Is The Fear Exhausted?

It’s a confusing time.

Semiconductors with chief cook and bottle washer Nvidia, seem to be reversing. Other sectors like biotech and mid-caps were never part of the mania.

Add to that, biotech and life insurance may be correlated (more on that, in another update).

As the market looks to pivot lower, bonds are also pivoting lower or at least under pressure.

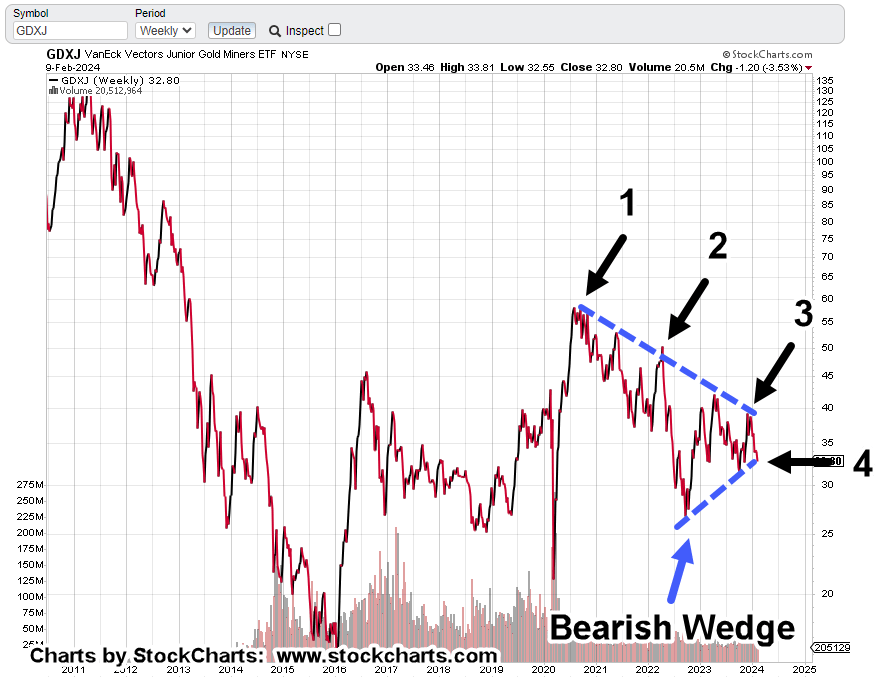

In response, one can say there’s been sort of a panic into the mining sector GDX, GDXJ; like it’s somehow more safe there.

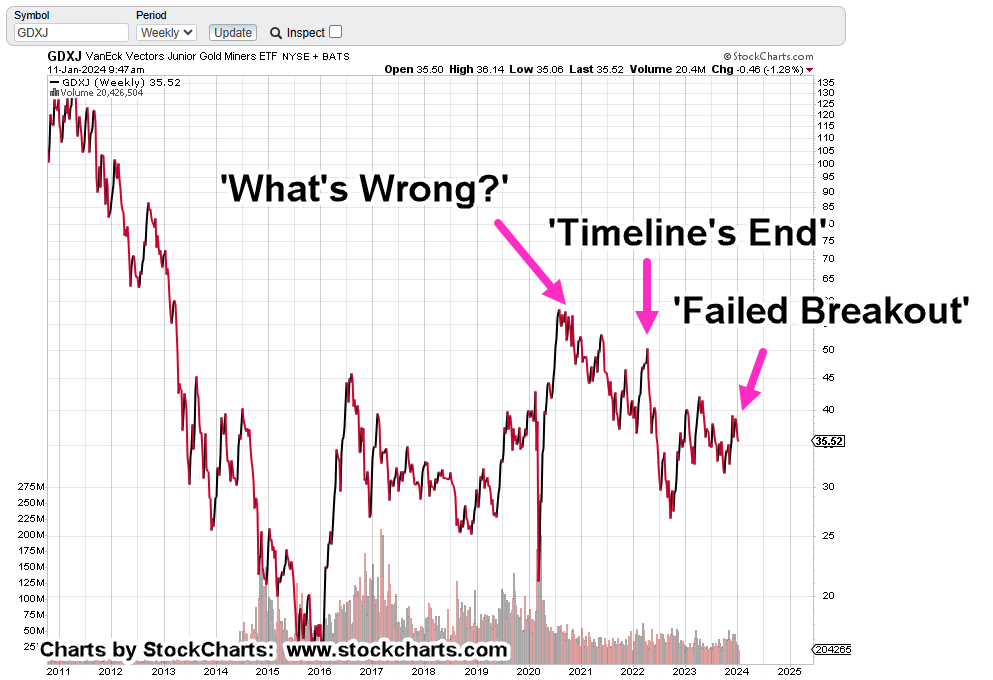

Let’s see if the miners really are the safe-space.

