Today, Is ‘Day 13’

Strange things happen in the markets just before, during, or just after a holiday week.

This time is no different.

With all that’s gone on in the past few weeks, one gets a sense ‘the jig is up’.

One example of the curtain being pulled back on a well-established grift, is this unrelated, but related post, link here.

So, it could be with biotech.

The past two weeks look like a change of character (not advice, not a recommendation).

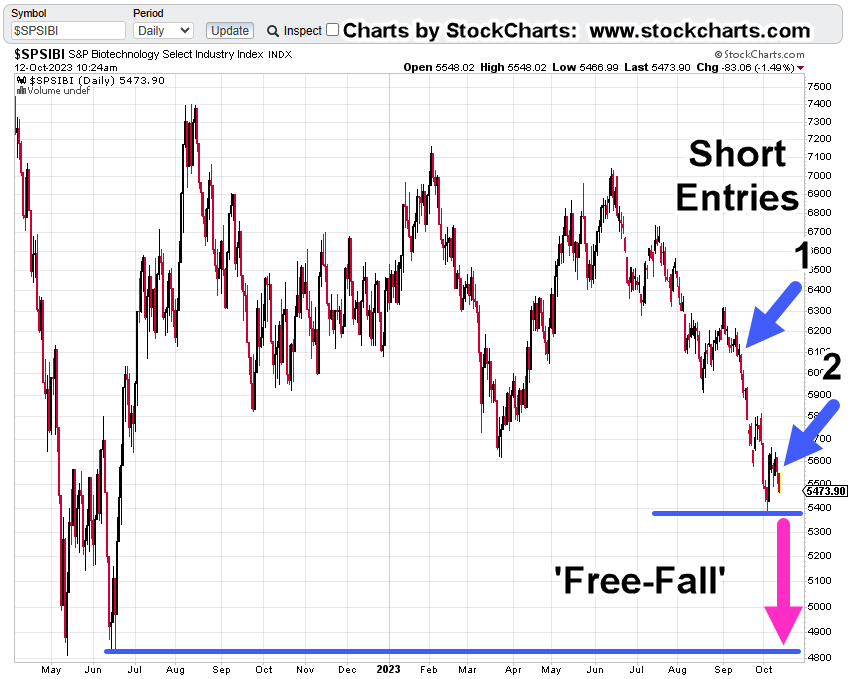

Biotech XBI, Daily

It’s been a Fibonacci 13-Days since the reversal on 11/11.

The sector has accelerated to the downside on record volume and now, is testing that break.

The ‘Axis Line’, is also the location of the 61.8%, retrace for the current down-move and test.

Although there’s been no new daily low to ‘confirm’ the test is complete, (upside) risk may be at a low.

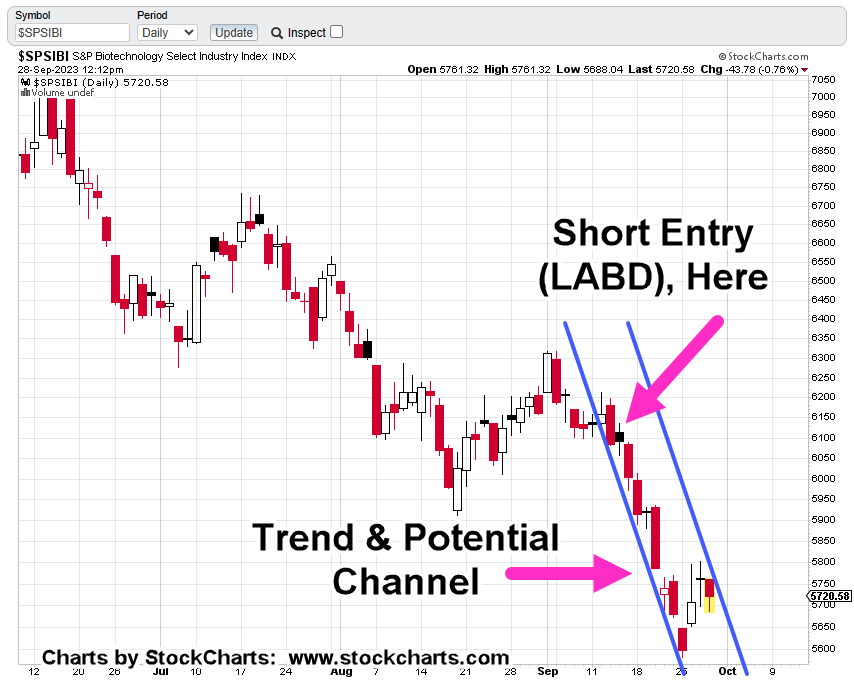

Positioning

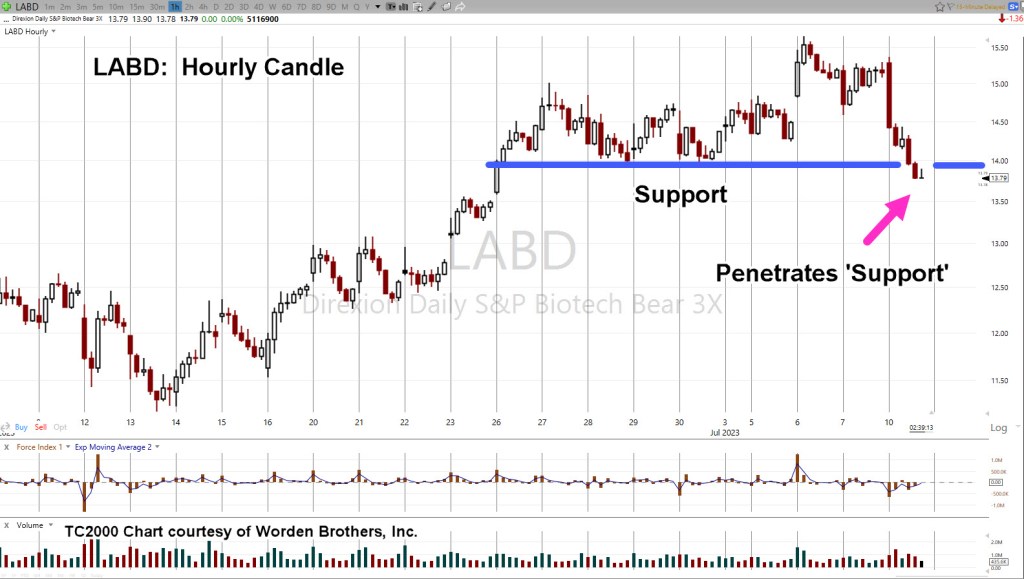

For reasons to be covered in a later update, this sector’s being shorted directly as opposed to using leveraged inverse LABD (not advice, not a recommendation).

Trade is labeled: XBI-24-01

Stop level for the short is (or will be) the session high, currently at XBI 99.79 (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279