The Air’s Going Out

It’s time for the truth on gold and the miners.

Before we get to the charts, we’re going to start with an unlikely source:

Dr. Vernon Coleman

His latest video post is here; it’s important to watch in its entirety.

At time stamp 13:30, in the link, he says that restrictions are backing off, not because of any real change of conditions; no, they’re backing off to clear room for the next scam.

Useful Idiots

For obvious lies to have any effect, one has to have a whole pack of idiots to believe them.

The last post showed with the anecdotal ‘Target’ update, of that, there is no shortage.

So how does one think a dirty, dangerous mining operation is going to be functional with an ever declining or impaired workforce coupled with a potential ‘climate lockdown’?

Let’s not forget, these operations are also working to solve problems that don’t exist (i.e. ‘sustainability’ and ‘net zero’).

Was it like this in 1929 ?

The latest post from Economic Ninja, talks about the market becoming more “narrow” … which is just an alternate term for “thinning-out”.

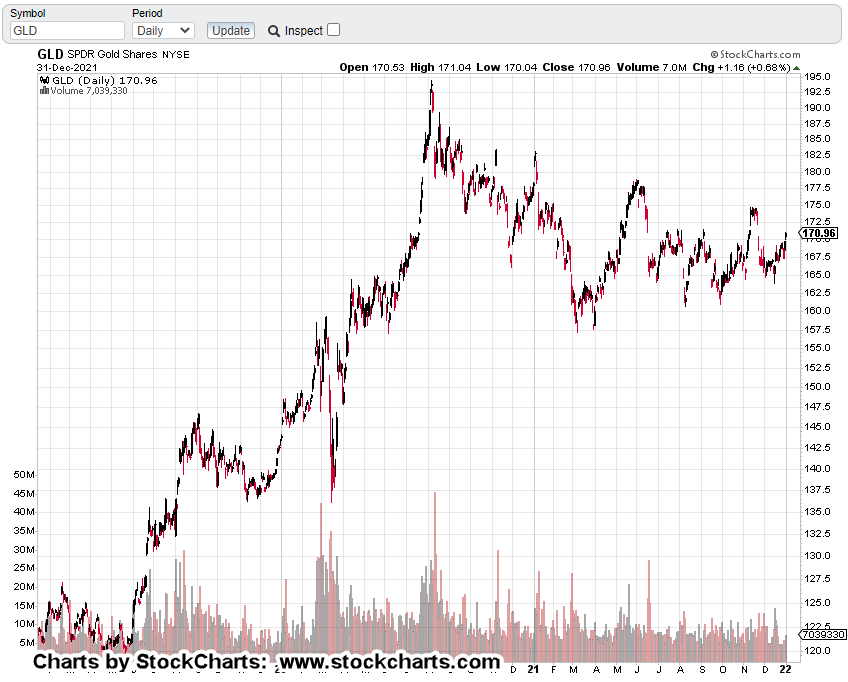

All of this brings us to the market at hand: Gold and the miners.

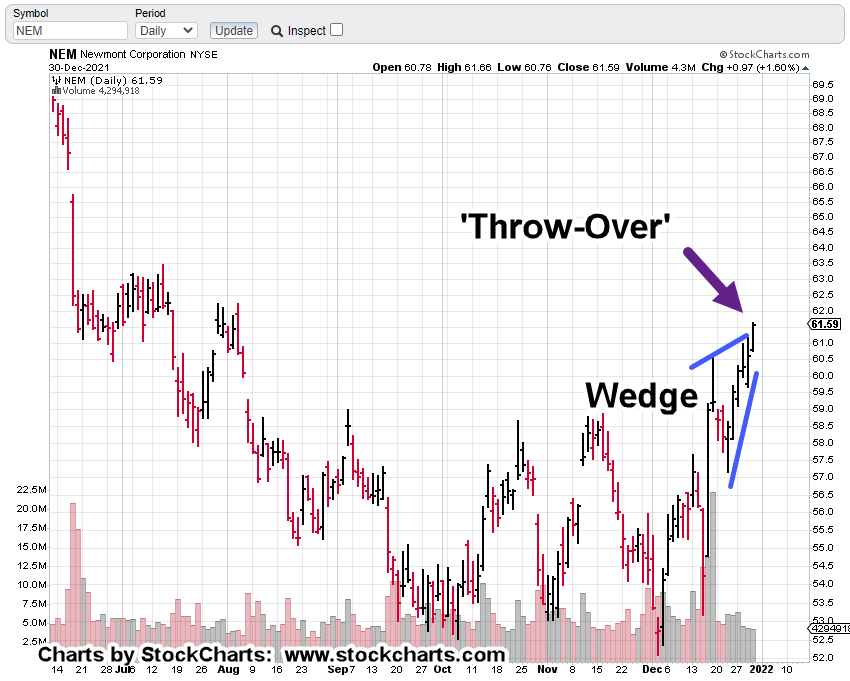

Newmont Mining (NEM):