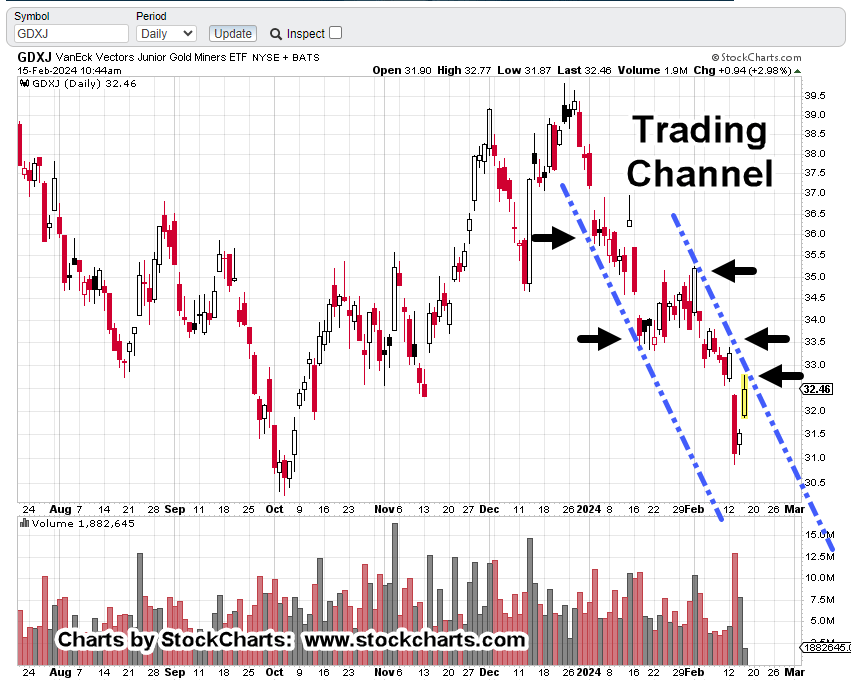

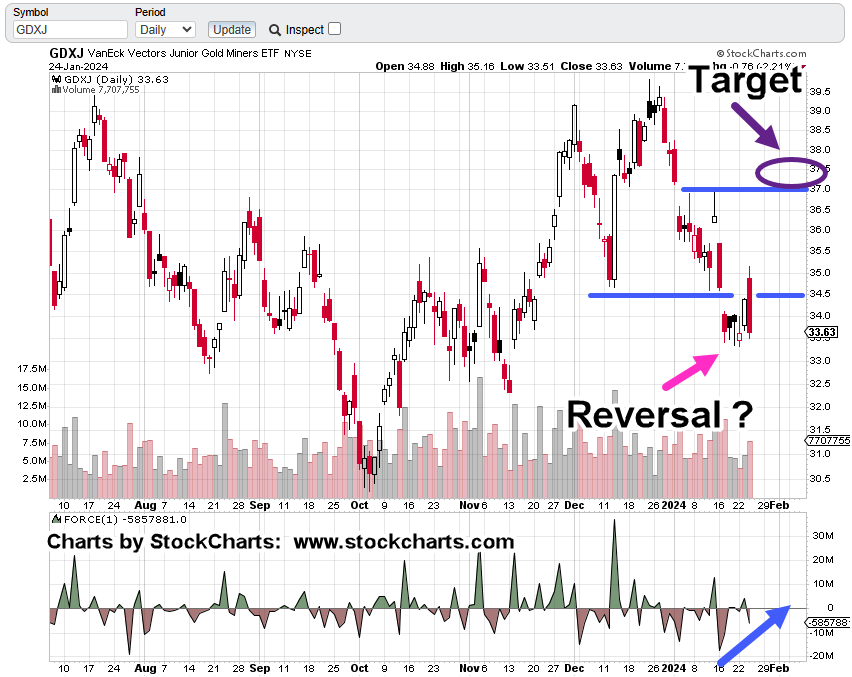

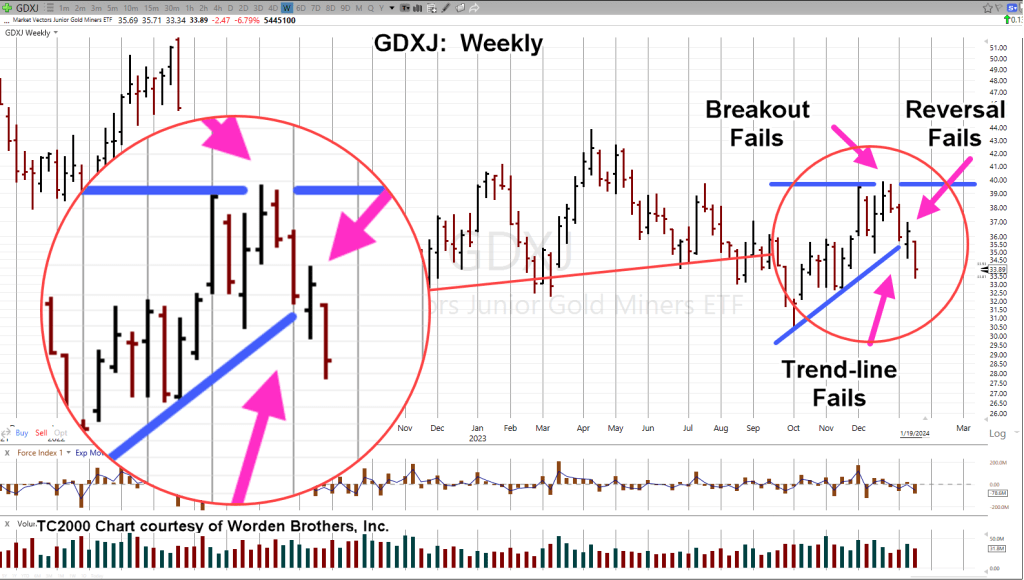

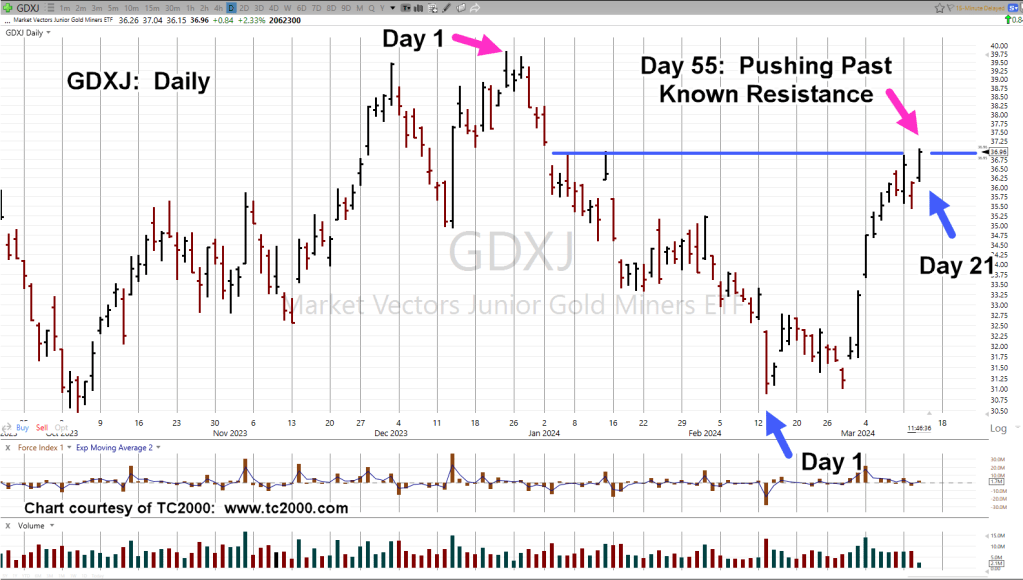

Junior Miners GDXJ, Daily

As the chart shows (as of 12:35 p.m., EST), we’re pushing into known resistance (blue line) at the 37.00, area.

There’s also a Fibonacci time frame. Today is ‘Day 55’, from the December 22nd high.

Not only are we at Day 55 from the 12/22/23 high, but we’re also at Day 21, from the February 13th, lows.

Essentially, GDXJ is about to post a Wyckoff up-thrust condition, the area for potential downside reversal.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279