Latest Reversal … Exposes The ‘Experts’

‘When the tide goes out, that’s when you find out who’s been swimming naked.’

No fan, and no endorsement of Buffett but the quote is applicable.

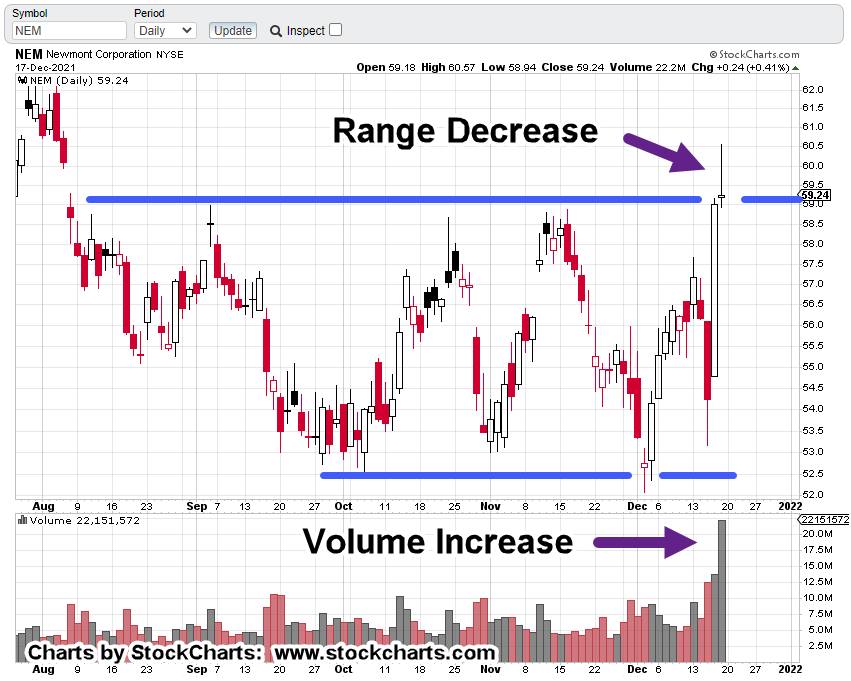

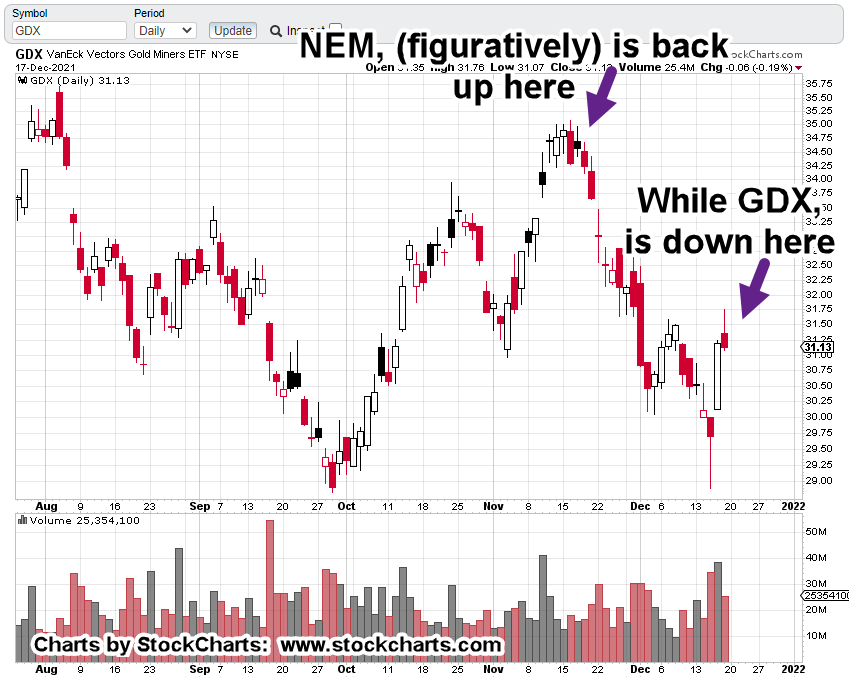

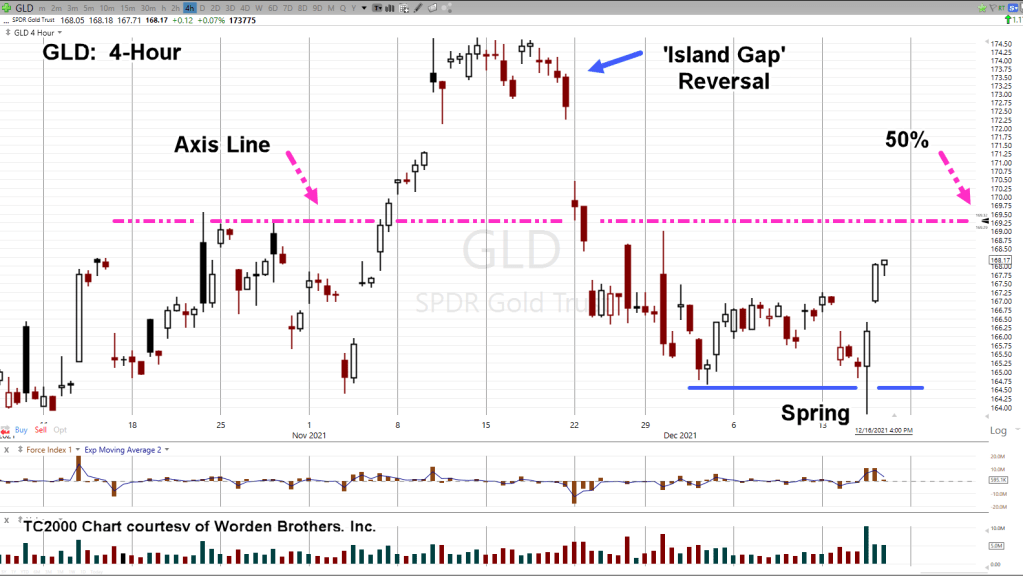

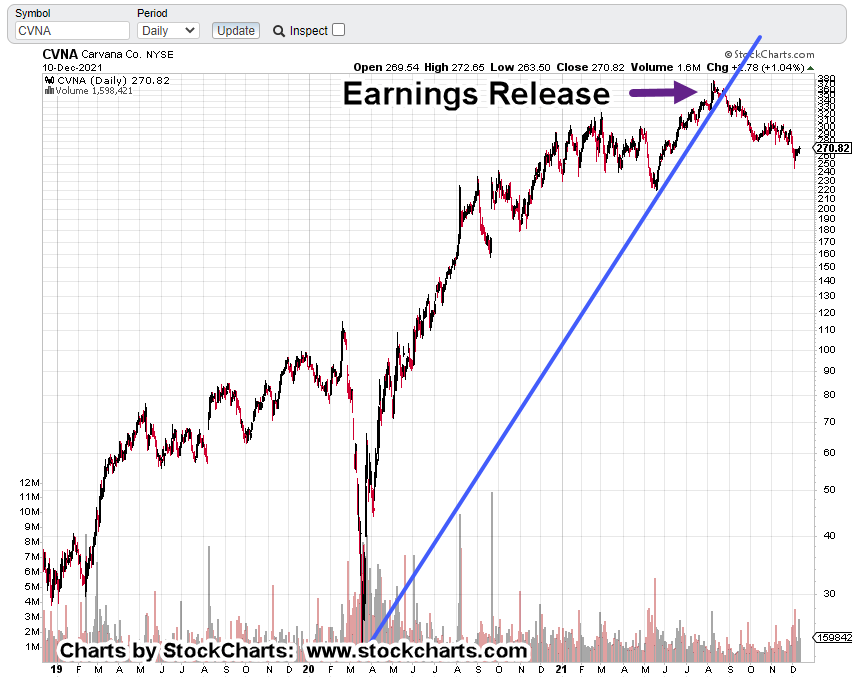

If yesterday’s Newmont analysis holds, meaning, it’s the last stand before another leg-lower, gold bulls might start acting irrationally.

Is it even possible to be more irrational?

Remember their manic prediction of $3,000/oz, gold in months, not years?

Barring a major reversal, the tide’s going out.

From the comments section of this ZeroHedge article, some in the herd are figuring it out as well.

As one of them says … ‘another year to wait before the Great Pumpkin’ (i.e., gold moving higher).

As this post is created, comments continue to pour-in.

Gold bulls are frustrated, confused, pontificating, crypto loving/hating, central bank blaming, it’s all there.

Thus far, there’s not one comment on what price action is actually doing.

Public Service Announcement

This whole business with the financial media and its attendant hucksters (recent examples, here and here) is actually a fantastic public service.

For anyone who’s still able to think (an act of rebellion in itself), it’s clear, or should be, if you’re on TV, or the mainstream media, you’re a shill until proven otherwise.

The good part?

