Was It ‘Manipulation?’

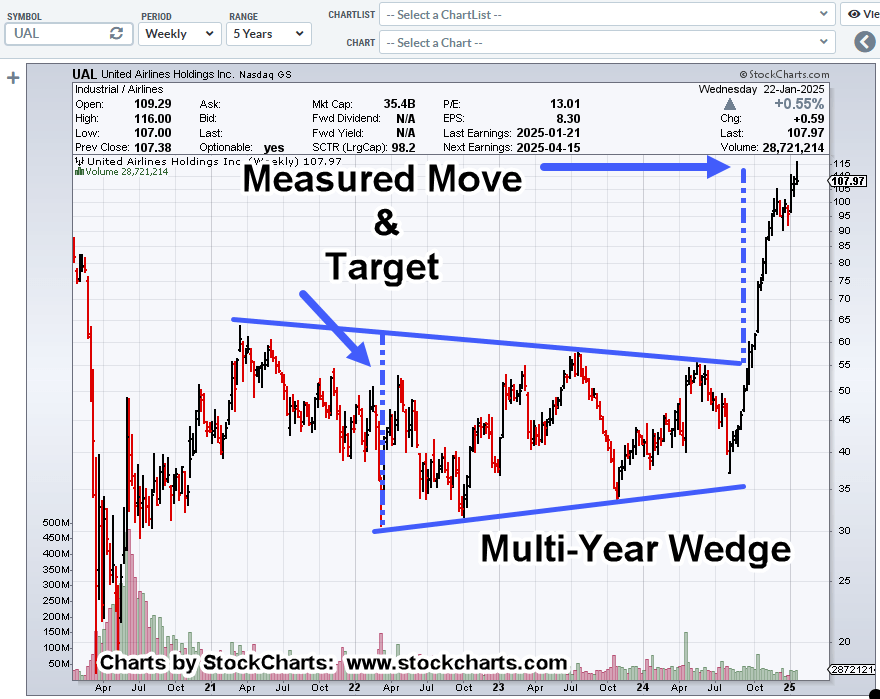

Looking at United Airlines (UAL), with the precise set-up, four-year wedge, measured move, the top, timed exactly at an earnings release, you have to ask yourself …

Was it all part of a (secret) plan?

Wyckoff Writes on Manipulation

Way back in 1910, Wyckoff wrote the following concerning manipulation (emphasis added, quote used with permission).

“Manipulators are giant traders, wearing seven-leagued boots. The trained ear can detect the steady ‘clump clump’ as they progress, and the footprints are recognized in the fluctuations and quantities of stock appearing on the tape.”

United Airlines UAL, Weekly

When looking at the chart, it all makes sense … it just took over four years to play out.

As the last update said, ‘what now?’

All three major (largest cap) airlines are currently (flat to) lower; DAL, UAL, LUV (11:02 a.m., EST).

American Airlines (AAL), lower as well; it’s down a whopping -10%, just today

What does that mean?

Here’s an interview with Ed Dowd, just posted.

All of the damage inflicted over the years, is not going to be wiped-out with the stroke of a pen (to borrow a comment).

With that, one of the hardest industries to make a profit even in good times, are the airlines. (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279