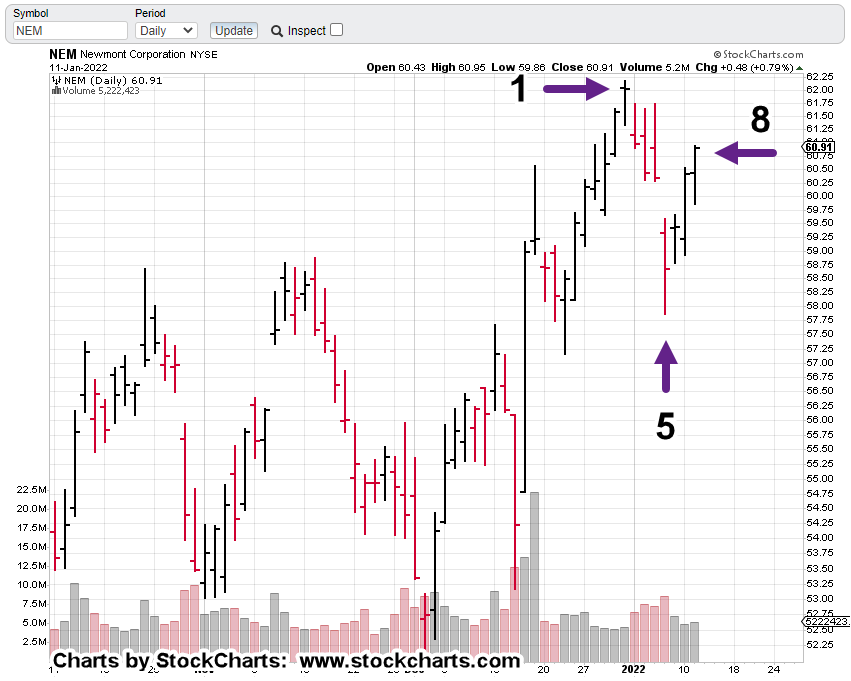

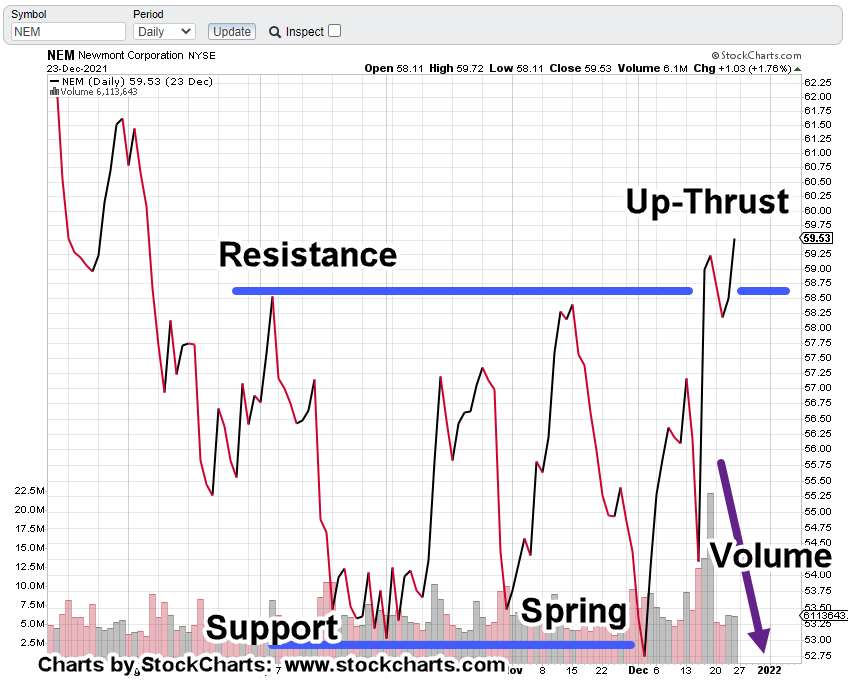

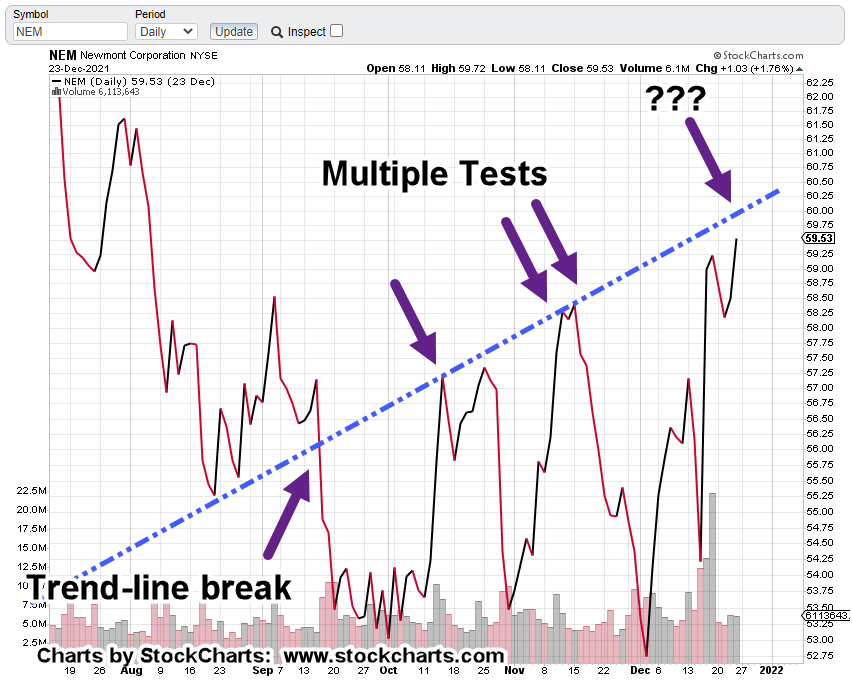

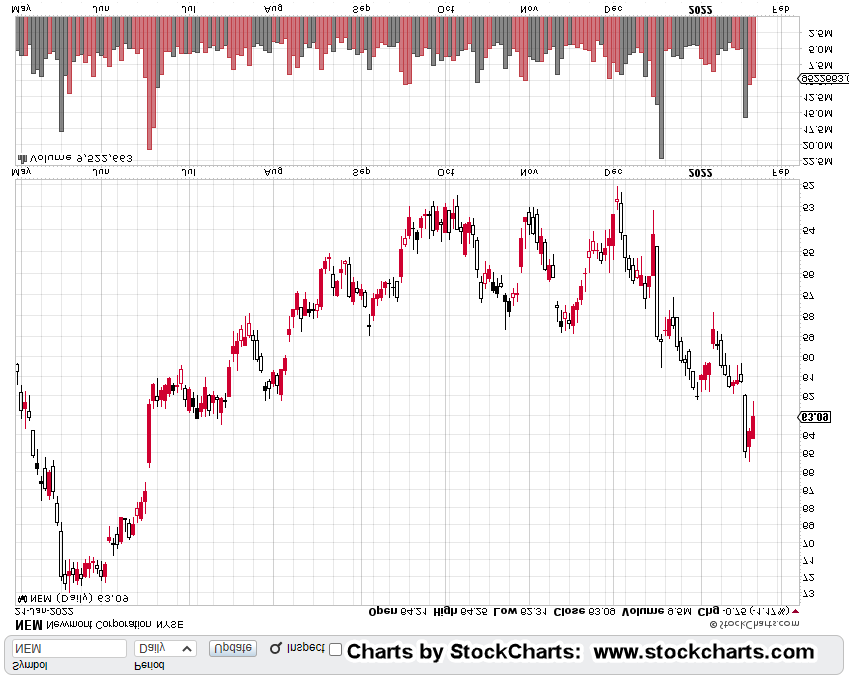

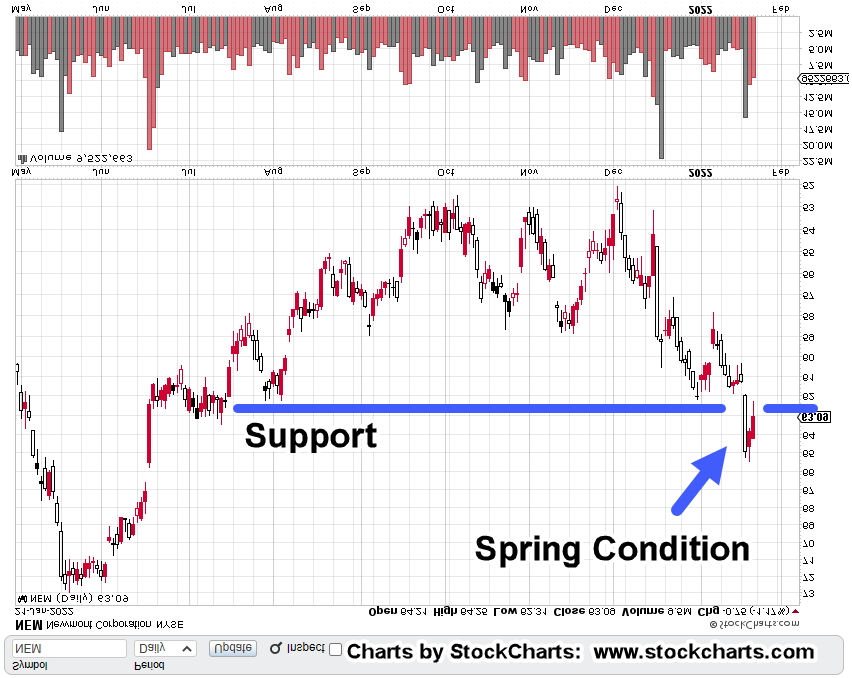