All of this media, podcast, carpetbagging and corruption, plays right into the hand of Wyckoff analysis.

Wyckoff focused on what is … not what should be.

Even back in the early 1930s, he was adamant about ignoring the financial press. ‘You’ll never be successful’, he said if you listen to the hype.

Mixed Messages

On cue to support that statement, is Dan, from i-Allegedly; he reports ‘we’re getting mixed messages‘ in the economy.

Proving the point.

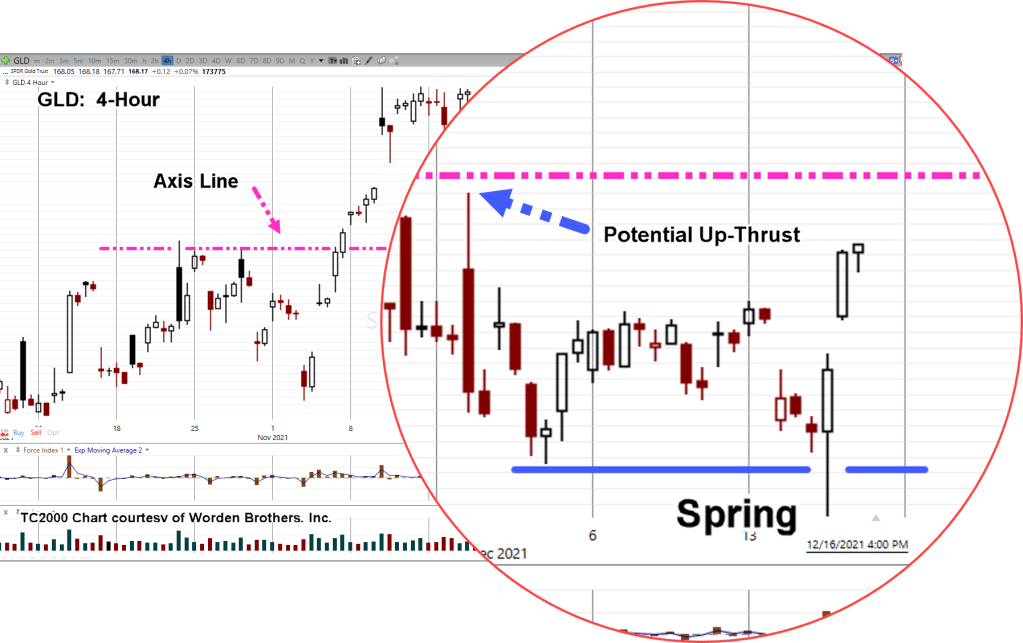

