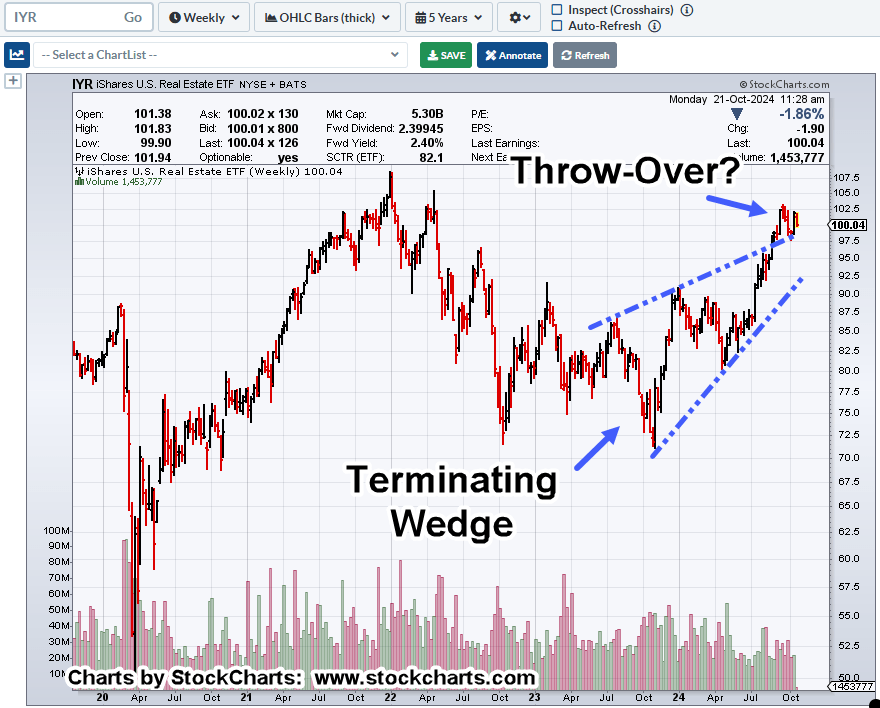

Repeating Set-Up

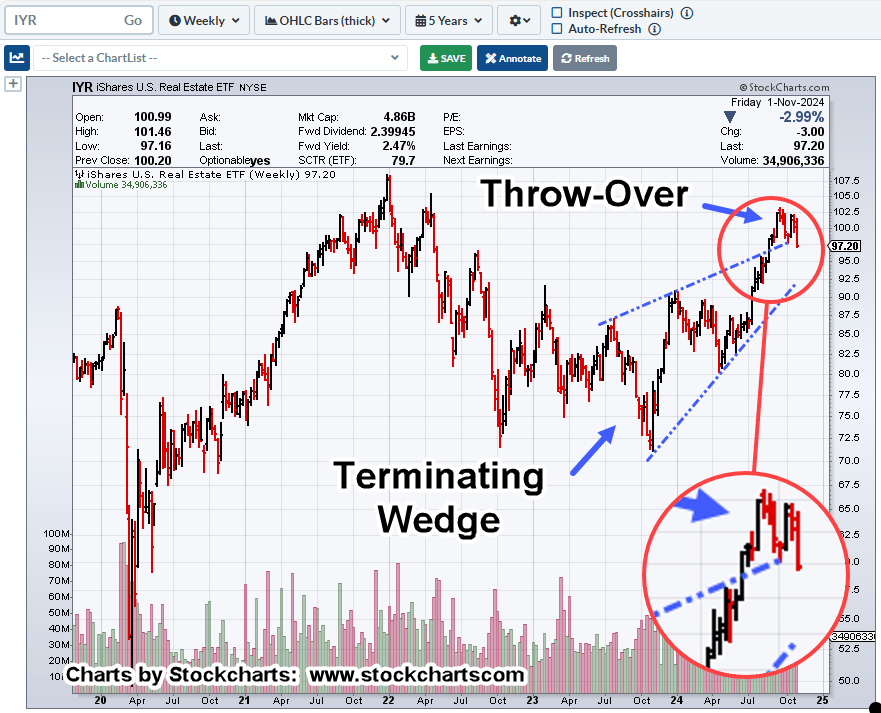

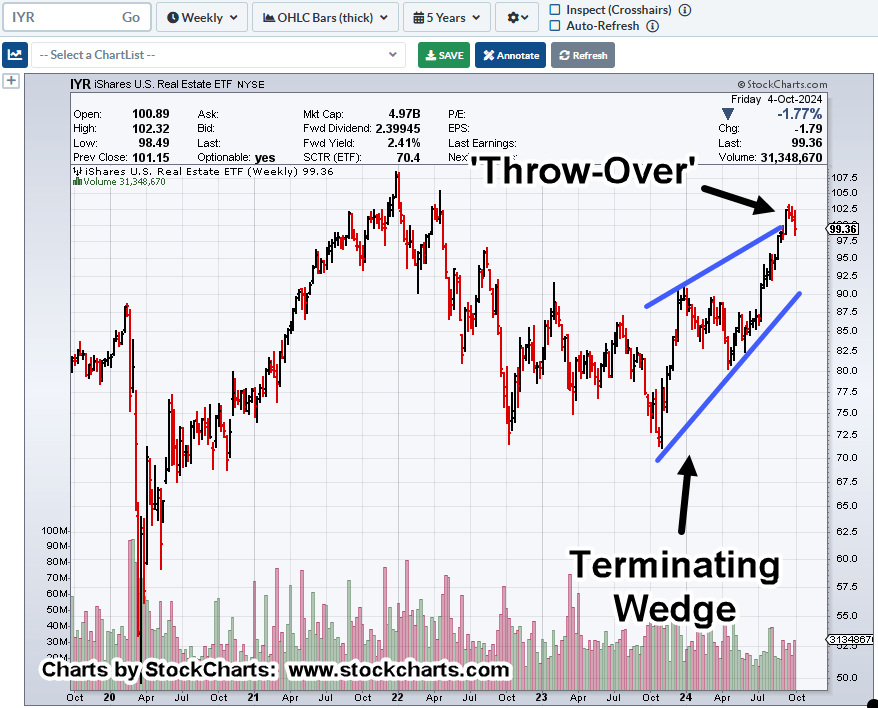

