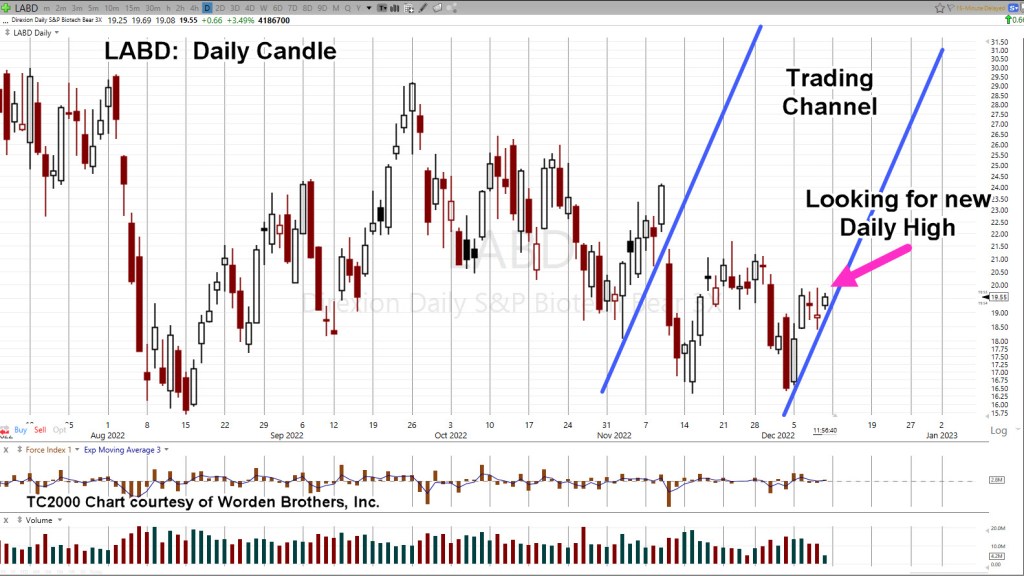

Then, there’s biotech; stubbornly refusing to break down.

First, Some Housekeeping

Before we go any further, from a housekeeping standpoint, all biotech short positions have been closed (not advice, not a recommendation).

Each apparent downside breakout attempt for the past three months, has been thwarted. There is something else going on.

Possible reasons for biotech’s resilience can be found here, and here and here.

Hint: There’s another planned ‘event’, on the way.

Now, back to the markets.

All major indices are sharply lower but for this update, we’ll focus on the Small Caps (Russell).

Russell 2000 IWM, Daily

Instead of starting with the big picture and longer timeframes, we’ll get straight into why today’s action may be significant.

Yesterday, price action attempted to ‘spring’ off the support boundary. Today, that spring has apparently failed.

Failed moves bring out the other side in force; in this case, the bears as it’s obvious the opposing side, the bulls, are exhausted.

It’s getting late in the session (2:50 p.m., EST) and the expectation is for a lower close.

If this really is the kick-off to the downside, then we’ll expect some kind of follow through at the next session.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279