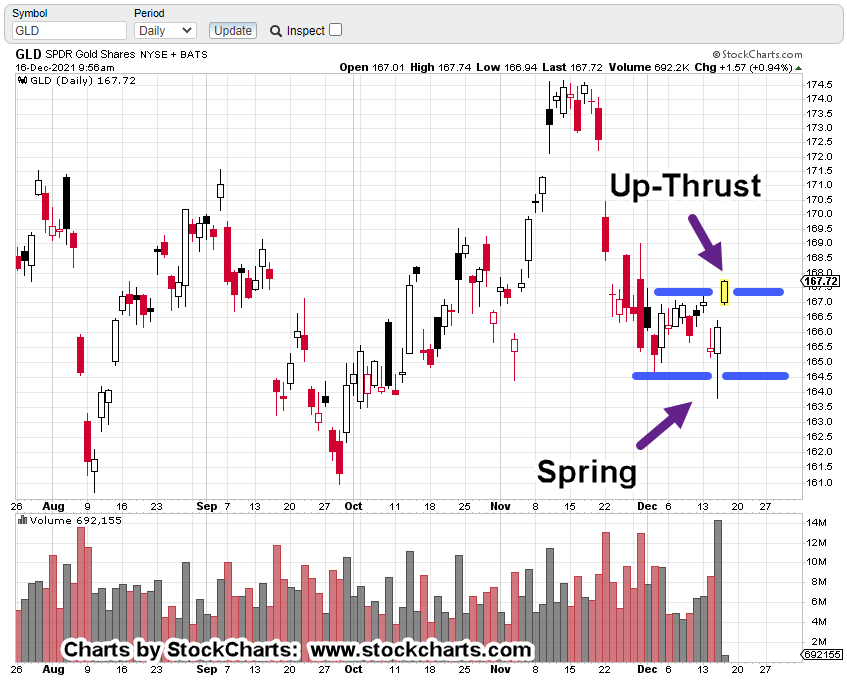

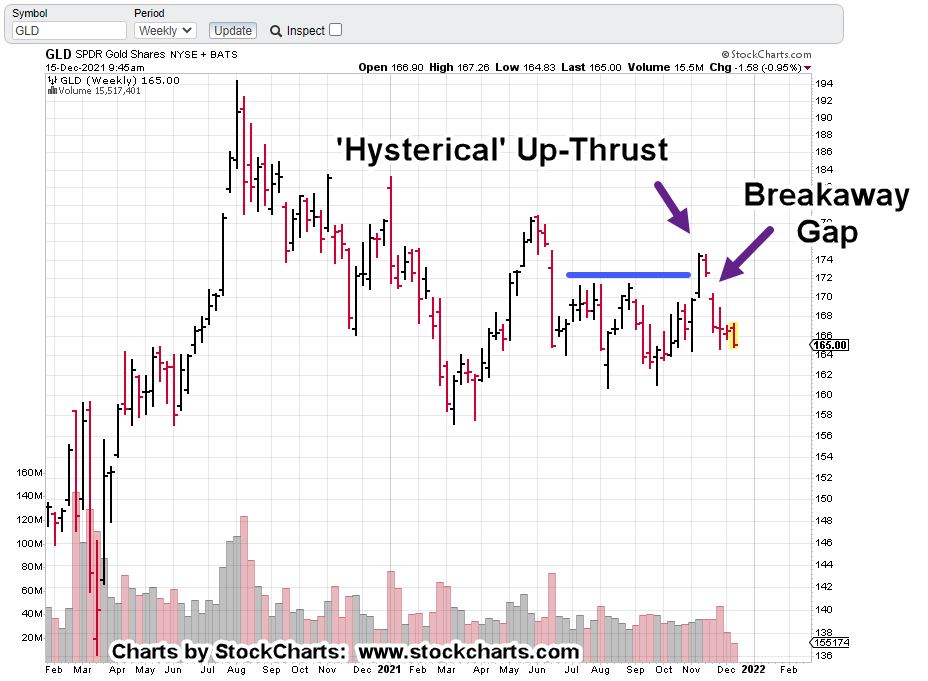

The (Trade) Plan Forward

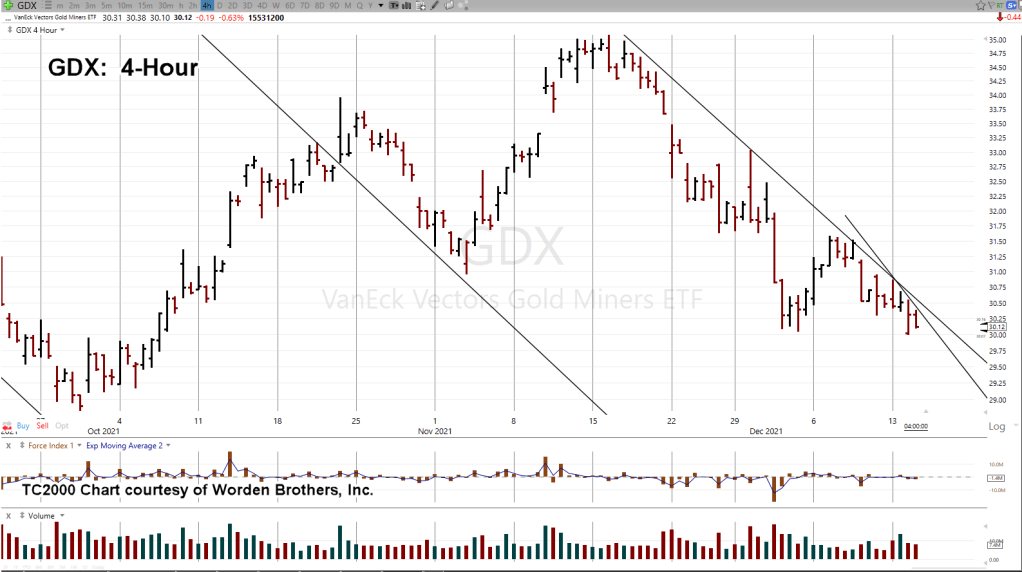

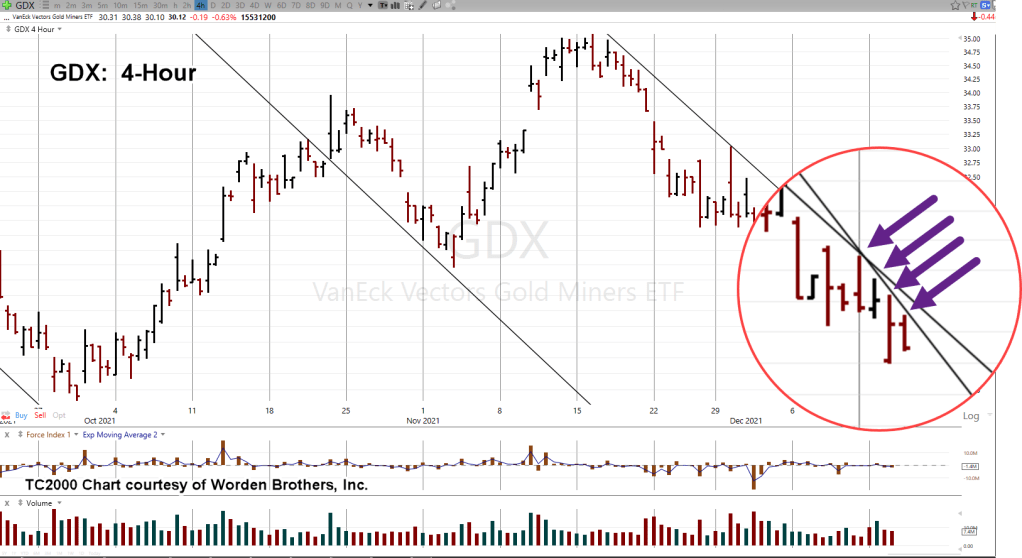

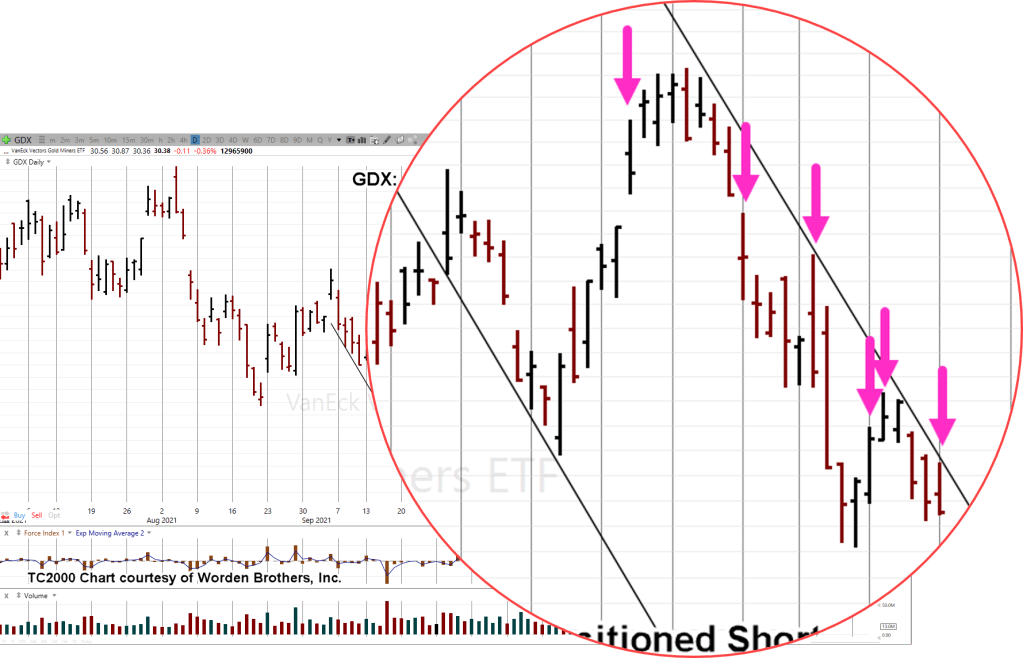

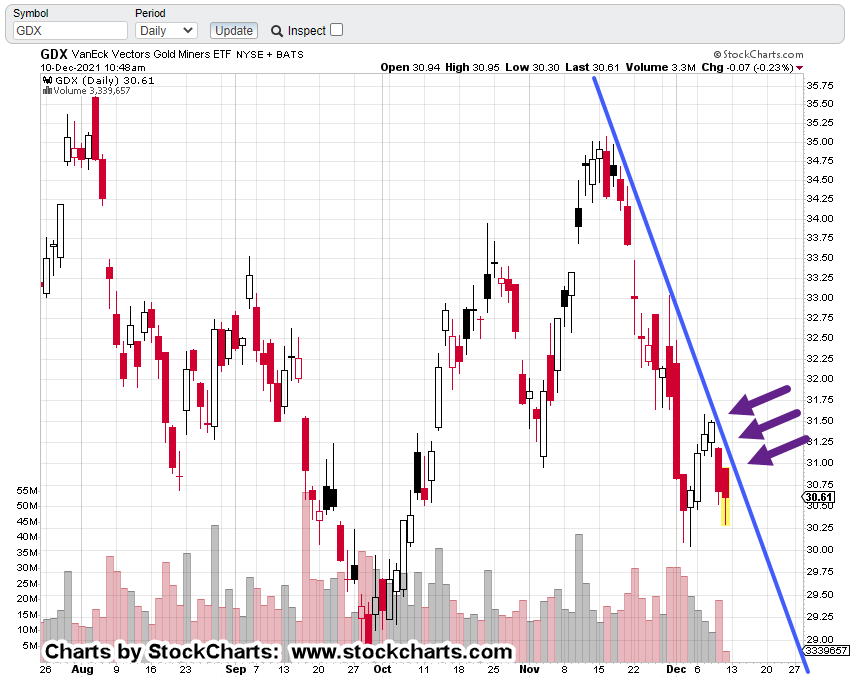

With the caveat, anything can happen; gold could rally in a couple hours when the futures open, the short via DUST (not advice, not a recommendation), is as follows:

- The Set-Up: Complete

- The ‘test’ or ‘gut-check’: Complete