We’ll go straight to the inverted daily chart of NEM:

This prior post did an excellent job showing the potential bearish reversal conditions for NEM.

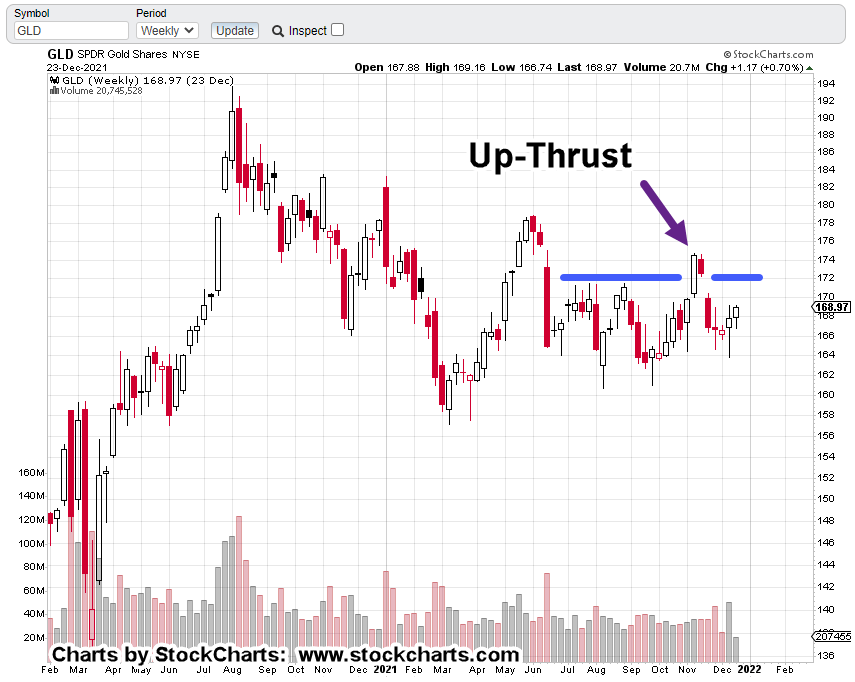

However, there’s at least one more bearish condition and that is, ‘up-thrust’.

Remember, that if it’s ‘up-thrust’ on the regular chart, it becomes ‘spring’ on the inverted.

