Rule Of Alternation

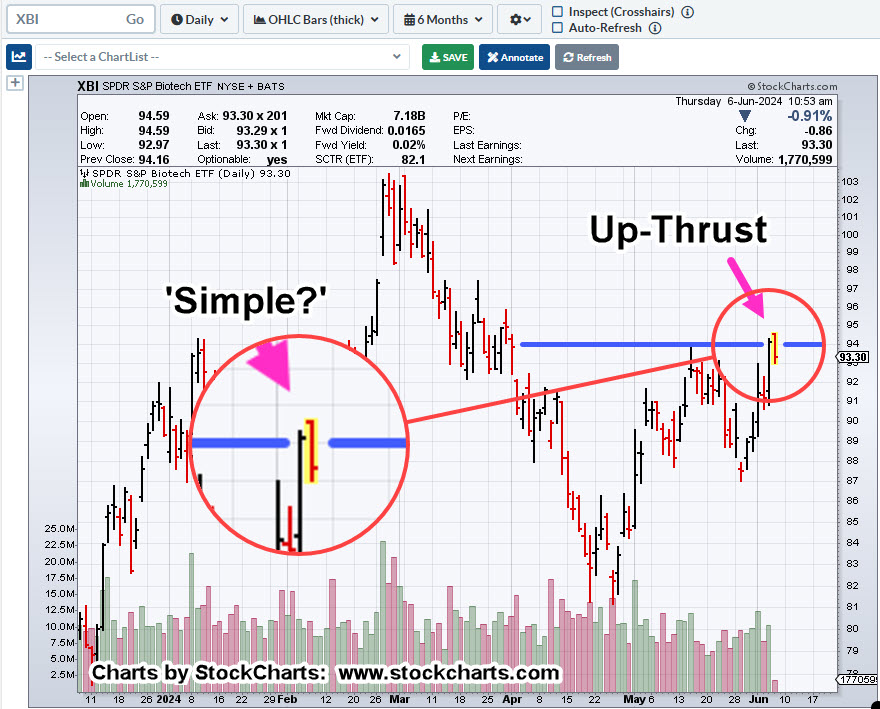

The last update presented a multi-timeframe analysis; medium to long-term (potential) bearish set-up in biotech, XBI.

This morning’s action appears to be confirming the up-thrust potential.

Now, we’ll get into why this move may happen quickly.

Multiple Timeframes

If the premise is correct, that we’ve gone through a month-long test of the weekly (timeframe) up-thrust, testing may now be complete.

Naturally, the power behind a weekly move, has more substantial effect than daily.

Next, the topic at hand; Prechter’s ‘Rule of alternation’.

Biotech XBI, Daily

The first chart shows detail on the last up-thrust.

Price action penetrated resistance, then posted five-days of congestion before breaking lower.

We’re labeling that congestion action as ‘complex’.

Next, we have the current situation. An apparent up-thrust in its initial stages.

If what we have now, is indeed an up-thrust, taking all the prior considerations into account, it’s reasonable to expect the subsequent move will be less complex, having different form, and move more quickly (not advice, not a recommendation).

In any case, we have a ‘hard stop’ for a short position, at the session high (not advice, not a recommendation).

Our Quest, Is At An End

Like something out of Monty Python, the entire analysis of downside potential feels like the quest is at an end.

However, just like the video snippet in the link above, what looks to be a dramatic conclusion to weeks if not months of work, could be completely derailed by a bunch of ‘French’ guys hanging out in a British castle 🙂

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279