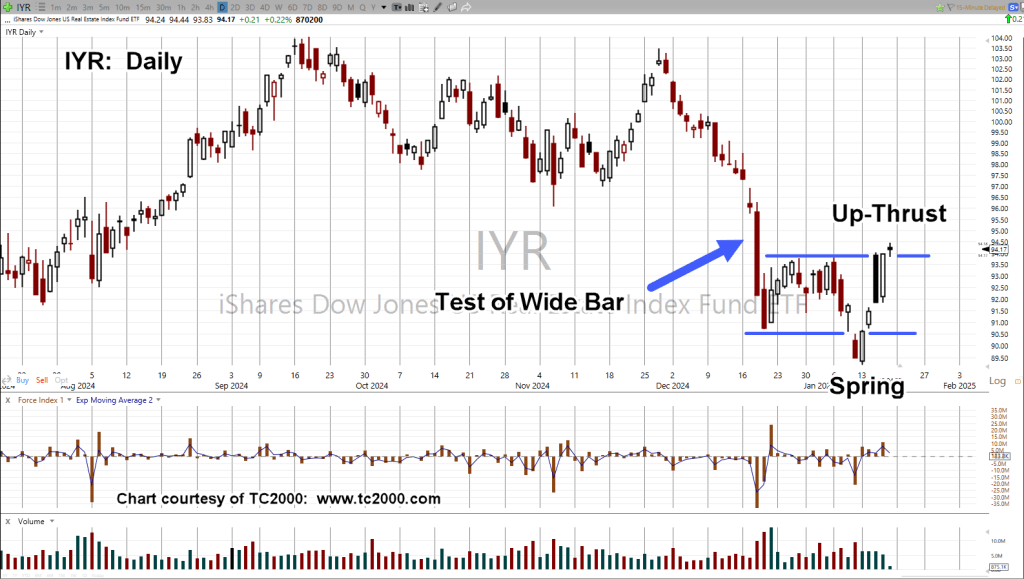

Real estate (IYR) has pushed higher above resistance and stopped dead; currently trading in a very narrow range.