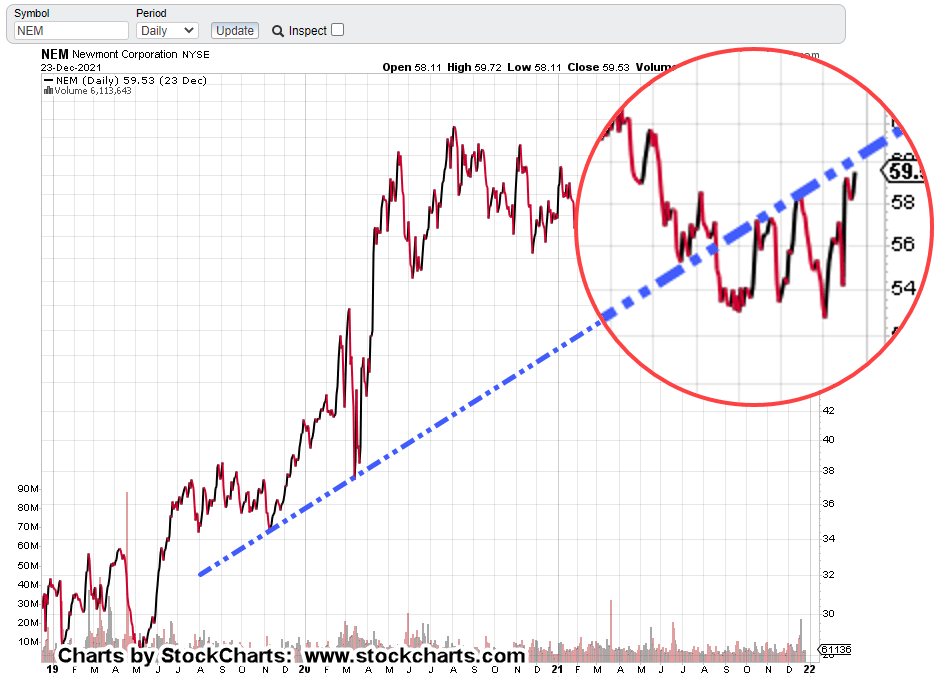

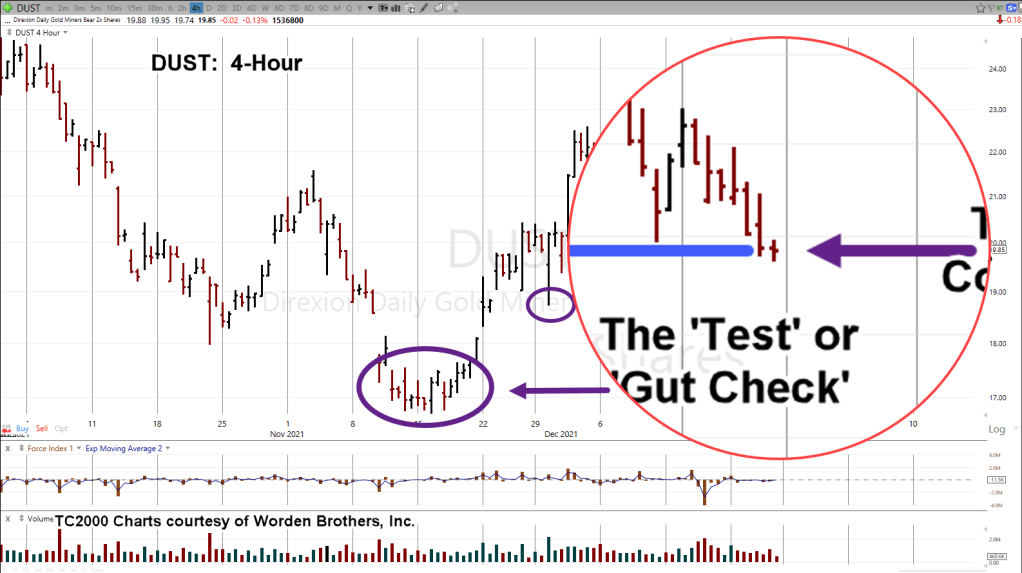

The zoom chart below shows price action has come back to test support quickly; an indication the downside thrust cleared out the weak hands and allowed strong hands to take positions.

We’re talking ‘inverted’ here.