- The first ‘correction’: On-going

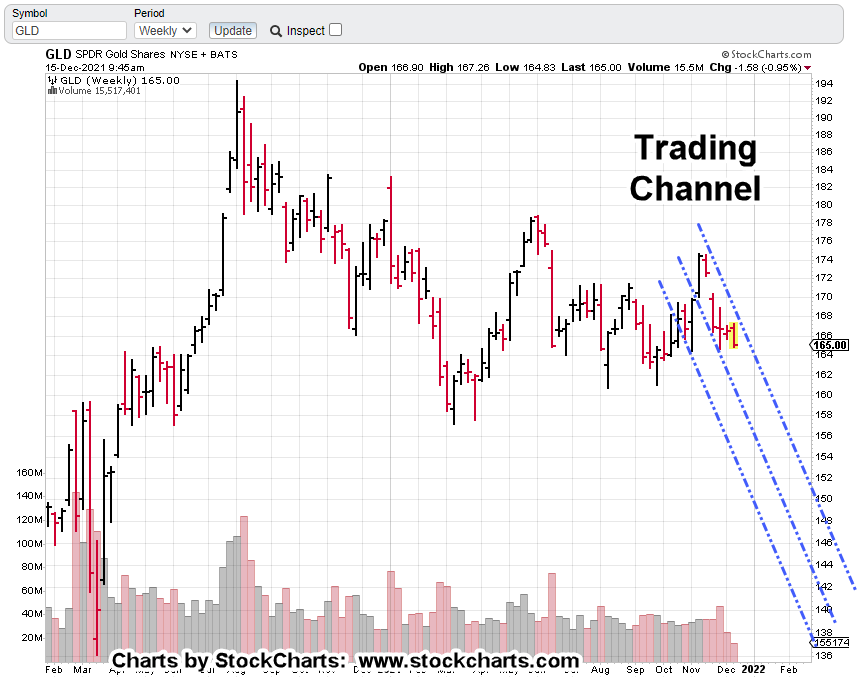

- Continuation or Failure

- Trend identification

- Potential channel(s)

- Exit process

- Scale out

- Full exit

- Post trade evaluation

What’s In A Name ?

Even if the trade fails at the next session, it would still provide valuable information.

With that in mind, no matter what happens it’s likely to be referenced in the future; so, it needs a name (or number).

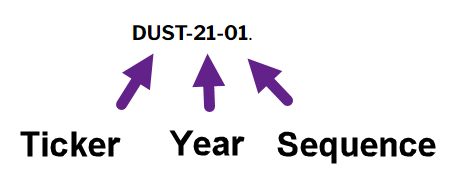

Taking a cue from prior engineering work (creating numbering schemes), the current trade will be identified now, and in future posts, as: DUST-21-01.

Seems straightforward.

The ‘First’ Correction

No. 3, above is titled ‘The first correction’.

This labeling is borrowed from a trade discussed by William Doane, in Dr. Elder’s book: Entries & Exits.

Price action permitting, we’ll discuss how this first correction may be a brief one as opposed to a drawn-out choppy affair.

Stay Tuned

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279