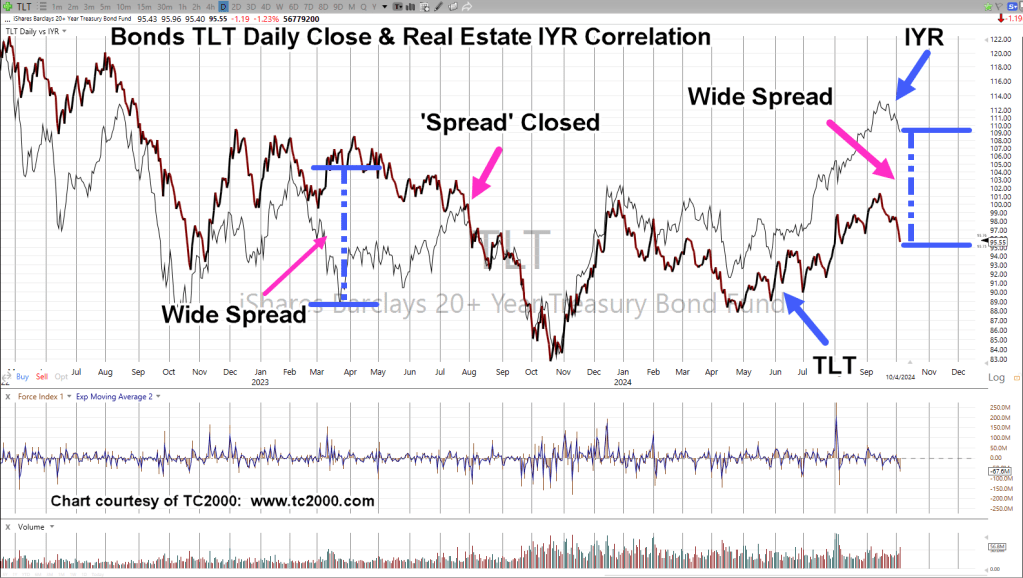

It wouldn’t be all that interesting if price action was not in a repeating set-up:

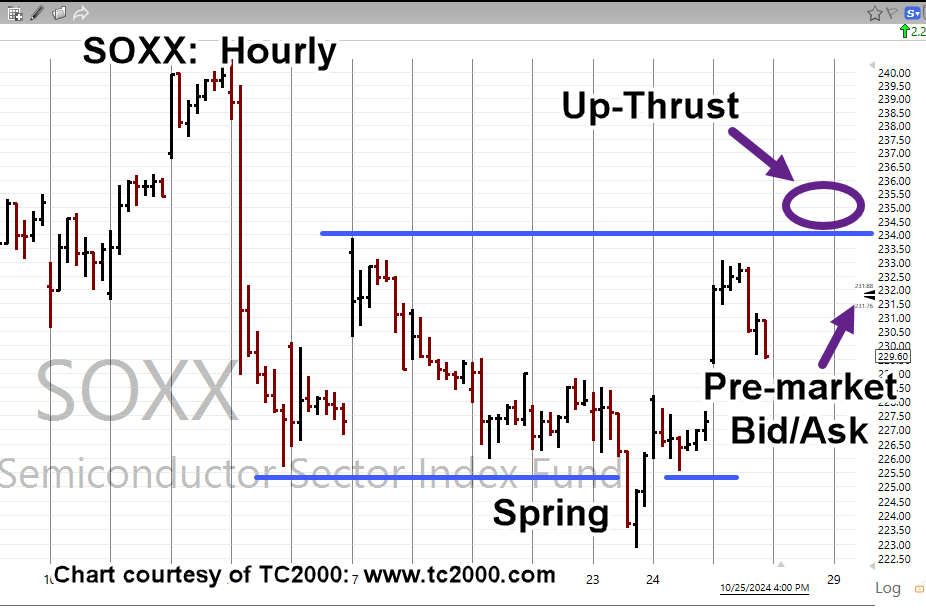

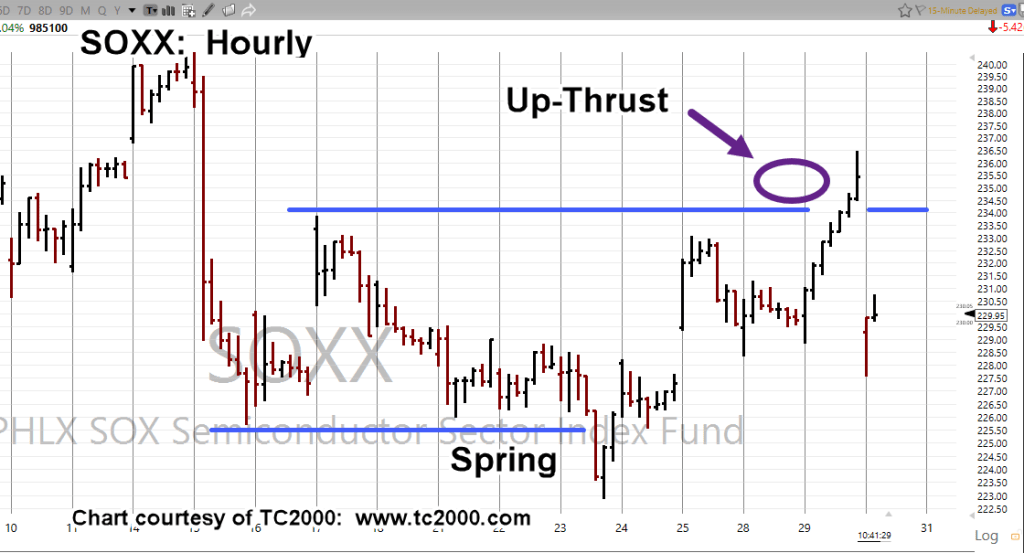

Wyckoff Spring-to-Up-Thrust

Click on the side bar under the same name to see all posts related to this set-up.

Note: A set-up does not guarantee anything.

It’s just a market observed phenomenon that may result in a directional move (not advice, not a recommendation).

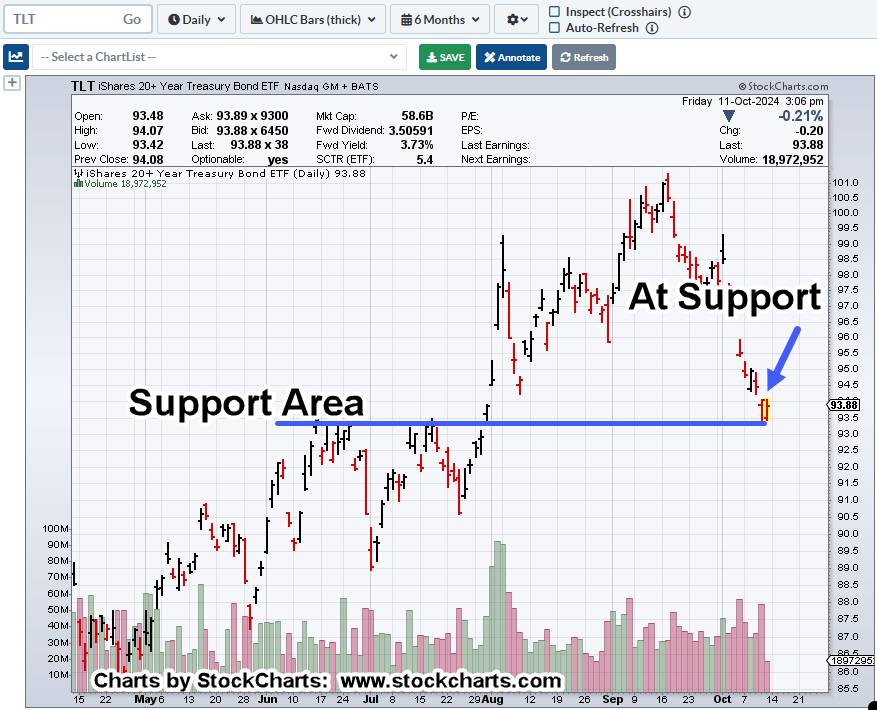

Real Estate IYR, Daily

There it is:

This is what’s called The Danger Point®

The risk of being wrong on a short position is at its least (not advice, not a recommendation).

Positioning (updates)

Biotech XBI is spending a lot of time hovering around support and not progressing downward (no matter all the Fibonacci correlations).

With that, LABD-25-01 was closed at slightly above break even (not advice, not a recommendation).

Real estate IYR was entered short early in the session via leveraged inverse DRV, as trade DRV-25-01. Stop for the trade is currently the session low. (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279