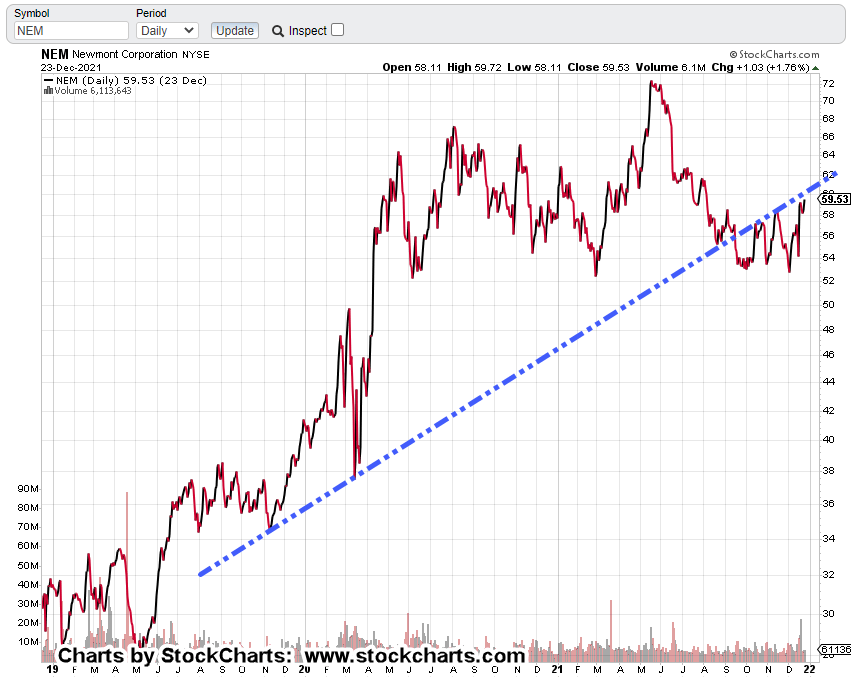

So, what’s likely happened in the real (non-inverted) world:

The herd has bought into the inflation narrative.

They think Newmont, the miners and the gold market, are breaking out to the upside. Meanwhile, back at the ranch, the professionals have likely used the opportunity to sell or sell-short.

Back In The Day

Way back in the day, when Steven Van Metre, still had his 1970s wood-paneled office, he used to talk about how the Fed knows its actions are deflationary.

Also, how the Fed was in no way going to educate the public; so, they let that public believe that it’s all about inflation and dollar destruction.

The herd is nearly always on the wrong side of the trade. Here’s a blast from the past to help make that case.

Data Dump & Asset Transfer

With so many bits of data swirling around like Cryptos, Digital Dollar, UBI, Supply Chain Destruction, Depopulation, Neo Feudalism, and on, who of us in the proletariat, really know how it’s all going to play out?

However, there’s one thing of which, we can be sure:

It’s an asset transfer of Biblical proportion.

Next On The Schedule

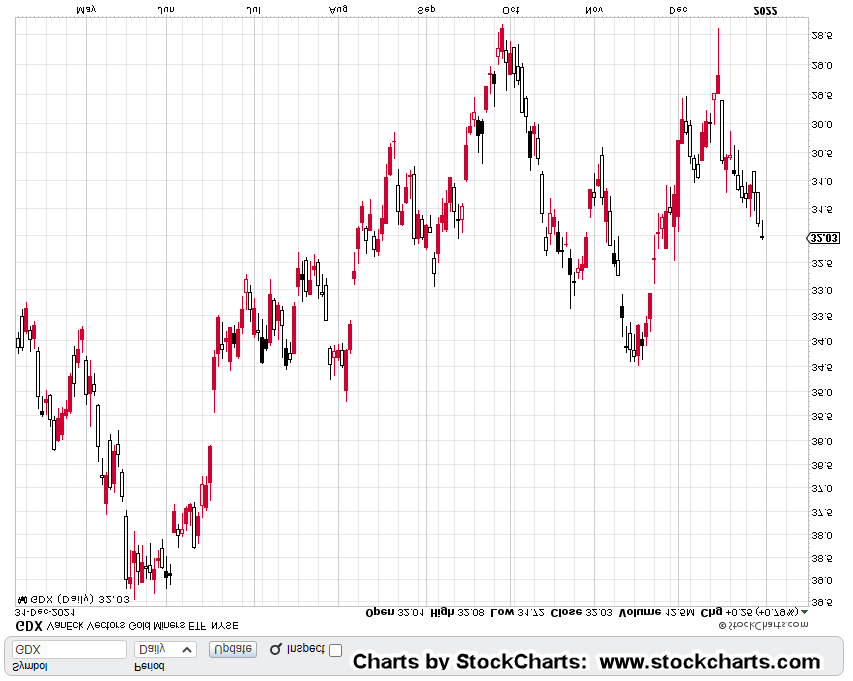

This post is already long and we’ve not discussed the mining indices and downside projections.

Depending on price action or news, we’ll cover that in tomorrow’s update.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279